You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Crypto trading/market thread

- Thread starter pmbug

- Start date

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Status

- Not open for further replies.

- Messages

- 23,741

- Reaction score

- 4,352

- Points

- 288

From the link:

Longhorn Pad C is located about half a mile south of a small cemetery and a little over a mile north of a Methodist church in Elk County, in northwestern Pennsylvania. With a population of around 30,000, this county sits squarely in the center of the path the Marcellus Shale formation takes as it curves through the commonwealth.

The lonely well pad houses four natural gas wells that records show were initially drilled in 2011 but sat inactive for years after that. Now, it also houses infrastructure designed to mine cryptocurrency, which, according to a comment filed by the surrounding township’s Board of Supervisors, hums loudly enough to have solicited numerous noise complaints from residents. Though it has applied for them, the company behind this operation has yet to receive the permits it is required by law to construct or operate the engines to power a cryptocurrency mine.

www.desmog.com

www.desmog.com

Longhorn Pad C is located about half a mile south of a small cemetery and a little over a mile north of a Methodist church in Elk County, in northwestern Pennsylvania. With a population of around 30,000, this county sits squarely in the center of the path the Marcellus Shale formation takes as it curves through the commonwealth.

The lonely well pad houses four natural gas wells that records show were initially drilled in 2011 but sat inactive for years after that. Now, it also houses infrastructure designed to mine cryptocurrency, which, according to a comment filed by the surrounding township’s Board of Supervisors, hums loudly enough to have solicited numerous noise complaints from residents. Though it has applied for them, the company behind this operation has yet to receive the permits it is required by law to construct or operate the engines to power a cryptocurrency mine.

Crypto Mining at Gas Wells Sparks Regulatory Headaches, Outcry in Northwestern Pennsylvania

Before obtaining the required permits, Diversified Energy began installing cryptocurrency mining infrastructure on one of its thousands of well pads.

It's a bank report touting CBDCs, but it includes the following statement:

icg.citi.com

icg.citi.com

... Tokenization of financial and real-work assets could be the killer use case driving blockchain breakthrough with tokenization expected to grow by a factor of 80x in private markets and reach up to almost $4 trillion in value by 2030. ...

Money, Tokens, and Games

Can you always spot disruptive innovation? When we hear the story of how the invention of the automobile hastened the demise of buggy whip companies, we often question why the disruptive potential of gas-powered cars wasn’t noticed. In the modern era, most people buying digital cameras in the...

spinalcracker

Ground Beetle

- Messages

- 560

- Reaction score

- 986

- Points

- 218

spinalcracker

Ground Beetle

- Messages

- 560

- Reaction score

- 986

- Points

- 218

that was the spike high for that time

back in the day bugs would tell all the newbies to get ready to ride the gold bull because there would be days where gold would go up and down by the hundreds of dollars

never happened

it may happen

it did happen with Bitcoin , only on steroids

back in the day bugs would tell all the newbies to get ready to ride the gold bull because there would be days where gold would go up and down by the hundreds of dollars

never happened

it may happen

it did happen with Bitcoin , only on steroids

Heh, being 'all in' with p.m.'s, I was outraged when one bitcoin could suddenly buy you an ounce of gold.

Ive followed Bitcoin from the start, even attempted to make sense of Satoshi's 'green paper' but I choose to be a technophobe with a litany of lost passwords and access denied in so many places because I will not submit to their processes .....

There have been $100 days for gold though, or at least very short periods of time when weve seen these moves.

Perhaps now that one bitcoin is closer to buying a kilo of gold, we could compare the price movements for the kilo price ?

Gold up $3500 on the day !

Ive followed Bitcoin from the start, even attempted to make sense of Satoshi's 'green paper' but I choose to be a technophobe with a litany of lost passwords and access denied in so many places because I will not submit to their processes .....

There have been $100 days for gold though, or at least very short periods of time when weve seen these moves.

Perhaps now that one bitcoin is closer to buying a kilo of gold, we could compare the price movements for the kilo price ?

Gold up $3500 on the day !

