Well it looks like this certainly is something. Perhaps Just the Threat of a tariff has drained the LBMA of GOLD no less. I can't imagine what is going on in Silver then.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bank of England delaying gold deliveries 4 to 8 weeks

- Thread starter Voodoo

- Start date

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Messages

- 34,562

- Reaction score

- 5,847

- Points

- 288

London gold market queues up to borrow central bank gold after big shipments to US, sources say

LONDON, Jan 29 (Reuters) - London bullion market players are racing to borrow gold from central banks, which store bullion in London, following a surge in gold deliveries to the United States on speculation of potential import tariffs there, two sources familiar with the matter said.More:

- Messages

- 80

- Reaction score

- 32

- Points

- 78

Bank of England cries

Deliveries are delayed

Stuck in the queue

Deliveries are delayed

Stuck in the queue

Yea, the biggest Gold dealer in the world can't deliver for a month. Umm Hello McFly. Game over.

When we had the Northwest Mint problems they played tons of shipping games and often had 1-2 weeks problems. A month ment they were going down.

When we had the Northwest Mint problems they played tons of shipping games and often had 1-2 weeks problems. A month ment they were going down.

Here's the Reuters report (no paywall). The Financial Times was quoted in the video, but that has a paywall:

More:

London bullion market players are racing to borrow gold from central banks, which store bullion in London, following a surge in gold deliveries to the United States on speculation of potential import tariffs there, two sources familiar with the matter said.

The minimum waiting time to load gold out of the Bank of England, which stores gold for central banks, has reached four weeks, one of the sources said. In normal times, the release time is a few days or a week.

The BoE declined to comment when asked about the queue.

...

"The key with the BoE is that they are not a commercial vault so not prepared to handle the onslaught of gold borrowing banks are requesting from the central banks," said Robert Gottlieb, an industry expert and former head of precious metals at Koch Supply and Trading.

The size of so-called Loco London free float, the amount of gold readily available to the London OTC market stored in London, has fallen after the jump in supplies to New York.

...

More:

Rotten, stinking no good fish. For sure.

Viking

Yellow Jacket

I can wait.

The London Bullion Market Association (LBMA) said on Thursday it is liaising with CME Group and US authorities on the significant premium of COMEX gold to the London market.

...

LBMA liaising with CME Group and US authorities on gold premium

London gold market stocks and liquidity remain strong, the association added.

What exactly are they "liaising" about?

Begging.... please man, you can't do this we'll be screwed and the world will go to hell. yada yada

London has Waaay more metal than the COMEX. The Comex was sending people to London, that was the whole EFP scheme. If London is out then its game over. They are completely out of Gold.

Global bullion banks are flying gold into the United States from trading hubs catering to Asian consumers, including Dubai and Hong Kong, to capitalize on the unusually high premium that U.S. gold futures are enjoying over spot prices.

...

"Gold prices are skyrocketing, and in Asia, demand has pretty much disappeared," said a Singapore-based bullion dealer with a leading bullion supplying bank. Spot gold prices hit a record high on Monday.

...

The cost of moving gold from Asian hubs to the U.S. is fractional when compared with prevailing Comex premiums, said a Mumbai-based bullion dealer.

A leading bullion bank even moved gold stored in a customs-free zone in India to the U.S. last week, he said.

In normal situations, many banks bring gold into India and keep it in customs-free zones, clearing consignments by paying import taxes only after realizing demand. They can move the cargo back overseas without paying taxes.

As retail demand in Asian markets was muted by high prices, bullion banks were even sourcing gold from refiners in Dubai, which usually serve as a major India-supplying hub, to cater their demand in the U.S, said a Dubai-based bullion dealer.

"The U.S. is like a gold magnet right now, pulling in gold from all over the world," he said.

Reminder of recent history and big picture view of the physical gold and silver market right now:

www.sprottmoney.com

www.sprottmoney.com

On Tariffs and Gold Prices

Gold price spreads widen as delivery delays increase. Is the NY/London Gold Pool collapsing? Buy gold, buy silver before prices surge.

...

A 25% tariff on gold imported from Mexico or Canada will therefore add $700 per oz to the international gold price, assuming a $2800 gold price, and leave the final price post tariff at a staggering $3500 per oz. All of this is also taking place in an environment in which gold prices have yet again reached , with a highest daily close and a highest monthly close registered on the last day of January.

...

... together Mexico and Canada accounted for 80% of all US silver imports. This is a staggering figure and shows how dependent the US is on silver from Mexico and Canada. Imposing a 25% import tariff on Mexican and Canadian silver imports is going to affect the US silver sector in a massive adverse way.

...

More (long):

Gold at All Time Highs amid Physical Gold Shortages

Trump tariffs on Mexico and Canada cause COMEX-London dislocations, and highlight cracks in the LBMA London gold market.

