Crypto in 2024 looks like a no brainer investment from everything I see. BTC and ETH are likely going to lift all the other boats - at least all the top crypto.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Crypto trading/market thread

- Thread starter pmbug

- Start date

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Status

- Not open for further replies.

This could be huge if it works at scale:

Citrea, a project incubated by Chainway Labs, came out of stealth to propose the first Bitcoin native scaling solution involving ZK rollups. The innovation, which takes advantage of the possibilities introduced by BitVM to natively verify zero-knowledge (ZK) proofs without making any changes to the protocol, takes a different approach to blockchain scaling.

For Citrea, any project that seeks to scale Bitcoin without using its blockspace is not helping it scale and will eventually become a competition for Bitcoin itself. Also, these solutions fail to address the functionalities needed to make Bitcoin the foundation for world finance: the Lightning Network fails to add programmability to Bitcoin. Similarly, sidechains fail to use Bitcoin blockspace, diverting their action to other chains.

Citrea proposes a solution that addresses these two aspects, leveraging ZK proofs that use the Bitcoin blockspace to settle its transactions while sharding the execution task to its virtual machine. Citrea claims it is the “only execution layer on Bitcoin that settles on Bitcoin, the first ZK proof verification, and the first universal L2 verification inside Bitcoin.”

Citrea also allows the implementation of Ethereum Virtual Machine (EVM) apps on top of Bitcoin, allowing it to become the bedrock for different apps that have been pushed to other chains that lack the trust and security that Bitcoin offers. Nonetheless, it is not limited to EVM apps and can adopt new virtual machines due to its modular architecture.

The project is already being tested in a private testnet. Citrea reported that it is working hard to launch a public testnet for its product, with more information available in the coming months.

spinalcracker

Ground Beetle

- Messages

- 560

- Reaction score

- 986

- Points

- 218

lulz...

PR team using a "cool" meme without understanding it's meaning. Idiots.

~~~

www.coindesk.com

www.coindesk.com

Did President Biden Just Endorse Bitcoin?

The octogenarian politician is sporting laser eyes on Twitter, seemingly unaware it is a symbol of support for the cryptocurrency.

...

PR team using a "cool" meme without understanding it's meaning. Idiots.

~~~

Franklin Templeton has applied for a spot Ethereum exchange-traded fund (ETF), a filing with the Securities and Exchange Commission (SEC) shows.

The asset manager joins BlackRock, Fidelity, Ark and 21Shares, Grayscale, VanEck, Invesco and Galaxy, and Hashdex, who have all submitted applications in recent months.

...

Franklin Templeton Joins Ethereum ETF Race

The asset manager is also one of the issuers of a spot bitcoin exchange-traded fund but hasn’t seen the same success as frontrunners BlackRock and Fidelity.

So many bullish headlines this morning...

www.coindesk.com

www.coindesk.com

~~~

www.coindesk.com

www.coindesk.com

Bets on futures tracking Solana’s SOL have risen to a lifetime peak of $1.7 billion in the past week, with bulls leading the charge.

Notional open interest – or the dollar value locked in the number of unsettled futures contracts – has risen over $700 million since the start of February to $1.7 billion, with $400 million added since Feb.8. This exceeds the $1.4 billion figure set in late December, the previous record when the ecosystem saw a meme coin-led frenzy.

Data from tracking service Coinalyze shows over 63% of positions are long or betting on higher prices – implying upward of $1 billion in bullish futures bets.

...

Solana’s SOL Futures Rack Up $1B in Record Bullish Bets

The present bias towards long positions means potential for a long squeeze, where investors who hold long positions feel the need to sell into a falling market to cut their losses.

~~~

Crypto traders may want to pull up ether’s (ETH) relative strength index (RSI) on their screens as the popular technical analysis tool is signaling uptrend acceleration ahead.

RSI, developed by J. Welles Wilder, is a momentum indicator that measures the speed and change of price movements over a set period, usually 14 days or 14 weeks.

The indicator oscillates between 0 and 100, with readings above 70, indicating strong upward momentum instead of overbought conditions as popularly perceived. Meanwhile, readings below 30 show strong downward momentum.

EEther’s14-week RSI has crossed above 70. Parabolic bull runs unfolded following similar crossovers in January 2016, February 2017, December 2017, July and November 2020 and March 2021.

...

The ether (ETH) price rose through the $2,700 mark early Thursday for the first time since May 2022 as traders bet on the possibility of a spot ETH exchange-traded fund (ETF) approval in the U.S., a move that could boost its institutional appeal.

As of Thursday, Franklin Templeton, BlackRock, Fidelity, Ark and 21Shares, Grayscale, VanEck, Invesco and Galaxy, and Hashdex, had all submitted applications for an ether ETF. ...

...

Traders say ether could be headed back to its 2022 highs in the coming months. The token’s lifetime peak was nearly $5,000 in November 2021.

“Possibly as part of a new wave of growth, ETH could quickly find itself approaching $3500 - returning to the April 2022 peak,” Alex Kuptsikevich, a FxPro senior market analyst, said in an email to CoinDesk.

“The 15% rise in less than nine days suggests impressive buying interest after the bulls reloaded their positions in January,” he said.

Ether Traders Target $3.5K as ETH Jumps on ETF Expectations

Several traditional financial firms are vying for an ether exchange-traded fund in the U.S., a move that is boosting the token’s medium-term outlook.

They have a plan, and you're not privy.So many bullish headlines this morning...

When I'm being driven and herded, I wanna know WHY.

lol. The headlines are from a crypto mag, so they publish bullish news when it's there, but it isn't always there. There just happens to be some convergence of news with Bitcoin and Ethereum driving the bus. It's not always a conspiracy and "they" (meaning the elites/government) hate crypto (see war on crypto and CBDC = TOFO).

All these people trying to reinvent gold.lol. The headlines are from a crypto mag, so they publish bullish news when it's there, but it isn't always there. There just happens to be some convergence of news with Bitcoin and Ethereum driving the bus. It's not always a conspiracy and "they" (meaning the elites/government) hate crypto (see war on crypto and CBDC = TOFO).

I had to think long and hard about this - and thanks for answering some of my questions; but "money" that I have to study up on; and where if I make a mistake with, it's disastrous; money that depends not only on my computer, but my link to the network and the OTHER party's link to that network (unlikely to be reliable once the dollar falls) and then, secure from government snoops' prying eyes (how much of what we used to think was secure, online, now is routed right into that Utah data-vacuum site?) for collection, taxation and punishment...no. Just now.

I have PM coins. Not so good when you're crossing borders, but the global chaos has pretty much put THAT out of mind. If/when that changes, I'll deal with reality as it is at the time; but for now, I don't want to be the guy with my money in collapsed Greyscale, or Mt. Gox, or with a thumb drive that's now obsolete...

That's true. The riggers have Captured Cryptos. Well most of them and especially the ones going UP. Everyone likes to tout how there can't be more Bitcoin ever. Which is a farce because its the DERIVATIVES of bitcoin that are expanding rapidly, like with these ETF's.

On the other hand look at Monero. A privacy coin that is actually used a lot and it gets hammered because Binance got strong armed (likely) to take it off the platform.

On the other hand look at Monero. A privacy coin that is actually used a lot and it gets hammered because Binance got strong armed (likely) to take it off the platform.

- Messages

- 23,731

- Reaction score

- 4,349

- Points

- 288

Not news, not a how to, it's a biography on Brock Pierce. About a third through, listening / watching in one tab paying around the forum in a different tab.

Takeaways:

- Brock's Unique Success: From acting to gaming, Brock Pierce's diverse journey defines his crypto triumph.

- Crypto Trailblazer: Early in virtual currencies, Pierce pioneered ICOs, venture funds, and stablecoins.

- Understanding Crypto Risks: Despite Bitcoin ETF progress, Brock stresses risks and the need for instinctual decisions.

- Keys to Success: Tenacity and curiosity are vital for triumph in the ever-changing crypto world.

- Crypto's Big Role: Cryptocurrencies are set to transform finance and industries in the future.

1:03:57

Chapters:

00:00 Introduction and Background

08:25 Early Life and Acting Career

09:25 Entry into the Gaming Industry

22:05 Transition to Cryptocurrency and Blockchain

30:03 Early Involvement in Bitcoin and Virtual Currencies

37:12 Early Investments and Innovations in Crypto

41:54 Bitcoin ETFs and Regulatory Clarity

48:14 Observations on DeFi and Market Cycles

48:53 Missed Opportunities and Counterparty Risk

51:06 Staying Updated on Blockchain and Cryptocurrency

54:20 Getting Involved in Governance55:02 Tenacity and Curiosity as Key Traits

55:56 The Future of Finance and the Role of Cryptocurrencies

58:51 The Impact of AI and Machine Learning

59:45 The Power of ChatGPT and Superhuman Capabilities

01:00:44 Managing Messages and Investments

01:02:53 Civic Participation and Being the Change

From Disney Star to Crypto-Billionaire

Brock Pierce, Disney star turned Crypto-Billioniare shares insights from his journey, highlighting achievements like pioneering the first ICO and venture fund. Running for Presidency in 2020, and discussing recent Bitcoin ETF approvals and the future role of cryptocurrencies. Pierce emphasizes the importance of staying informed. He also underscores the impact of AI, machine learning, and ChatGPT in shaping the future.Takeaways:

- Brock's Unique Success: From acting to gaming, Brock Pierce's diverse journey defines his crypto triumph.

- Crypto Trailblazer: Early in virtual currencies, Pierce pioneered ICOs, venture funds, and stablecoins.

- Understanding Crypto Risks: Despite Bitcoin ETF progress, Brock stresses risks and the need for instinctual decisions.

- Keys to Success: Tenacity and curiosity are vital for triumph in the ever-changing crypto world.

- Crypto's Big Role: Cryptocurrencies are set to transform finance and industries in the future.

1:03:57

Chapters:

00:00 Introduction and Background

08:25 Early Life and Acting Career

09:25 Entry into the Gaming Industry

22:05 Transition to Cryptocurrency and Blockchain

30:03 Early Involvement in Bitcoin and Virtual Currencies

37:12 Early Investments and Innovations in Crypto

41:54 Bitcoin ETFs and Regulatory Clarity

48:14 Observations on DeFi and Market Cycles

48:53 Missed Opportunities and Counterparty Risk

51:06 Staying Updated on Blockchain and Cryptocurrency

54:20 Getting Involved in Governance55:02 Tenacity and Curiosity as Key Traits

55:56 The Future of Finance and the Role of Cryptocurrencies

58:51 The Impact of AI and Machine Learning

59:45 The Power of ChatGPT and Superhuman Capabilities

01:00:44 Managing Messages and Investments

01:02:53 Civic Participation and Being the Change

- Messages

- 471

- Reaction score

- 305

- Points

- 168

so, the conservative ETF with 1% crypto and 0% gold...

FWIW, when I visit Fidelity's page, it only reports the allocation ratio from December 31, 2023. I don't see the Feb 2024 update captured in that tweet. But the page does include this blurb:

www.fidelity.ca

www.fidelity.ca

Not sure why it wouldn't include an allocation to gold.

Edit: I asked them about it via their website's contact form:

Why invest in this fund?...

- A global multi-asset strategy designed with a neutral mix of approximately 40% equity factors, 59% systematic and actively managed fixed income ETFs and 1% cryptocurrencies.

Fidelity All-in-One Conservative ETF Fund

Not sure why it wouldn't include an allocation to gold.

Edit: I asked them about it via their website's contact form:

I was wondering why your "All-in-One" Conservative ETF Fund does not include any allocation to gold. Is gold not considered a conservative investment?