Remember when DCRB tried to drag us all kicking and screaming in the nascent Bitcoin experiment (long before the Mt Gox implosion)? Bitcoin was around $10 (or was it $100?) per coin back then IIRC. He sent me a couple dollars worth of BTC back then when I offered to create a wallet and help him experiment with transfering coins around. It's worth a lot more than a couple of bucks today.... Ive followed Bitcoin from the start, ...

spinalcracker

Ground Beetle

- Messages

- 560

- Reaction score

- 986

- Points

- 218

Remember when DCRB tried to drag us all kicking and screaming in the nascent Bitcoin experiment (long before the Mt Gox implosion)? Bitcoin was around $10 per coin back then IIRC. He sent me a couple dollars worth of BTC back then when I offered to create a wallet and help him experiment with transfering coins around. It's worth a lot more than a couple of bucks today.

some very fortunate humans who got in early

any idea how many BC Max Keiser has?

i was lucky and got in under $400

that coin has been a cash cow ever since , i think my portfolio is up like 2816%

- Messages

- 15,685

- Reaction score

- 10,045

- Points

- 288

China’s Top Banks Start Supporting Crypto Businesses

Crypto businesses in Hong Kong received sudden support from China’s largest banks, particularly the Bank of China, Bocom, and Shanghai Pudong. This is reported by local entrepreneurs.By CoinsPaid Media Editor

View original

China’s Leading Banks Offer Services to Crypto Businesses in Hong Kong

Amid the banking meltdown in the U.S., which significantly hit the cryptocurrency sector, China’s largest banks started offering their services to global crypto companies opening offices in Hong Kong.

China’s Top Banks Start Supporting Crypto Businesses

Crypto businesses in Hong Kong received sudden support from China’s largest banks, particularly the Bank of China, Bocom, and Shanghai Pudong. This is reported by local entrepreneurs.

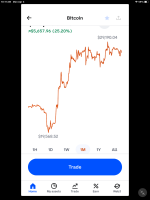

Crypto markets popped yesterday and last night. I'm interested to see how they trade today. Seems like a lot of them pushed past their local highs in the last 24 hours. They seem to still be running as of the moment.

spinalcracker

Ground Beetle

- Messages

- 560

- Reaction score

- 986

- Points

- 218

Despite being down over 57% from an all-time high in November 2021, bitcoin is up more than 80% since Jan. 1.

spinalcracker

Ground Beetle

- Messages

- 560

- Reaction score

- 986

- Points

- 218

some investors took this as a strong Buy signal

stocks.apple.com

stocks.apple.com

Warren Buffett slams crypto investors, calls bitcoin a gambling token — Business Insider

Warren Buffett took aim at bitcoin, calling the crypto intrinsically worthless. Investing in crypto is like "wanting to play a roulette wheel" the Berkshire Hathaway chair told CNBC. Crypto markets have been rallying, with bitcoin surging 65% in the past three months.

- Messages

- 23,741

- Reaction score

- 4,352

- Points

- 288

Man gets prison time after feds discover $3.4 billion in stolen Bitcoin hidden inside a Cheetos popcorn tin and underground safe

Story by cdavis@insider.com (Charles R. Davis) • Yesterday 7:04 PM- A man convicted of stealing around 50,000 Bitcoin was sentenced Friday to a year in prison.

- At the it was seized, the Bitcoin was worth over $3.4 billion.

- Prosecutors said the crypto-currency was stolen from the Silk Road dark web marketplace.

More:

...

After seizing the ill-gotten cryptocurrencies, authorities have to secure and then liquidate them. However, a court order is usually required to do this, and as you can imagine, that can take years to arrive in some cases. When the assets are eventually liquidated, the sale proceeds are given to the victims of a crime (hack) or distributed between government agencies.

Authorities have also turned to auction houses to sell recovered crypto assets. For instance, in February 2019, an independent auction house in the UK sold crypto assets as law enforcement did not have any other option. The auction attracted bidders from over 90 countries, and one middle-aged woman who had purchased half a Bitcoin insisted on carrying it home in a bag with all the other items she had purchased, as per a Bloomberg report.

The US Marshals Service — with experience in disposing of assets like houses and artworks — faces challenges in ridding itself of cryptocurrencies. From 2014 to 2020, they too had no option but to auction off recovered crypto assets.

