...

"The Costco Gold & subsequent media boom has already punched above its raw (fundamental) weight in influencing opinion; it alone is putting Gold as an asset class back on the map for new (that's the key word here) retail investors," she said. "Game-changing market moments come'n go. Some are just well-timed, coincidentally, or not. GLD was developed a couple of years after 9/11 and at the start of zero interest rates, easily creating a bigger path for investors to access the metal. Costco has done more for sentiment and opening new channels when trust has completely broken down post-COVID."

...

Shiels also noted that a new consumer demographic is also driving gold demand as Millennials, worried about their future, are attracted to traditional safe-haven assets.

"'The peoples' confidence in the U.S.' ability to destroy itself over time is at an all-time high, and they are seeking a more traditional escape (in assets like Gold) via traditional outlets (in outlets like Costco)," she said.

Shiels also noted that Costco's robust gold sales have defied a few interesting trends in the physical marketplace. Retailers are buying gold as prices trade near record highs. Historically, higher gold prices have weighed on physical demand.

However, this historical trend is seen in more traditional bullion vehicles.

"While consumers are snapping up bars at Costco, subdued coin premiums and Mint sales estimates (US Mint Gold coin sales down were 25% in Q1'24; Perth Mint Gold sales hit its lowest in 5 years in March 2024) indicate aggregate retail demand in the US & Western Europe is subdued," Sheils said.

Although this new Costco phenomenon is attracting mainstream media attention, Shiels said that she sees it as a part of a much larger physical landscape. She noted that Western consumers are only following the trend set by Asian consumers.

...

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Costco selling gold and silver bullion

- Thread starter pmbug

- Start date

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

Unless the entrepreneurial class that mostly shops at Costco is a new group of stackers, the hype will fade. Some of the buyers were looking to flip their bars according to Salivate Metal, but some were upside down with premiums and sales taxes.

Last edited:

- Messages

- 34,215

- Reaction score

- 5,813

- Points

- 288

Costco is buying up ASEs now.

ALERT! You Won't Believe Who Just Bought ALL The 2024 Silver Eagles!

May 2, 2024 #silver #gold #preciousmetals11:08

- Messages

- 34,215

- Reaction score

- 5,813

- Points

- 288

Coin dealer talks about his Costco experience.

16:05

Channel: https://www.youtube.com/@Spegtacular/videos

I returned to Costco for Silver Bars and THIS happened!

May 6, 202416:05

Channel: https://www.youtube.com/@Spegtacular/videos

- Messages

- 18,213

- Reaction score

- 10,972

- Points

- 288

Coin dealer talks about his Costco experience.

I returned to Costco for Silver Bars and THIS happened!

May 6, 2024

16:05

Channel: https://www.youtube.com/@Spegtacular/videos

Good reason to live in Florida!

I was at my local Costco the other day and asked a manager if they were going to carry gold or silver in the store. He said no - it was just for online and they wouldn't be carrying it in any store in the greater Houston area. That surprised me given the reports I see online of people finding it in stores at other locations. I'm guessing the purchasing manager for the Houston area might be a bit ignorant of precious metal demand and Houston area wealth.

- Messages

- 34,215

- Reaction score

- 5,813

- Points

- 288

Nothing special, just another buy. We're in FL.

8:25

Channel: https://www.youtube.com/@Spegtacular/videos

I returned for Gold Bars at Costco and THIS happened!

Jun 3, 2024 #spegtacular #coincollecting #gold8:25

Channel: https://www.youtube.com/@Spegtacular/videos

- Messages

- 34,215

- Reaction score

- 5,813

- Points

- 288

Nothing special in this one. Just Sal's take on things. 11 mins, 14 secs.

Costco's Gold Bar & Silver Motive Revealed! The Cheat Code!

Jun 4, 2024 #silver #gold #preciousmetalsDid some shopping at my local Costco this morning. Surprise! They had 1toz gold Buffalos for sale (limit 5 per customer) for $2,399.99. They also had a 10toz silver bar for $329.99. The Buffalos were calling me like the one ring torturing Gollum.

Or, he recognizes the relative safety of the Houston area, and potential store-security problems.I was at my local Costco the other day and asked a manager if they were going to carry gold or silver in the store. He said no - it was just for online and they wouldn't be carrying it in any store in the greater Houston area. That surprised me given the reports I see online of people finding it in stores at other locations. I'm guessing the purchasing manager for the Houston area might be a bit ignorant of precious metal demand and Houston area wealth.