Last edited:

- Messages

- 23,731

- Reaction score

- 4,349

- Points

- 288

^^^^^^^

Don't know if you read this https://www.fidelity.com/learning-center/investment-products/etf/types-of-etfs-commodity

Don't know if you read this https://www.fidelity.com/learning-center/investment-products/etf/types-of-etfs-commodity

- Messages

- 471

- Reaction score

- 305

- Points

- 168

Imo it has nothing to do with financial reasons, this is just psychology.Not sure why it wouldn't include an allocation to gold.

Wall Street's level of despise for the barbarous relic is off the charts.

Last edited:

- Messages

- 23,731

- Reaction score

- 4,349

- Points

- 288

Fed Governor Discusses Crypto's Impact on US Dollar Dominance — Says Banks Should Avoid Bitcoin ETFs as Primary Asset – Featured Bitcoin News

A Fed governor has addressed crypto's impact on the U.S. dollar's dominance. He believes banks should not hold bitcoin ETFs as primary asset.

- Messages

- 23,731

- Reaction score

- 4,349

- Points

- 288

Texas Electric Utility Courts Unnamed Crypto Miners With Five-Year Deals – Bitcoin News

Texas-based Denton Municipal Electric (DME), is attracting interest from several crypto mining companies seeking to establish operations.

... Responding to a question ... his view on crypto ..., Waller reiterated his position from a year ago that ... people buy and hold them hoping someone else will pay more later. ...

That describes every investment opportunity available on Wall Street.

- Messages

- 23,731

- Reaction score

- 4,349

- Points

- 288

Cryptoverse: Breezy bitcoin reclaims $1 trillion crown

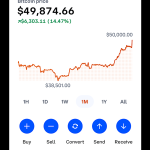

Feb 20 (Reuters) - Bitcoin is riding high.The world's largest cryptocurrency has leapt 22% this year to $52,005, pushing it past a market value of $1 trillion mark for the first time since its record heyday of late 2021.

Its resurgence has electrified the broader cryptocurrency market, including ether and other digital coins, which has now exceeded $2 trillion, as per data from CoinGecko.

The sector has been bolstered by the U.S. regulatory approval of several spot bitcoin exchange-traded funds (ETFs), from BlackRock and Fidelity among others, which allow access to the crypto coin vis regular stock exchanges.

More:

Whitney Webb is a beating to listen to. She cannot state any thought clearly. I skimmed the transcript of that video and did not see what her supposed prediction was. Lot's of half formed comments and insinuations though. Let me break this down for you:

Digital ID = surveillance

CBDC = control

(decentralized) crypto <> (centralized) CBDC

If you need more context/detail, please see:

www.pmbug.com

www.pmbug.com

www.pmbug.com

www.pmbug.com

The Blackrock ETF would not exist if Federal Courts had not bitch slapped the SEC thanks to GrayScale's decade long fight. Please use some common sense when evaluating conspiracy theory gobbledegook.

~~~

www.coindesk.com

www.coindesk.com

Digital ID = surveillance

CBDC = control

(decentralized) crypto <> (centralized) CBDC

If you need more context/detail, please see:

America's War on Crypto

The crypto industry recently held a Consensus 2023 industry event in Austin, Texas. It was a 3 day event featuring numerous panels/sessions with speakers/representatives from both crypto and non-crypto companies/industries as well as representatives from various government regulators. The...

CBDCs = TOFO (Tools of Financial Oppression)

Chatter about CBDCs has grown in the last few years. Central banks around the world are engaged in various projects to design, test and integrate CBDCs for future replacements of their national paper/coin currencies. In the absence of any compelling justifications, pundits proclaim CBDCs as a...

The Blackrock ETF would not exist if Federal Courts had not bitch slapped the SEC thanks to GrayScale's decade long fight. Please use some common sense when evaluating conspiracy theory gobbledegook.

~~~

Trading volumes of VanEck’s HODL, one of the ten spot bitcoin (BTC) exchange-traded funds in the U.S. (ETF), surged over 2,200% on Tuesday in a move driven by individual traders.

HODL traded over $400 million in volumes on Tuesday, a 22-fold jump over its daily average of $17 million. The figures came ahead of a planned fee cut on Wednesday, when VanEck will reduce its offering fees from 0.25% to 0.20%, as per a filing.

HODL’s volumes were the third-largest after Grayscale’s GBTC and BlockRock’s IBIT, the usual leaders. The ETF now holds nearly $200 million worth of bitcoin as of Feb.20, data shows.

Bloomberg Intelligence analyst Eric Balchunas said on X that the volumes came from 32,000 individual trades instead of one big investor – showing signs of a retail mania.

...

VanEck's Bitcoin ETF Records 2,200% Volume Surge in a Day

A sudden trading volume on VanEck’s HODL product seemed “retail armyish,” one analyst said.

- Messages

- 23,731

- Reaction score

- 4,349

- Points

- 288

5 Things Satoshi Nakamoto Correctly Predicted About Bitcoin

In a document dump of emails, Bitcoin’s pseudonymous creator foresaw many of the biggest trends driving the development of the first cryptocurrency.

Correspondence between Satoshi Nakamoto and his earliest known collaborator, Martti Malmi, was released as part of an ongoing lawsuit in the United Kingdom regarding the true identity of Bitcoin’s pseudonymous creator. For some, the documents represent a new avenue of research for anyone looking to finally identify who Satoshi really is. For others, the 120 pages of emails (also posted to Github) offer fresh insight into the character and personality of the long gone developer.

As Bitcoin historian (and former CoinDesk editor) Pete Rizzo notes, the emails largely conform to and confirm what the world already knows about Satoshi, who between 2009 and 2011 was an active participant on message boards like BitcoinTalk and the Cryptography mailing list, and who cataloged his thoughts in a formal white paper.

More:

- Messages

- 23,731

- Reaction score

- 4,349

- Points

- 288

Bitcoin tops $57,000 as big buyers circle

LONDON/SINGAPORE, Feb 27 (Reuters) - Bitcoin hit a two-year high on Tuesday on signs of large players buying the cryptocurrency, while smaller rival ether topped $3,200 for the first time since 2022.Bitcoin has rallied more than 10% in two sessions, helped by a Monday disclosure from crypto investor and software firm MicroStrategy (MSTR.O), opens new tab that it had recently purchased about 3,000 bitcoins for an outlay of $155 million.

The original and largest cryptocurrency by market value has also been buoyed recently by the approval of bitcoin-owning exchange-traded funds (ETFs) in the United States. On Monday, trading volumes in several of the funds spiked and crypto-linked firms rallied too, in contrast to nervous broader markets.

More:

- Messages

- 23,731

- Reaction score

- 4,349

- Points

- 288

US SEC expected to drag its feet on new wave of crypto ETFs

Feb 27 (Reuters) - Buoyed by the successful launch of U.S. bitcoin exchange-traded funds (ETFs), asset managers are lining up to list a second wave of more complex crypto products, setting the stage for another tussle with the U.S. securities regulator.The Securities and Exchange Commission (SEC) rejected spot bitcoin ETFs for more than a decade, hoping to protect investors from market manipulation. But the SEC was forced to approve them last month after Grayscale Investments won a court challenge. A federal appeals court ruled that the SEC had not sufficiently detailed its reasoning for rejecting the products.

That decision encouraged 12 asset managers, including Grayscale, ProShares, VanEck, Invesco, Fidelity and Ark Investments to file applications to launch 25 next-generation cryptocurrency ETFs.

Many are complex products that would use options to amplify bitcoin's volatility. Others would track the price of ether, the No. 2 cryptocurrency after bitcoin.

Investors hope the new products will help drive crypto further into the mainstream. Bitcoin hit $50,000 on Feb. 12 for the first time in over two years and ether has climbed more than 12% this year on hopes the SEC will approve the spot products.

More:

So Bitcoin over $61k at the moment...