In an interview with CNBC, Jarod Koopman, director of the IRS’s cybercrime unit said that the auction proceeds are usually deposited into the Treasury Forfeiture Fund or the DoJ’s Assets Forfeiture Fund. He also stated that federal agencies can use this money to fund upcoming operations. Of course, they would have to put in a formal request that would need to be approved by the Executive Office of Treasury.

However, the marshals seldom turn to auctions these days. Instead, they seek proposals from companies that can store and sell cryptos for them. They also use a secure online platform for disposing of digital assets and have an asset forfeiture manual that dictates how the authorities should deal with cryptos. One of the instructions is to transfer the crypto pronto from the criminal's wallet to an agency-controlled wallet.

...

What happens when authorities seize Bitcoin and other crypto assets?

When authorities legally evict criminals of digital assets that are not theirs, it is known as 'crypto seizure'. But how can digital assets even be seized? And what happens when authorities take these crypto assets? Scroll down to find out.

Since Silk Road - the marketplace that was defrauded - no longer exists (taken down by the Feds), I assume the Bitcoin will be sold off via DoJ proxies and the proceeds put in the Treasury Forfeiture Fund or the DoJ’s Assets Forfeiture Fund. Either way, that's 50,000 bitcoin that is going from an inactive whale wallet into circulation. I have to think that will put some downward price pressure on Bitcoin whenever the DoJ proxies get around to liquidating the seizure.

SEC Commissioner dissents on their attempts to stifle crypto innovation:

More (long):

www.sec.gov

www.sec.gov

...

No longer does this Commission think creatively about regulatory alternatives that advance the Commission’s mission while preserving space for potentially disruptive innovation. No longer does this Commission worry that regulatory bullheadedness often produces absurd consequences.

...

More (long):

SEC.gov | Rendering Innovation Kaput: Statement on Amending the Definition of Exchange

Rendering Innovation Kaput: Statement on Amending the Definition of Exchange Commissioner Hester M. Peirce April 14, 2023

SEC bringing the hammer to another crypto exchange:

www.coindesk.com

www.coindesk.com

The U.S. Securities and Exchange Commission alleged that crypto exchange Bittrex simultaneously operated a national securities exchange, broker and clearing agency in violation of federal statutes. Former CEO Bill Shihara and Bittrex Global GmbH are also facing charges.

...

Bittrex announced last month it planned to exit the U.S. by the end of April, citing "the current U.S. regulatory and economic environment." This past weekend, the company shared more information, when general counsel David Maria told the Wall Street Journal that the company had received a Wells Notice – a statement that the SEC's Enforcement Division found evidence of legal violations – in March. Maria told the Journal that Bittrex would fight the suit unless the SEC provided a "reasonable settlement offer."

...

Crypto Exchange Bittrex Violated Federal Laws, SEC Charges in Lawsuit

The agency said Bittrex failed to register as an exchange, broker or clearing agency.

Coinbase is preparing for a years-long court battle with the U.S. Securities and Exchange Commission, the company's chief executive told CNBC Tuesday, after the regulator warned the cryptocurrency exchange of potential violations of securities law.

...

Brian Armstrong, CEO of Coinbase, called the issuing of the Wells notice "unfortunate" and said the company has not got any more information on the specific issues the SEC has.

"We've met with them over 30 times in the last year … never got a single piece of feedback from them about what we can be doing better or differently, and then this Wells Notice arrived," Armstrong told CNBC in an interview.

"I think we're going to have to actually end up going to court to get the clarity we need and create the case law."

Case law refers to judicial precedent.

...

The cryptocurrency industry has complained that the SEC has not given companies clarity on what they can and cannot do. The SEC, meanwhile, argues that the rules are clear under existing laws.

Armstrong accused the SEC of an "abdication of responsibility."

"The regulators' job is to publish a clear rulebook and allow that market to be safe but also to flourish in that country and I think they've completely abdicated responsibility," Armstrong said.

...

Coinbase CEO says the crypto exchange is preparing to go to court with the U.S. SEC

Brian Armstrong, CEO of Coinbase, told CNBC that it is "going to have to actually end up going to court" with the U.S. Securities and Exchange Commission.

Committee Republicans Blast Chair Gensler’s Misrepresentation of Non-Existent Digital Asset Trading Platform Registration Process

Gensler continues to try to force trading platforms to “come in and register,” while failing to provide a workable process

Washington, April 18, 2023 -

In advance of today’s hearing, all Republicans on the House Financial Services Committee—led by Chairman Patrick McHenry (NC-10)—sent a letter to Securities and Exchange Commission (SEC) Chair Gary Gensler. Republicans are slamming the Commission’s approach to digital asset regulation and attempts to force digital asset trading platforms to “come in and register” under the ill-fitting national securities exchange (NSE) framework. Republicans are urging Chair Gensler to work with Congress to develop clear rules of the road for digital assets that foster innovation and protect investors.

Read the full letter here.

Read key excerpts from the letter below:

“We write regarding the Securities and Exchange Commission’s (SEC) approach to the digital asset ecosystem under your tenure. To date, the SEC has forced digital asset market participants into regulatory frameworks that are neither compatible with the underlying technology nor applicable because the firms’ activities do not involve an offering of securities. Both approaches hamper the digital asset ecosystem’s ability to realize the unique benefits the new technology offers, which harms consumers, investors, and the economy as a whole.

“As Chair, you have acknowledged that digital asset trading platforms do not perfectly fit under existing laws and regulations. You have been outspoken in your push for digital asset trading platforms to ‘come in and register’ under the national securities exchange (NSE) framework. Yet, at the same time, you have failed to provide a path that allows digital asset trading platforms to register. As you know, many digital assets are developed for the purpose of being used within a developing system, are capable of being used in non-securities transactions, and are meant to be consumed and used in the protocol for which it was designed. Existing regulations under the NSE framework do not contemplate these features.

“Given an NSE can only list securities that have been offered in compliance with the securities laws, the inability to register makes the current NSE framework ill-suited for digital asset trading platforms. Moreover, the lack of clarity provided by the SEC as to what digital assets are considered securities also limits what an NSE can list. It is not clear whether a NSE could list non-securities assets even if such assets were otherwise in compliance with the law.

“Without clear rules of the road, your push for firms to ‘come in and register’ is a willful misrepresentation of the SEC’s non-existent registration process. The only entity to blame for the lack of registrants is the SEC itself. The SEC should take this opportunity to work with Congress to ensure innovators and investors have the regulatory clarity and protections that they deserve.

“We look forward to continuing our discussion on these critical issues.”

- Messages

- 23,741

- Reaction score

- 4,352

- Points

- 288

LONDON, April 18 (Reuters) - The U.S. and Britain should make their rules for the crypto industry much clearer to prevent firms from developing in "offshore havens", the chief of U.S. crypto exchange Coinbase Global Inc (COIN.O), Brian Armstrong, said on Tuesday.

The failure last year of the Bahamas-based FTX exchange has highlighted the importance of major economies developing clear crypto regulations, Armstrong said at a conference held by the Innovate Finance industry body.

www.reuters.com

www.reuters.com

The failure last year of the Bahamas-based FTX exchange has highlighted the importance of major economies developing clear crypto regulations, Armstrong said at a conference held by the Innovate Finance industry body.

Crypto firms will develop 'offshore' without clear US rules, Coinbase chief says

The U.S. and Britain should make their rules for the crypto industry much clearer to prevent firms from developing in "offshore havens", the chief of U.S. crypto exchange Coinbase Global Inc , Brian Armstrong, said on Tuesday.

- Messages

- 23,741

- Reaction score

- 4,352

- Points

- 288

LONDON, April 19 (Reuters) - Crypto firms have been left scrambling to find banking partners after the collapse of three crypto-friendly lenders in the U.S. last month, creating a risk their business will become concentrated in smaller financial institutions.

It is a scenario that concerns U.S. regulators, who have expressed doubt about the safety and soundness of bank business models that are highly focused on crypto clients after Silvergate Capital Corp (SI.N), Signature Bank and Silicon Valley Bank imploded.

www.reuters.com

www.reuters.com

It is a scenario that concerns U.S. regulators, who have expressed doubt about the safety and soundness of bank business models that are highly focused on crypto clients after Silvergate Capital Corp (SI.N), Signature Bank and Silicon Valley Bank imploded.

