Sounds crazy, right? Maybe it is. Maybe it isn't. I'll explain my thinking and you decide...

Four Years of Structural Deficit Draining Vault Inventories

Silver has been in a structural deficit for the last four years. Demand (mostly industrial, investment demand is fairly insignificant in comparison) has outpaced supply (mining and scrap recycling). This deficit has been running in the neighborhood of 180 to 200 million troy ounces per year.

The structural deficit is draining the LBMA + COMEX of their vaulted stocks. The run rate for the remaining vaulted stock appears to be somewhere between 2-10 years depending upon what numbers you look at and what assumptions you make about mining production (fairly fixed - ramping up production takes years), industrial demand (growing but at what rate? is it sensitive to a recession?) and investment demand (ETFs hold a lot of vaulted metal too - will folks sell or buy?).

... the market is headed for a fourth year in deficit, with this year’s shortage seen as the second biggest on record.

That’s led industrial users — which typically rely on miners for supply — to seek ounces by draining the world’s major inventories, according to Silver Bullion’s Gregersen. Stockpiles tracked by the London Bullion Market Association fell to the second-lowest level on record in April, while the volumes at exchanges in New York and Shanghai are near seasonal lows.

Over the next two years, the LBMA stockpiles may be depleted given the current pace of demand, according to TD Securities. ...

Hot Commodity Silver Outpaces Gold as Buying Gains Momentum

(Bloomberg) -- Gold’s record-setting rally may have captured the headlines this year, but it’s silver that’s running harder and faster as the less glamorous metal benefits from robust financial and industrial demand.Most Read from BloombergChina Attempts to End Property Crisis With Broad Rescue...

Additionally, it appears that the drain rate on vaulted silver may have been shored up by strategic government stockpiles that were depleted in FY 2021:

As the stockpile is now gone, the draining of silver from LBMA + COMEX vaults since FY 2021 has mirrored the structural deficit (ie. the excess demand is now 1:1 with vault drain).

Gold Silver ratio

Almost everyone knows the Gold-Silver Ratio (GSR) has historically been around 15:1 while in modern (fiat money) times, it has mostly bounced around between 50:1 and 80:1. If we look at the ratio of current mining production, we see:

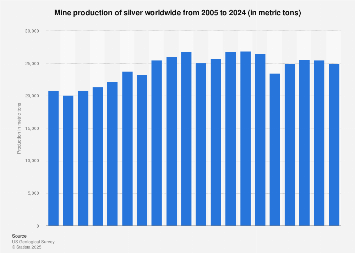

The estimated global production of silver in 2023 amounted to 26,000 metric tons.

Global silver production per year 2023 | Statista

How much silver is mined each year? Despite having remained relatively stable over the past two decades, global silver mine production has increased recently.

Approximately 3,000 metric tons of gold was produced from mines worldwide in 2023

Topic: Gold mining worldwide

Find the most important statistics and facts on the global gold mining industry

According to those numbers, in 2023, silver was mined at a 12:1 ratio to gold. I have seen other people mention that silver is being mined at 7:1 presently. The Statista numbers likely include everything - including mining production from places like China that do not get sold on the open market. I don't know what the exact ratio is today for silver/gold production that makes it to the open market, but it seems to be less than 15:1.

Math is Hard

If we assume that industrial demand will maintain it's pace of the last few years (that it isn't hampered by economic crisis or recession) and that the LBMA + COMEX vaulted inventory will go to zero within the next 2-3 years, it is understood that industrial demand will no longer have available vaulted supply to draw upon. There won't be any physical stock in exchange vaults for futures markets to short. All industrial demand will need to source silver from new mining supply (plus scrap refining), and there won't be enough of it.

I posit that it will be reasonable, in that environment, for the GSR to reach equilibrium with mining production. Given a spot gold price of $2,430 (as of the moment I'm writing this), a GSR of 12:1 would equate to a silver price at $202.50. A GSR at 7:1 would equate to $347.14.

Assuming that the price of gold is higher in 3 years than it is today, is it really unreasonable to think silver might hit $300+ within the next three years?