This post may contain affiliate links for which PM Bug gold and silver discussion forum may be compensated.

That's a bit odd and unexpected as the SIlver spread is coming in today.

- Messages

- 18,322

- Reaction score

- 11,027

- Points

- 288

listen at 1.75X

As they delve deeper into the world of investments, Bill and Dr. Janda also touch on the topic of cryptocurrencies like Bitcoin. While some may tout crypto as a viable store of value, Bill cautions that it is not without its own set of risks and uncertainties. He notes that the lack of physical backing and the highly speculative nature of cryptocurrency markets make it a less reliable option for those seeking a safe haven in times of economic uncertainty. In contrast, precious metals have inherent value, are easily transferable, and have stood the test of time as a trusted store of value. Whether you're a seasoned investor or just starting to build your financial portfolio, this insightful conversation is sure to provide valuable insights and inspiration for anyone looking to secure their financial future in today's uncertain economic climate.

22

Bill Holter: The Financial Disruptors Vs Precious Metals

In this enlightening interview, Dr. Dave Janda sits down with renowned financial expert Bill Holter to discuss the crucial topic of precious metals investing in uncertain economic times. As the global economy continues to experience volatility and instability, Bill emphasizes the importance of having a diversified portfolio that includes physical gold and silver as a store of value. He highlights how these tangible assets have historically performed well during periods of economic stress, serving as a hedge against inflation and market downturns.As they delve deeper into the world of investments, Bill and Dr. Janda also touch on the topic of cryptocurrencies like Bitcoin. While some may tout crypto as a viable store of value, Bill cautions that it is not without its own set of risks and uncertainties. He notes that the lack of physical backing and the highly speculative nature of cryptocurrency markets make it a less reliable option for those seeking a safe haven in times of economic uncertainty. In contrast, precious metals have inherent value, are easily transferable, and have stood the test of time as a trusted store of value. Whether you're a seasoned investor or just starting to build your financial portfolio, this insightful conversation is sure to provide valuable insights and inspiration for anyone looking to secure their financial future in today's uncertain economic climate.

22

- Messages

- 18,322

- Reaction score

- 11,027

- Points

- 288

pocket change...Watch the prices of 1/10 gold coins and 20 francs.

Just over a year ago I was buying any 1/10th gold coins under $200 each. I was also bottom fishing for.any 20 francs under $375.

$548 for 20 franc rooster today!

- Messages

- 18,322

- Reaction score

- 11,027

- Points

- 288

Zerohedge Edit- London’s Gold Market Can’t Satisfy Current U.S. Demand

London's bullion market is under strain. A surge in gold shipments to the U.S. has left traders scrambling to borrow from central banks, with wait times at the Bank of England stretching from days to weeks. The gold supply chain, long considered reliable, is now exposed to cracks that weren’t apparent before.The Just-in-Time Model Breaks Down

For decades, bullion banks operated on the assumption that gold was always available. The system worked because gold isn’t consumed—it’s recycled, leased, and traded. When supply disruptions occurred, banks could borrow metal, cover their needs, and replace it later. That model is now failing.A new kind of buyer has entered the market: one that doesn’t see gold as a financial instrument but as money itself. Countries like China and Russia have spent years accumulating gold, prioritizing it over U.S. bonds. Their strategy has chipped away at the available leasing pool, leaving Western banks exposed.

The Musical Chairs of Gold Supply

Zerohedge Edit-The LBMA Doesn't Have the Gold

London’s Gold Market Can’t Satisfy Current U.S. Demand

- Messages

- 34,562

- Reaction score

- 5,847

- Points

- 288

Ronan Manly said:The gold clearing banks of London Precious Metals Clearing Ltd (LPMCL) have exhausted the metal they had available for delivery in their own vaults… so they are trying to borrow as much gold as possible via the gold lending market at the Bank of England. But this looks exhausted too.

These clearing banks (JP Morgan, HSBC, UBS and ICBC Standard) need to keep gold in their vaults for their own loco london liquidity. But it looks like they don’t have any more gold to do this.

Counterparty risk has therefore risen between all the LBMA bullion banks which trade unallocated “gold credit” between each other. The clearers, the market makers and all the other LBMA bullion banks and brokers and traders. About 50+ entities.

basically they trade paper “claims” on gold (or the electronic equivalent). These claims are now trading at a discount to reflect the fact that they can’t be converted at will into physical due to a lack of availability of sufficient loco London physical gold.

One word of caution as I just don't quite trust this Gold rally. First, its mostly left Silver and Miners in mud. Second we know that bankers like gold as they have most of the metal. The market sniper has had the 2,900 level on Gold as a long term target and we just about got there. So I might hedge some by selling GLD call spreads and getting a few puts. Staying long the silver and miners.