Analysis: Crypto firms scramble for banking partners as willing lenders dwindle

Crypto firms have been left scrambling to find banking partners after the collapse of three crypto-friendly lenders in the U.S. last month, creating a risk their business will become concentrated in smaller financial institutions.

...

It is a scenario that concerns U.S. regulators, ...

It's a scenario that has been constructed by U.S. regulators. Who are they trying to kid? Operation Choke Point 2.0 is unAmerican bullshit.

Coinbase is going on the offensive:

www.cnbc.com

www.cnbc.com

Crypto exchange Coinbase filed suit against the Securities and Exchange Commission on Monday, asking that the regulator be forced to publicly share its answer to a months-old petition on whether it would allow the crypto industry to be regulated using existing SEC frameworks.

The July 2022 petition asked that the SEC “propose and adopt rules to govern the regulation of securities that are offered and traded via digitally native methods,” referring to digital assets like cryptocurrencies.

...

Coinbase sues SEC after months of silence from federal regulator

The crypto exchange asked a judge to compel the SEC's answer whether existing rule-making processes would be extended to the crypto industry.

11C1P

Yellow Jacket

'Crypto is dead in America,' says longtime bitcoin bull Chamath Palihapitiya

Tech investor Chamath Palihapitiya, who previously claimed bitcoin has replaced gold and would eventually get to $200,000, now says "crypto is dead in America."

- Messages

- 23,741

- Reaction score

- 4,352

- Points

- 288

April 25 (Reuters) - What do you get when you cross cryptocurrencies with artificial intelligence?

A seemingly sentient bitcoin that codes itself in the style of Japanese haikus? Alas not, though you do get billions of dollars of trading in a new class of crypto tokens.

The machine mania sweeping the tech world amid the launches of bots like ChatGPT and Bard has reached the cryptoverse, with interest in tokens tied to AI blockchain projects surging.

www.reuters.com

www.reuters.com

A seemingly sentient bitcoin that codes itself in the style of Japanese haikus? Alas not, though you do get billions of dollars of trading in a new class of crypto tokens.

The machine mania sweeping the tech world amid the launches of bots like ChatGPT and Bard has reached the cryptoverse, with interest in tokens tied to AI blockchain projects surging.

Cryptoverse: Investors pick their AI race horses

What do you get when you cross cryptocurrencies with artificial intelligence?

- Messages

- 23,741

- Reaction score

- 4,352

- Points

- 288

Wallets holding large amounts of bitcoin (BTC), that saw no activity for several years are suddenly showing signs of life, sparking conversations on Crypto Twitter about the possible reasons behind such moves.

Whale, a colloquial term used in crypto circles, refers to holders of large amounts of any tokens. Due to the size of their holdings whales can influence the price or sentiment around a token.

One such wallet, which was last active in 2012, moved over 400 bitcoin ($11 million) over the weekend, data shows. The bitcoin whale moved 360 bitcoin to one wallet, and 40 bitcoin to other wallets. The whale had purchased some 900 bitcoin in 2012, holding on to the asset ever since and seeing a nearly 40,000% gain on the initial investment.

www.coindesk.com

www.coindesk.com

Whale, a colloquial term used in crypto circles, refers to holders of large amounts of any tokens. Due to the size of their holdings whales can influence the price or sentiment around a token.

One such wallet, which was last active in 2012, moved over 400 bitcoin ($11 million) over the weekend, data shows. The bitcoin whale moved 360 bitcoin to one wallet, and 40 bitcoin to other wallets. The whale had purchased some 900 bitcoin in 2012, holding on to the asset ever since and seeing a nearly 40,000% gain on the initial investment.

Bitcoin Whales Spook Crypto Twitter With Sudden Wallet Movements

At least four wallets from bitcoin’s early days have seen signs of activity in the past few days.

... The whale had purchased some 900 bitcoin in 2012, holding on to the asset ever since and seeing a nearly 40,000% gain on the initial investment.

...

I like to read things like this and think to myself - that could be @DoChenRollingBearing .

It could also be the government getting ready to auction off/sell coins they have seized ( like these ).

- Messages

- 23,741

- Reaction score

- 4,352

- Points

- 288

I like to read things like this and think to myself - that could be @DoChenRollingBearing .

