...

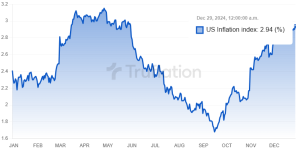

Real numbers. Inflation is falling.

...

I just happened to visit truflation.com this morning (see below). Looks like their data showed declining rate of inflation from June to October and then it spiked back upwards:

This is what led me to the site:

Dear D.O.G.E.

At Truflation.com, 3 years ago in the disbelief that inflation was transitory we launched the first, fully real-time, US inflation index.

Trusted by investors and economists globally, Truflation utilizes its dedicated Application Specific Blockchain providing transparency, governed by an independent network, and leveraging a consensus algorithm verifying data quality and accuracy.

Truflation tracks the granular movement of consumer prices in real-time (daily) computing:

Despite wide recognition among economists and investors, attempts to work with the BLS and its Agencies have failed, yet outsourcing the BLS to Truflation aligns with DOGE’s mandate to

- 30 Million Price Points.

- 3 price feeds for every price point.

- Sourced from over 80 different data providers and APIs.

- In partnership with Universities.

- Deployed on a decentralized database built with US technologies.

- Maintained, operated and enhanced by a network of 20 different node operators.

- Backed by Chainlink, Coinbase and Balaji Sirivasan.

- Eliminate bureaucracy

- Adopt technology-driven solutions

- Increase velocity of information distribution

- Accelerate financial and economic growth

Truflation has demonstrated its capability working with the Argentina Government, exposing government data as a public good while acting as the independent source of truth for Argentina CPI calculations.

Due to the real time availability of the economic data combined with the index calculations and other benefits, Truflation can unlock significant financial value opening new markets accelerating investment decisions, as well as optimizing central interest rate policies.

We would love to explore the opportunity to collaborate with DOGE and explore unlocking true economic potential bringing about and documenting the economic renaissance.

Sincerely,

Stefan Rust

Founder of Truflation.