On a podcast somewhere, some wag - who might be a PM vendor or be sponsored by one, I don't remember - he remarked, Costco is selling gold bars...but isn't buying any of them back.

I'm three miles from a Costco. And two miles from my family-run PM dealer - who sells at a fair price, and has bought from me a considerable number of coins, back six years ago when I was in dire straits. Not only will he buy, he's contracted with a local (regional) bank to cash checks issued by his business, to anyone they're made out to. If I sell four K-rands to him for $9600, the bank will cash that check. Not require it be deposited or exchange it for a Cashier's Check - give the bearer cash, once he gives proof of identity.

Not the kind of service you get with Costco.

- Messages

- 34,215

- Reaction score

- 5,813

- Points

- 288

Costco had 100-gram gold bars for $7,600. They sold out in less than a day.

- Costco's largest gold product is a 100-gram bar from PAMP Suisse that last sold for $7,599.99.

- The jumbo-sized bar was briefly available this week, but sold out in less than a day.

- The quick sellout shows just how strong demand still is for Costco's precious metals business.

More:

Here's Sal.....................

- Messages

- 34,215

- Reaction score

- 5,813

- Points

- 288

Costco Moving $200 Million in Bullion per Month

August 01, 2024- Messages

- 34,215

- Reaction score

- 5,813

- Points

- 288

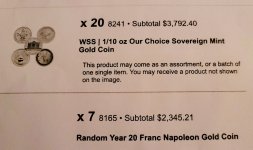

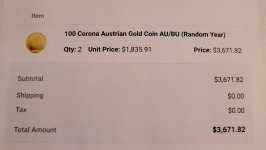

Flipping PMs for fun & profit

11:23

___________________________________

For those who prefer to read...........

Business Insider

More:

Man Makes $500 A Week Buying Costco Gold & Silver!

Aug 3, 2024 #silver #gold #preciousmetals11:23

___________________________________

For those who prefer to read...........

Business Insider

A Costco gold collector has bought more than $100,000 of coins this year — mostly for flipping

- Costco sells an estimated $200 million worth of gold and silver coins and bars a month.

- One Costco coin flipper says he can make up to $500 per week.

- However, short-term trading is a highly risky activity with the potential for significant financial losses.

More:

Thy need to sell .999 bullion bangles and chains.

Small business owners are hedging our currency and the stock market. Even if gold prices fall you still can hold something in your hand to reduce the pain unlike red ink on Wall St.

Small business owners are hedging our currency and the stock market. Even if gold prices fall you still can hold something in your hand to reduce the pain unlike red ink on Wall St.

- Messages

- 34,215

- Reaction score

- 5,813

- Points

- 288

Costco adds platinum bars to its precious metals lineup

Costco on Wednesday announced the 1-ounce platinum bars, on sale for $1,089.99 on its website alongside its now-famed gold bars and silver coins.

I am astounded that this has remained A Thing. I mean, seriously: Why would you go to your China-Junk retailer...even if a very good retailer like Costco - for something that's just not their bailiwick? Courses for horses. I go to Wally World for crappy window fans - not fresh meat. I go to Carvana to buy a used car - not toilet paper.

And my PM dealer isn't going to have a new suit to sell, or a used car - even though there's probably plenty of people who'd want to trade.

IF Costco wants to continue this...it would probably be worth their while to set up an agreement with a bullion dealer with a large footprint. Like Kitco - yeah, I know, they're a dirty word, now; but you get the idea. I don't know who the big names are, but if a Costco buyer could go to a JM Bullion store-within-the-website, or even have a real-life person at a counter within - like contract jewelers used to do at Walmart - if they had that, they'd have more confidence, get the same web hits and foot traffic, and even some customers could walk out of the store with gold in their hands.

If they did that, though, it would behoove them to up their parking-lot security...

And my PM dealer isn't going to have a new suit to sell, or a used car - even though there's probably plenty of people who'd want to trade.

