When I read these I wonder if they're made up or true.

My parents want to pay off my $200,000 mortgage, and move into my rental. They say I’ll owe my sister $100,000. Is this fair?

Dear Quentin,

Recently, my parents sold their condo to fulfill their long-standing desire to live in my downtown condo, offering them greater convenience for shopping, socializing with friends, and fostering a stronger connection to the community.

My parents propose to use the proceeds from their condo sale to pay off my mortgage, an amount that precisely matches the outstanding balance. The challenge arises as I still carry a mortgage on my condo, initially intending to rent it out to cover the monthly payments.

Complicating matters, my older sister is entitled to 50% of the money from our parents’ condo sale, given that there are only two children in the family. If they clear my mortgage, how do I determine my sister’s future claim on my condo?

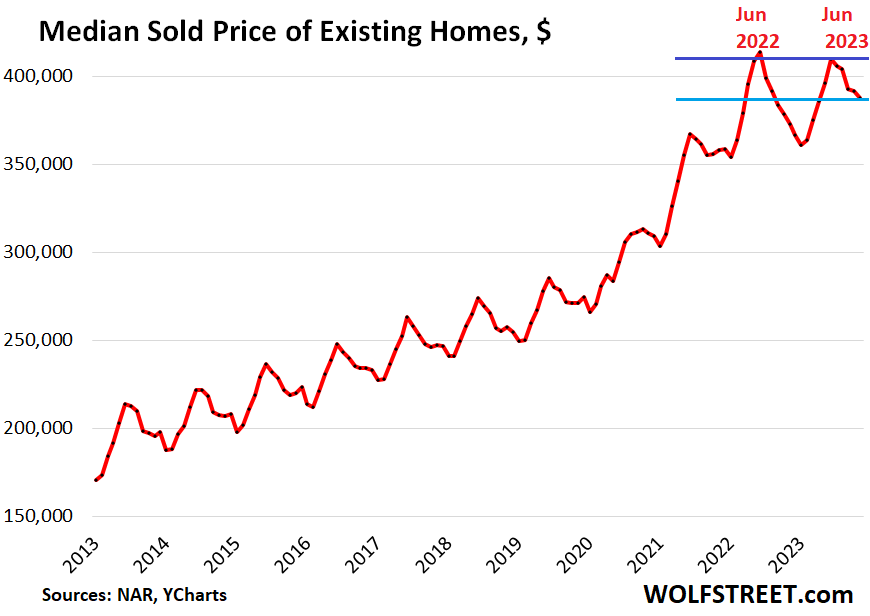

Assuming the condo sale fetches $400,000, with $200,000 allocated to settle my mortgage, my parents assert that, upon their passing, I must return this amount to my sister. However, I wonder if it’s truly that straightforward, considering the potential inflation of this value over time.

More: