Regulators again assured the public that the banking system is safe, as fresh data showed customers recently pulled nearly $100 billion in deposits.

Treasury Secretary Janet Yellen, Federal Reserve Chairman Jerome Powell and more than a dozen other officials convened a special closed meeting of the Financial Stability Oversight Council on Friday.

A readout from the session indicated that a New York Fed staff member briefed the group on "market developments."

"The Council discussed current conditions in the banking sector and noted that while some institutions have come under stress, the U.S. banking system remains sound and resilient," the statement said. "The Council also discussed ongoing efforts at member agencies to monitor financial developments."

There were no other details provided on the meeting.

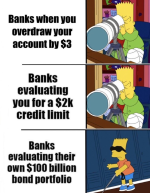

The readout, released shortly after the market closed Friday, came around the same time as new Fed data showed that bank customers collectively pulled $98.4 billion from accounts for the week ended March 15.

That would have covered the period when the sudden failures of Silicon Valley Bank and Signature Bank rocked the industry.

Data show that the bulk of the money came from small banks. Large institutions saw deposits increase by $67 billion, while smaller banks saw outflows of $120 billion.

The withdrawals brought total deposits down to just over $17.5 trillion and represented about 0.6% of the total. Deposits have been on a steady decline over the past year or so, falling $582.4 billion since February 2022, according to the Fed data released Friday.

Money market mutual funds have seen assets rise over the past two weeks, up $203 billion to $3.27 trillion, according to Investment Company Institute data through March 22.

...