...

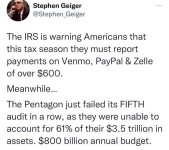

A group called the Coalition for 1099-K Fairness has been pushing for Congress to roll back the change to help “casual sellers and micro-businesses,” as part of the usual lobbying by industries for year-end legislation. Its members include eBay EBAY, -0.13%, Etsy ETSY, +4.48%, Poshmark POSH, -0.08%, Mercari MCARY, -0.31%, Airbnb ABNB, -0.49% and PayPal PYPL, +0.53%, which operates its original payment system as well as other offerings such as Venmo.

“Without timely Congressional action, millions of Americans and fledgling micro-businesses will begin receiving 1099-Ks in January 2023, often in instances where there is no tax liability whatsoever, creating significant confusion and administrative challenges,” the coalition says on its website.

The group says it supports bills put forth by some lawmakers that aim to raise the 1099-K reporting threshold to $5,000 or even put it back at $20,000, saying the measures “represent a starting point for a bipartisan compromise.”

Analysts are divided on whether this lobbying push will be successful. Ben Koltun, director of research at Beacon Policy Advisors, is sounding somewhat upbeat, while Tobin Marcus, senior U.S. policy and politics strategist at Evercore ISI, is skeptical.

“This is something that has bipartisan support, and I still think it’s more likely than not to pass this year,” Koltun said, referring to setting the threshold somewhere above $600, such as at $5,000. But he added that any change would have a price tag and still needs to “reach the critical mass of support among leadership in the House and the Senate.”

...