cheka

Ground Beetle

from another board -- dyodd

April 25, 2019: Biden announces his presidential campaign…

13 days later, Sam Bankman-Fried, son of Barbara Fried ( Stanford Professor and co-founder of political fundraising organization "Mind-the-Gap), launches #FTX crypto exchange.

The exchange is magically an overnight success. BF becomes biggest donor to Biden. Election day, FTX implodes

completely.

If you think this scandal is done, it goes even deeper.

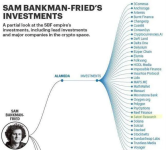

Gabe Bankman-Fried, brother to Sam (also a former Jane Street trader), is founder of "Guarding Against Pandemics"

He was a Legislative Correspondent for the US House of Representatives and an advisor to large political donors in the Democrat party.

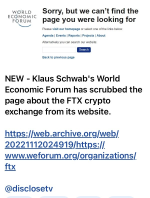

The family Aunt Linda Fried is a WEF member on the Global Agenda Council on Aging.

The father, Joseph Bankman is a Stanford professor who has lobbied on behalf of Hedge Fund managers before Congress before (film records exist).

FTX' Head of Ventures & Commercial at FTX Ventures Amy Wu, started with the Clinton Foundation years ago.

Nishad Singh FTX Director of Engineering has spent over 8 million for Dem candidates.

And finally Obama's Commodity Futures Trading Commissioner, Mark Wetjen was literally the head of FTX Policy & Regulation.

Reports were the organization wanted to spend over a billion dollars on the Democratic party for 2024.

April 25, 2019: Biden announces his presidential campaign…

13 days later, Sam Bankman-Fried, son of Barbara Fried ( Stanford Professor and co-founder of political fundraising organization "Mind-the-Gap), launches #FTX crypto exchange.

The exchange is magically an overnight success. BF becomes biggest donor to Biden. Election day, FTX implodes

completely.

If you think this scandal is done, it goes even deeper.

Gabe Bankman-Fried, brother to Sam (also a former Jane Street trader), is founder of "Guarding Against Pandemics"

He was a Legislative Correspondent for the US House of Representatives and an advisor to large political donors in the Democrat party.

The family Aunt Linda Fried is a WEF member on the Global Agenda Council on Aging.

The father, Joseph Bankman is a Stanford professor who has lobbied on behalf of Hedge Fund managers before Congress before (film records exist).

FTX' Head of Ventures & Commercial at FTX Ventures Amy Wu, started with the Clinton Foundation years ago.

Nishad Singh FTX Director of Engineering has spent over 8 million for Dem candidates.

And finally Obama's Commodity Futures Trading Commissioner, Mark Wetjen was literally the head of FTX Policy & Regulation.

Reports were the organization wanted to spend over a billion dollars on the Democratic party for 2024.