swissaustrian

Yellow Jacket

- Messages

- 2,049

- Reaction score

- 0

- Points

- 0

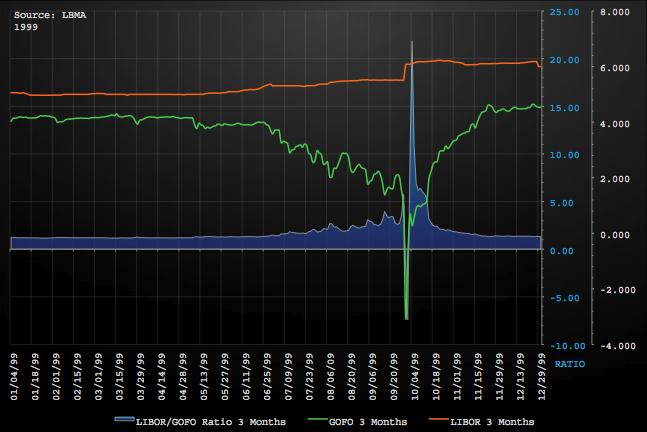

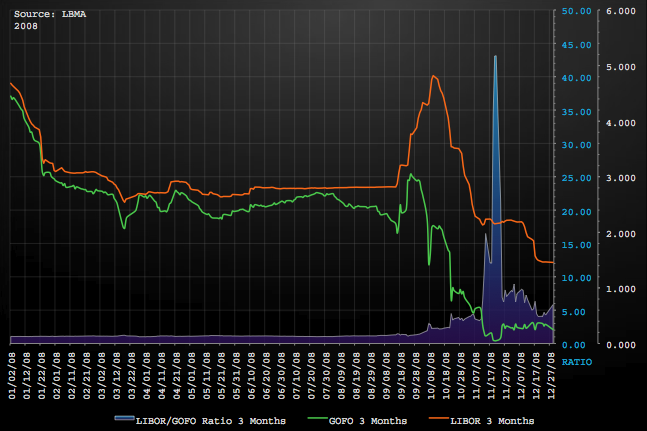

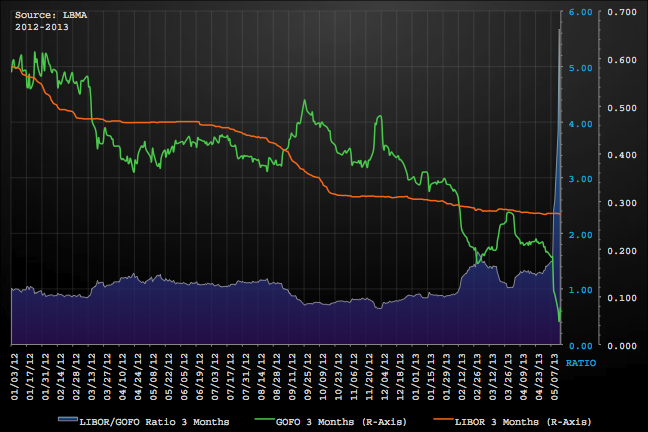

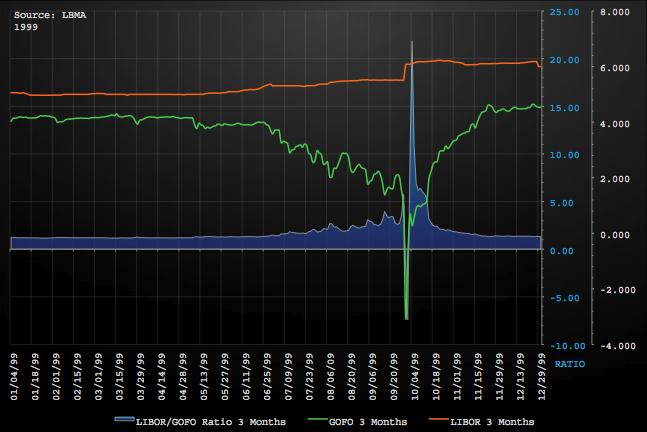

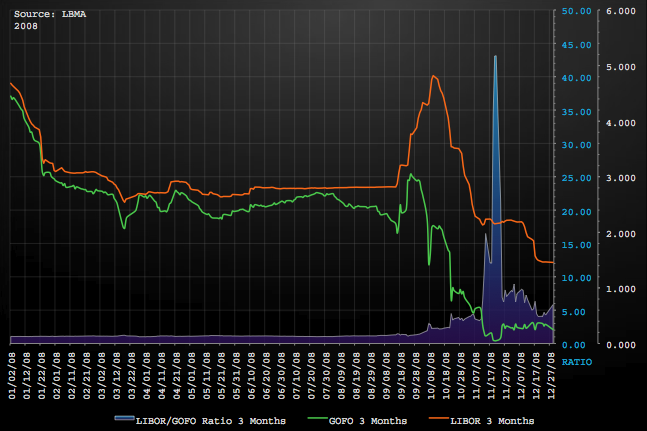

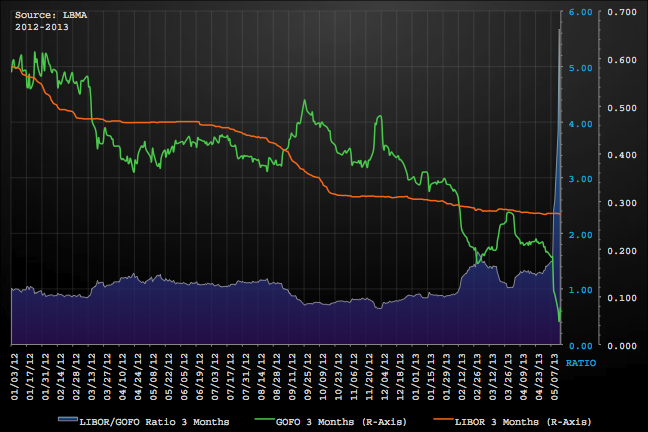

Somebody (unknown to me) has posted these three Charts (here: http://justpaste.it/2n00 ) showing the gold forward rates (GOFOs, the premium for future delivery over spot) of 1999, 2008 and 2013. He also calculated the lease rates, ie the profitability of selling spot, purchasing gold back in 3 months and investing the funds from the sale of spot in 3m Libor. That's called the gold carry trade. It's especially profitable when forward rates are very low or even negative.

1999 and 2008 were the last times when GOFO was so dislocated compared to LIBOR, ie lease rates were rapidly rising.

In 1999, it signalled the coming dotcom bust and the effects Washington Agreement (which limited gold sales by central banks). In 2008, it heralded Lehman and the stock market crash.

Both times GOFO and the derived lease rate were the canary in the coalmine and marked cyclical lows in spot prices.

Now the physical market is dislocated again. What's the coming bust in financial markets this time? A global bond bust?

1999 and 2008 were the last times when GOFO was so dislocated compared to LIBOR, ie lease rates were rapidly rising.

In 1999, it signalled the coming dotcom bust and the effects Washington Agreement (which limited gold sales by central banks). In 2008, it heralded Lehman and the stock market crash.

Both times GOFO and the derived lease rate were the canary in the coalmine and marked cyclical lows in spot prices.

Now the physical market is dislocated again. What's the coming bust in financial markets this time? A global bond bust?

These negative rates should diminish in a matter of days. If they don't, we can start taking preparations for the big one.

These negative rates should diminish in a matter of days. If they don't, we can start taking preparations for the big one.