... I might hedge some by selling GLD call spreads and getting a few puts. ...

Careful with GLD:

Borrowing fees are a bit tricky. Trust me I've been following them a long time with Gamestop. Now, a much larger commodity is a pretty different animal and more things going on. But sometimes this could mean that there is a lot of demand to Short the item. Perhaps people are going short GLD and buying real GOLD. Perhaps they know that a rug pull is about to come. Or perhaps they got called on their derivative sales and really do need to get the real stuff. Not sure. But I'm fine shorting a little GLD and being long real stuff and SLV as well as miners.

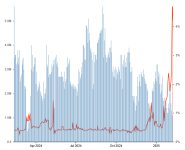

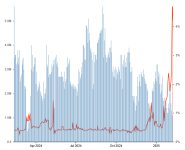

Here's a chart of recent data on GLD. It certainly is spiking. But this is also only data from Interactive Brokers.

www.iborrowdesk.com

www.iborrowdesk.com

IBorrowDesk

Actually, 20 francs were pocket change! There were so many varieties across many countries all with the same measure. Must have been interesting times to know what you carried in your pocket was what it was worth and you were personally responsible for keeping your stuff in order.

Wall of text is worth digesting:

www.financialsense.com

www.financialsense.com

Bob Coleman said:...

Yeah, I can answer the four to eight weeks real quickly. I know the bank of England has come out and other experts in the industry have come about actually how the gold is stored in England. At the bank of England, there's about 400,000 gold bars. And the way they store it is in an allocated format. So everybody has like a numbered bar. The problem is these bars kind of get shifted around and traded amongst central banks or large players. So the bars may not move, but the owner does. And so they have to go out and look for all these serial numbered bars. That's one of the problems that they're running into is just the logistics of trying to find all this metal and then get it shipped out. What's interesting on the tariff side, I've been sort of in front of this entire issue. Back In, I think December 5th, I put something out on my X feed, really discussing tariffs and explaining what it actually means. And you have to almost start back in 2018, if you remember Trump, Trump's administration put a tariff on China across, it's almost across the board. But what people didn't understand back then is they actually tariffed gold and silver refined bullion. And not very many people understood that. So in 2022, we had a client that was actually trying to bring metal over into the country. They actually owned metal they bought probably back 15 years ago, but it happened to have a Chinese hallmark. They were sold a bar with a Chinese hallmark. They weren't storing it in China. It was stored in Hong Kong or Singapore. What ended up happening was when they tried to bring that bar in, it had a 25% tariff associated with it. I contacted the CME which runs the COMEX, and they weren't even aware of it at the time. And so the market, I started realizing, wait a second, these tariffs could become very restrictive to COMEX. Deliveries because you know, even though that Chinese bar was from China, it was from a good delivery refiner. That is acceptable hallmarks from for, for the COMEX and the LBMA. Now fast forward to last November with the election and so forth and the tariff talk starting to rumble. What people didn't realize was these hallmark bars, he's talking about Mexico, he was talking about Canada, Australia. These are massive exporters of precious metals around the world. But Mexico and Canada specifically are huge exporters. Mexico is a huge exporter of silver into our country. I think about half the silver that comes in comes from Mexico. But obviously Canada is obviously a huge exporter of metals as well. And not only that, the hallmarks, they're very well-known brand name hallmarks that come out of Mexico as well as Canada as well. So what happens is these bars, even if they're not coming from Mexico or Canada, let's say it's royal Canadian mint 1 kg gold bars for example, and they're stored over in London and Trump institutes a tariff. All of a sudden if you're trying to ship Royal Canadian Mint bars, even if it's not coming from Canada, it's coming from London, the customs looks at the product of origin. And so when that bar is brought into the US it's declared as a Canadian hallmark. So therefore it would be susceptible to tariffs. That has what's awakened this sort of sleeping giant in a way with the tariff issues. And not very many banks really understood this going back into November and early December when I wrote about it, it was really ahead of most research houses and refinery reports out there that were even discussing it. And then all of a sudden mid December I posted this everywhere and it kind of went. And then all of a sudden mid December you started to see the EFP, which is the exchange for physical premium. And this is where it gets, this is what starts to tie in the paper world to the physical world. The, the, a lot of banks short on the, the futures market because the futures price tends to be a little bit higher price than the spot price. You're, when you're in a contango and you have interest rates at 4 or 5%, you know, there's a cost to carry and a value of money as you go a little bit longer in time. So the price is naturally a little bit higher. And so what happened was the EFP started typically what happens, the banks short the exchange for physical premium because they're trying to capture a spread between a future price of gold, for example, and today's price and ultimately, when you get closer and closer to the expiration of that futures contract, both those prices come to parity. Well, what was happening was all of a sudden these players were short and they were sitting on a lot of metal in London, for example. And they were like, some of these bars may actually have tariffs potentially attached to them. We got to get these bars over to New York and get them in front of the tariff if the tariffs are instituted. So you had this big rush of metal coming on. At the same time, a lot of players were starting to panic and starting to close out short positions on the futures markets because they realized, wait a second, I may not be able to get that metal, or I never really had metal, I was just playing the spread on paper, so to speak. And so they started buying back the EFP. And that was instead of the EFP naturally dropping, it was actually accelerating to the upside. And the futures price was accelerating faster than the spot price. So you started to see a widening of that EFP, which was creating a lot of losses in the industry. Banks were starting to tighten up transaction activity. They were pulling thousand ounce bars from offers in December and into, into January. They didn't want to sell their metal, basically, they wanted to deliver it to the COMEX. So you had a lot of dynamics that were happening in the industry that was putting pressure on the mechanism that really creates the influence of the precious metal prices that we see every day.