Read a good bit of his posts (I enjoy reading through the older threads.) The link in the op here still works.

Money in the Bank? The Mercenary Geologist LOLs...

... "The Mercenary Geologist" (Mickey Fulp) suggests that the Banksters are laughing at all of us with CA$H in the bank... http://tinyurl.com/cy6r85k Actually, Fulp writes interesting stuff on mining, etc. My knowledge is weak on mining (and "etc."), so I find his work to be of great...

Came across some interesting stuff thanks to DoChen...........

FOFOA

A Tribute to the Thoughts of Another and his Friend<br> <i>"Everyone knows where we have been. Let's see where we are going!"</i> -Another

Fun With PM Prices And Premiums (January 2012)

In this article I will present whatever looks interesting from the data set I am collecting from the eBay / 24hgold.com Widget showing whate...

Some interesting reading in the older threads.

Gensler is just another puppet (bulldog in this case) doing what his bosses tell him to do.

cointelegraph.com

cointelegraph.com

The crypto community is calling out the alleged hypocrisy of Gary Gensler, the head of the United States securities regulator, after a 2018 video emerged of him stating that cryptocurrencies are on par with commodities or cash and are not securities.

The video came from a “Blockchain and Money” class in the Fall Semester of 2018 taught by Gensler, a former professor at the Massachusetts Institute of Technology (MIT) before he became chair of the Securities and Exchange Commission (SEC).

...

Gary Gensler links crypto with cash in viral 2018 video — Crypto Twitter reacts

A video from Gary Gensler’s pre-SEC days has gone viral on Twitter showing the now-SEC chair declaring cryptocurrencies, cash and commodities are one and the same.

- Messages

- 23,741

- Reaction score

- 4,352

- Points

- 288

Please Enjoy the Final Crypto Winter

Opinion by Paul Brody • 31m agoGot your skis on? If not, clip in and try to have some fun because this is going to be our very last crypto winter. We’ve had two or three, depending on how you count and this one has certainly been the worst and the most frustrating, but fortunately, it’s going to be the final one and let me explain why: Crypto and blockchain are on the cusp of becoming ordinary, regulated businesses. While it’s always extremely difficult to separate signals from noise, I see three big positive signs for the future.

Paul Brody is EY's global blockchain leader and a CoinDesk columnist.

Surge in enforcement actions by law enforcement

The world of crypto and blockchain has always had an uncomfortable relationship between starry-eyed do-gooders (count me among that crowd) and ruthless opportunists trying to hijack that message to sell whatever they’ve come up with. One of things that has been immensely frustrating over the years is seeing the warnings we and others have made about the dangerous, speculative and downright absurd nature of some crypto and blockchain investments go unheeded. We (EY) warned about the abysmal track record of initial coin offerings (ICO) in 2018 and again in 2019 and we were hardly alone in expressing our concerns. Enforcement actions are much more effective than warnings and social-media flame-wars.More:

The changing face of the cryptocurrency ecosystem is on full display at the annual Consensus conference in Austin, Texas, as projects focused on facilitating institutional adoption and providing professional services to crypto investors now populate the booths on display.

...

Franklin Templeton, which recently made headlines when it announced the launch of the first U.S. registered fund hosted on a public blockchain network, revealed that it has integrated its fund with the Polygon network to go along with its integration on Stellar.

According to Travis Fishstein, a corporate communications consultant with Franklin Templeton, the firm sees a lot of promise in the cryptocurrency industry and wanted to be one of the first to offer regulated crypto products and actually utilize blockchain technology.

And it's not just institutions in the U.S. showing interest as multiple companies present at the conference are focused on increasing adoption among the international institutional investing crowd.

One example is Parfin, a leading Web3, institutional-grade infrastructure provider in the Latam region. As opposed to the U.S., which has adopted an oppositional stance towards the crypto industry as of late, countries in Latin America, and Brazil in particular, have adopted an open stance and are eagerly integrating blockchain technology into their financial systems.

...

Another firm that reported seeing an uptick in interest from institutional players is Infstones, a blockchain infrastructure provider that specializes in helping individuals and companies set up nodes, stake proof-of-stake tokens, and connect Web3 applications to more than 80 blockchain networks.