IF Costco wants to continue this...it would probably be worth their while to set up an agreement with a bullion dealer with a large footprint. Like Kitco - yeah, I know, they're a dirty word, now; but you get the idea. I don't know who the big names are, but if a Costco buyer could go to a JM Bullion store-within-the-website, or even have a real-life person at a counter within - like contract jewelers used to do at Walmart - if they had that, they'd have more confidence, get the same web hits and foot traffic, and even some customers could walk out of the store with gold in their hands.

If they did that, though, it would behoove them to up their parking-lot security...

- Messages

- 34,215

- Reaction score

- 5,813

- Points

- 288

You can now buy a $1,089 platinum bar from Costco—here’s what to know before investing

Shoppers love Costco for the affordable gas, bulk-priced consumer staples and unwavering commitment to charging $1.50 for a hot dog and a soda.Recently, though, they’ve found something new to love about the wholesaler: precious metals.

Costco began selling physical gold last year, and demand has been so hot that Wells Fargo analysts expect sales to now be in the neighborhood of $100 million to $200 million a month.

And earlier this month, the big box store began selling platinum on its website. A 1-oz. bar of the metal will run you $1,089, a small premium over platinum’s spot price, which recently hovered around $1,000 an ounce. You can only buy the bars on the company’s website, and you’ll need a membership, which costs between $65 and $130 a year.

More:

I was buying random 1 oz. platinum coins between $940-$989. If I wanted a USA eagle it was $1050-$1089. I also bought 1/10 random coins for $115-$129. I don't like bars in gold or platinum, only silver.

I stopped buying.platinum when I reached a limit recently.

I stopped buying.platinum when I reached a limit recently.

a couple of days ago i was doing some fileing .....looked at my PMs bought reciepts ...happened upon some from 2005 ...was buying 1/10 lunars at 40-50$ each .....just something that caught my eye in the stack of papers....kinda forget those days.......im still trying to add a little bit of PT/Ag just hard to find deals these daysI was buying random 1 oz. platinum coins between $940-$989. If I wanted a USA eagle it was $1050-$1089. I also bought 1/10 random coins for $115-$129. I don't like bars in gold or platinum, only silver.

I stopped buying.platinum when I reached a limit recently.

I don't know what to say.

I can go a mile from here and buy them, that price, all day long. On a street corner, sits the PM dealer I know, and three others, who, when I was new in town, didn't give me as good a price. Also, my guy focuses on metals - whereas the other two do jewelry and some other things.

Point is, it's not hard to find specific coins, even if you're picky. COSTCO just isn't the best place to buy them.

I know I've said similar before, but it just keeps blowing my circuits.

I can go a mile from here and buy them, that price, all day long. On a street corner, sits the PM dealer I know, and three others, who, when I was new in town, didn't give me as good a price. Also, my guy focuses on metals - whereas the other two do jewelry and some other things.

Point is, it's not hard to find specific coins, even if you're picky. COSTCO just isn't the best place to buy them.

I know I've said similar before, but it just keeps blowing my circuits.

Haven't checked the price, but he has them available.You can buy .9999 fine Maples under spot all day long? I wish my LCS would do that!

I got a quote a month ago. I think he was $200 over spot, give or take.

...Big difference in price? Sure.

So, say, a year ago, I bought gold with a spot price of $2100. And pay $175 over spot.

Would it really matter, now, with a 28-percent increase in value?

Remember, gold is not speculative. It's a buy-and-hold proposition. For the short term, the vig for the middleman, eats up a lot of any potential profit.

So, say, a year ago, I bought gold with a spot price of $2100. And pay $175 over spot.

Would it really matter, now, with a 28-percent increase in value?

Remember, gold is not speculative. It's a buy-and-hold proposition. For the short term, the vig for the middleman, eats up a lot of any potential profit.

- Messages

- 80

- Reaction score

- 32

- Points

- 78

Buy low and sell high

Arbitrage traders shop deals

Costco memberships

Arbitrage traders shop deals

Costco memberships

Always good advice.

But when you plan to hold, anyway...AND when you need to build/protect a relationship with someone in the conduit, who can help raise money quickly if the need arises...it might just be a better plan to deal with the small-business merchant, over the faceless monolith.

But when you plan to hold, anyway...AND when you need to build/protect a relationship with someone in the conduit, who can help raise money quickly if the need arises...it might just be a better plan to deal with the small-business merchant, over the faceless monolith.