Looks like Fidelity is now including an allocation to their Bitcoin ETF in all of their "all in one" funds now (FCNS, FBAL, FGRO, FEQT):

www.fidelity.ca

www.fidelity.ca

I saw a comment on on the internets:

Microstrategy is Michael Saylor's company. He's been buying Bitcoin as a treasury asset for Microstrategy for years. Some folks were buying Microstrategy stock as a BTC play before the spot ETFs were available. There is a website dedicated to tracking their BTC holdings:

saylortracker.com

saylortracker.com

corporatefinanceinstitute.com

corporatefinanceinstitute.com

Their BTC holdings are currently worth $11.7B. I'm not sure about the rest of the criteria.

Looks like Fidelity is now including an allocation to their Bitcoin ETF in all of their "all in one" funds now (FCNS, FBAL, FGRO, FEQT):

All-in-One ETFs | Fidelity Investments Canada

Strategically diversify your portfolio with our strong lineup of Fidelity Factor™ ETFs and fixed-income solutions.

I saw a comment on on the internets:

What's going to be funny is, as bitcoin pumps, Microstrategy will eventually get added to S&P500, then nocoiners in index funds will become passive investors in Bitcoin.

Microstrategy is Michael Saylor's company. He's been buying Bitcoin as a treasury asset for Microstrategy for years. Some folks were buying Microstrategy stock as a BTC play before the spot ETFs were available. There is a website dedicated to tracking their BTC holdings:

Michael Saylor (MicroStrategy) Portfolio Tracker

A website tracking the amount of bitcoin (and value in USD) owned by Michael Saylor (read: MicroStrategy).

...

Criteria for Inclusion in the S&P 500

A company must meet the following criteria to be selected by the Index Committee and be included in the S&P 500 index:

- The company should be from the U.S.

- Its market cap must be at least $8.2 billion.

- Its shares must be highly liquid.

- At least 50% of its outstanding shares must be available for public trading.

- It must report positive earnings in the most recent quarter.

- The sum of its earnings in the previous four quarters must be positive.

Any company that satisfies the above conditions can be considered for inclusion in the index. However, the ones that actually make it are the ones with the largest market capitalization. Since share prices fluctuate over time, the constituents of the index keep changing.

...

S&P 500 Index

The Standard and Poor’s 500 Index, abbreviated as S&P 500 index, is an index comprising the stocks of 500 publicly traded companies in the

Their BTC holdings are currently worth $11.7B. I'm not sure about the rest of the criteria.

spinalcracker

Ground Beetle

- Messages

- 560

- Reaction score

- 986

- Points

- 218

And its gone. Hopefully to your hard wallet.

spinalcracker

Ground Beetle

- Messages

- 560

- Reaction score

- 986

- Points

- 218

Institutional speculation has officially arrived for Bitcoin (BTC) as the latest statistics for the listed spot BTC exchange-traded funds (ETFs) show that flows have been ramping up this week, with the total average daily volume surpassing $2 billion.

BlackRock’s iShares Bitcoin Trust (IBIT) continues to be the most preferred Bitcoin investment vehicle among investors, setting and then breaking its own trading volume record each day this week. According to BitMEX Research, IBIT recorded inflows of $520 million on Tuesday, accounting for the vast majority of inflows for the day, which totaled $576.8 million.

The Fidelity Wise Origin Bitcoin Fund (FBTC) came in second with inflows of $126 million, while Grayscale recorded outflows of $125.6 million, decreasing the net inflows.

Data provided by Farside shows that, in total, the nine new ETFs have recorded inflows of $6.73 billion since launching, with IBIT accounting for $6.54 billion of the total.

...

Wall Street giant Morgan Stanley is in the midst of performing due diligence to add spot bitcoin ETF products to its brokerage platform, according to two people with knowledge of the matter.

One of the people said Morgan Stanley, which is among the largest U.S. broker-dealer platforms, has been evaluating offering spot bitcoin ETFs to clients since the Securities and Exchange Commission approved their introduction in the U.S. in January.

Although billions of dollars have already been invested in these products, the investment floodgates might not open until the bitcoin ETFs are offered by big registered investment advisor (RIA) networks and broker-dealers platforms such as those attached to firms like Merrill Lynch, Morgan Stanley, Wells Fargo and others.

