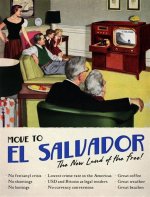

El Salvador Remains in the Red on Bitcoin Holdings, But Losses Are Narrowing

It's been a bit more than two years since the country made bitcoin legal tender there.

In November 2022, El Salvador President Nayib Bukele

announced a country-level dollar cost averaging (DCA) plan, promising to buy one bitcoin every day.

At the time, the country – based on public statements from Bukele - was already the owner of 2,381 bitcoins purchased at an average price of roughly $44,300. The price then was just $19,000, putting the country at about a $60 million loss on its holdings.

Bukele has kept pretty quiet about El Salvador’s purchases since and the exact amount of bitcoin that the country owns is not clear as there is no public government record.

Assuming that the country did indeed purchase one bitcoin per day over the past year, CoinDesk estimates El Salvador's holdings would sum to 2,744 bitcoin as of Nov. 14. Based on the median price of BTC over each of those days, the country's average purchase price would have drifted down to roughly $41,800.

Figuring a current bitcoin price of $36,000, El Salvador would now be sitting on a loss of about $16 million on its bitcoin holdings.

Since Bukele moved to make bitcoin legal tender, the International Monetary Fund (IMF) has

repeatedly warned of increased risks to the country's economic growth and ability to make good on its debt. Despite the modest paper losses on the nation's bitcoin holdings, things to this point appear to be on a good path.

El Salvador's bonds in mid-August

had posted a 70% year-to-date return, with a number of big-name banks recommending that more gains were coming. The country's debt earlier this month

was upgraded at S&P Global to B- from CCC+. Bukele recently announced his intention to run for re-election in 2024

and polls show him with an overwhelming lead.

As to whether

the populace is rushing to adopt a bitcoin standard, questions remain. One place to check would be remittances from outside the country, given the

economy's reliance on those payments. According to

central bank data, of $7 billion in remittances from abroad in 2022, just 1.2% used cryptocurrency wallets.

It's been a bit more than two years since the country made bitcoin legal tender there.

stocks.apple.com

www.forbes.com

www.forbes.com