The recent Shapella upgrade on the Ethereum network, which enabled the withdrawal of staked Ether for the first time, has led to an increase in interest from institutional investors in staking services, a representative from Infstones said.

Crypto tax service providers were also a prevalent sight at Consensus as the slowly increasing adoption of cryptocurrencies in the U.S. has created a niche accounting market that is full of confusion and unclear securities laws.

Overall, the booths on display at Consens signal the increasing legitimacy of the cryptocurrency industry in the U.S. and around the world and suggest that institutions are beginning to show a higher level of interest in engaging with the ecosystem.

Consensus conference highlights the growing legitimacy of cryptocurrencies

The projects on display at Consensus highlight the shifting landscape of the crypto ecosystem as firms focus on institutional investors and professional services for crypto investors.

www.kitco.com

The U.S. Securities and Exchange Commission (SEC) is making decisions about alleged legal violations “on the fly,” crypto exchange Coinbase (COIN) said Thursday.

...

Much of Coinbase’s arguments rest on the idea that cryptocurrencies listed on the exchange are not securities – a sharp contrast to claims by SEC Chair Gary Gensler, who has repeatedly stated that, in his view, the majority of digital assets do indeed meet the standards of a security under federal law. Other arguments outlined in the document say that even if certain digital assets listed on the exchange are securities, Coinbase’s own products don’t meet the standards for securities law violations.

The SEC warned Coinbase last month it could sue when it filed the notice. The SEC claims Coinbase’s staking service, Prime and Wallet products, along with its general listing process, may all violate federal securities law.

In a video shared earlier on Thursday, Gensler reiterated his view that crypto intermediaries must register as regulated entities in the U.S. “Crypto markets suffer from a lack of regulatory compliance. It's not a lack of regulatory clarity,” he said.

“An investment contract exists when you invest money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others. Intermediaries for investment contracts, whether they're exchanges, brokers, dealers, clearinghouses, they need to comply with the securities laws and register with the Securities and Exchange Commission,” he said. “Instead, many crypto platforms are just pretending that these investment contracts that they offer are more like goldfish,” using an analogy about pets.

In its response, which was filed on April 19 to the regulator, Coinbase said it had “repeatedly” answered SEC staff questions about how it determined whether listed assets were securities or not. The exchange also pushed back against SEC allegations that it was simultaneously operating a national securities exchange, brokerage and clearinghouse.

“The threat of imminent litigation appears to be intended to pressure Coinbase to accept demands that the Commission simply does not have the authority to order; namely, that Coinbase (i) agree that virtually all digital assets listed on Coinbase’s platform are securities; and (ii) overhaul its entire business model to register as an NSE [national securities exchange] and clearing agency, potentially requiring Coinbase to jettison its entire customer-facing business and overhaul its public company governance structure to conform to limits on concentrated voting control of NSEs and clearing agencies,” the exchange argued. “Neither of those objectives is supported by law or within the bounds of the Commission’s authority.”

...

More:

SEC Is Alleging Legal Violations ‘On the Fly,' Coinbase Says

The SEC last month warned the crypto exchange it may pursue an enforcement action.

The popular trading platform Robinhood Markets (HOOD) has unveiled "Robinhood Connect," a new feature for users to fund their Web3 wallets without having to leave a decentralized app (dapp) or be in their crypto accounts.

Robinhood Connect will also let developers embed the feature directly into their dapps, so that Robinhood users can buy, transfer and fund their self-custody wallets, the company announced at CoinDesk's Consensus 2023 conference in Austin, Texas. "With the introduction of [Robinhood] Connect, customers will be able to access their Robinhood credentials and bypass additional steps," the firm said in a statement.

Robinhood Connect is already live with MyDoge, Giddy and Slingshot wallets, while integration with other wallets such as Exodus and Phantom are coming soon ...

Robinhood Gives Users a New Way to Fund Their Web3 Wallets

The feature, Robinhood Connect, is already available on several decentralized apps, with more to onboard in the coming months.

I don't fully understand what all of that means, but it sounds like Robinhood is making it easier for their clients to buy crypto from Robinhood directly from a private wallet.

- Status

- Not open for further replies.