...

- Messages

- 23,731

- Reaction score

- 4,349

- Points

- 288

Bitcoin set for biggest monthly jump since 2020 amid ETF boost

SINGAPORE/LONDON, Feb 29 (Reuters) - Bitcoin was on track for its biggest monthly gain in more than three years on Thursday and within sight of a record high, propelled by cash rushing into exchange-traded funds.The approval and launch of spot bitcoin exchange-traded funds in the U.S. this year has opened the asset class to new investors and reignited the excitement that evaporated when prices collapsed in the "crypto winter" of 2022.

The largest cryptocurrency by market capitalisation was last up 3.4% at $62,205, having changed hands at $63,933 overnight, the highest since late 2021.

Bitcoin's monthly gain is more than 47%, its largest since December 2020, and its rally has pulled ether along in its wake. The smaller cryptocurrency topped $3,500 for the first time since April 2022 on Wednesday and was last up 4.3% at $3,466, taking its February increase to 52%.

More:

- Messages

- 23,731

- Reaction score

- 4,349

- Points

- 288

Wished I'd have taken a chance back then.

Here's a look back at the history of Bitcoin and how much an early investment in the leading cryptocurrency would be worth today.

What Happened: In October 2008, pseudonymous Satoshi Nakamoto published a whitepaper titled "Bitcoin: A Peer-to-Peer Electronic Cash System." The whitepaper provided many key details and explained why Bitcoin was created.

In January 2009, Nakamoto mined the genesis block of the first 50 Bitcoins and the cryptocurrency was officially born.

When Bitcoin was released, there were only two ways to get the cryptocurrency: mine the Bitcoin yourself or use a peer-to-peer transaction.

More:

If You Bought $1 Worth Of Bitcoin At Launch, Here's How Much You'd Have Today

The price of leading cryptocurrency Bitcoin (CRYPTO: BTC) surged in February 2024, hitting levels not witnessed since all-time highs were previously reached in November 2021.Here's a look back at the history of Bitcoin and how much an early investment in the leading cryptocurrency would be worth today.

What Happened: In October 2008, pseudonymous Satoshi Nakamoto published a whitepaper titled "Bitcoin: A Peer-to-Peer Electronic Cash System." The whitepaper provided many key details and explained why Bitcoin was created.

In January 2009, Nakamoto mined the genesis block of the first 50 Bitcoins and the cryptocurrency was officially born.

When Bitcoin was released, there were only two ways to get the cryptocurrency: mine the Bitcoin yourself or use a peer-to-peer transaction.

More:

Wished I'd have taken a chance back then. ...

November 11, 2013:

...

The Bearing, ever interested in improving his education (as long as he doesn't have to work too hard) is now learning about Bitcoin ("BTC"). Mostly how it works (that is, how to buy them and how to spend them).

A decent guy (a "virtual friend") gave me 0.11 BTC within the past couple of days. He also pointed the way to my downloading Multibit 0.5.14, which allowed me to make a BTC wallet, see just below (all the ones I have seen so far start with a "1"). I also had to download Oracle's Java software, but hey my computer skills are fairly limited, and so far everything has worked OK. ...

***

The FIRST one here at pmbug.com to email me their Bitcoin wallet address will win the 0.005 BTC (now worth about $1.50).

...

Bitcoin Contest -- FREE 0.005 BTC to Winner!

... The Bearing, ever interested in improving his education (as long as he doesn't have to work too hard) is now learning about Bitcoin ("BTC"). Mostly how it works (that is, how to buy them and how to spend them). A decent guy (a "virtual friend") gave me 0.11 BTC within the past couple of...

BTC was around $300 at the time of that post. @DoChenRollingBearing did send me that 0.005 BTC back then. I wish I had bought more, but back then, it was not easy to acquire if you weren't mining it. Mt. Gox was not an easy experience to navigate (and that was before it blew up).

- Status

- Not open for further replies.