...

Will Trump Revalue US's Gold Reserves? Jim Puplava Interviews Metals Expert Bob Coleman

Feb 7, 2025 – Gold and silver have seen significant price increases, with gold reaching record highs. In today's Big Picture segment of the Financial Sense Newshour, Jim Puplava speaks with metals expert Bob Coleman focuses on the effects...

- Messages

- 18,322

- Reaction score

- 11,027

- Points

- 288

Bit of history here

And that mean...get precious metals.

What the surging price of gold says about a dangerous world: https://www.economist.com/finance-and...

Detailed Timeline of Topics:

00:00 Introduction

01:13 London gold and tariffs

03:08 Question on the quickness of moving gold

04:05 Leasing gold concerns

05:34 Tightening physical gold market

06:11 Inflation and higher precious metals prices causing retail investors to sell

06:41 The real story is silver

08:36 Why is the silver price still lagging

09:44 Why gold keeps hitting new all-time highs

11:23 Silver being held as bank reserves

13:34 No alternative to central bank gold buying

15:00 BRICS, gold, and tariffs

17:34 Physical silver market looks to get tighter than gold

21:09 The upcoming Fed fight

25:19 Is inflation under control?

27:55 The black swans

Bill Holter - Physical Precious Metals Markets Tightening

Bill Holter ex-retail stock broker and precious metals expert tells us how the precious metals market is already tight and looks to get tighter. With events going on all over the world happening hard and fast Bill clears the air to help us get things in perspective.And that mean...get precious metals.

What the surging price of gold says about a dangerous world: https://www.economist.com/finance-and...

Detailed Timeline of Topics:

00:00 Introduction

01:13 London gold and tariffs

03:08 Question on the quickness of moving gold

04:05 Leasing gold concerns

05:34 Tightening physical gold market

06:11 Inflation and higher precious metals prices causing retail investors to sell

06:41 The real story is silver

08:36 Why is the silver price still lagging

09:44 Why gold keeps hitting new all-time highs

11:23 Silver being held as bank reserves

13:34 No alternative to central bank gold buying

15:00 BRICS, gold, and tariffs

17:34 Physical silver market looks to get tighter than gold

21:09 The upcoming Fed fight

25:19 Is inflation under control?

27:55 The black swans

- Messages

- 34,562

- Reaction score

- 5,847

- Points

- 288

Bank of England Stammers Through Gold WithDrawal Delay Explanations

The BoE Governor has downplayed the story, stating last week that gold is now unimportant and maintaining that London is still a key leader in the global gold market.

This week, the talking point was that they're managing it. It's orderly. The BoE bullion yard was jammed with an armored lorry Thursday morning, and gold bullion is a heavy element (nervous laughter).

The spot silver and gold markets traded up again this week.

The spot price of silver in fiat USD ended at $31.80 oz bid.

The spot gold price closed at...

- Messages

- 18,322

- Reaction score

- 11,027

- Points

- 288

Might be part of the global gold deliveries?

The data below looks at contract delivery where the ownership of physical metal changes hands within CME vaults. It also shows data that details the movement of metal in and out of CME vaults. It is very possible that if there is a run on the dollar, and a flight into gold, this is the data that will show early warning signs.

Read more here...

Is Someone Attacking the Comex? January Sees $5.2B in Gold Deliveries

The CME Comex is the Exchange where futures are traded for gold, silver, and other commodities. The CME also allows futures buyers to turn their contracts into physical metal through delivery. You can find more detail on the CME here (e.g., vault types, major/minor months, delivery explanation, historical data, etc.).The data below looks at contract delivery where the ownership of physical metal changes hands within CME vaults. It also shows data that details the movement of metal in and out of CME vaults. It is very possible that if there is a run on the dollar, and a flight into gold, this is the data that will show early warning signs.

Read more here...