- Messages

- 432

- Reaction score

- 294

- Points

- 168

A Big New Development

February 01, 2024Ted Butler

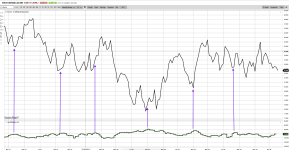

Over the past five reporting weeks the number of long traders in the Other Large Reporting Traders category has increased by 29 traders, from 49 to 78 traders – which I believe is both the largest increase and largest number of long traders in this category ever.

I must emphasize that the increase in new reporting traders came on a fairly significant and consistent decline in the price of silver of more than two dollars, which strongly suggests that these traders were not increasing their already substantial long positions on the flakey moving average penetrations that motivate the braindead managed money technical funds. The “new” longs obviously perceived value in extremely undervalued silver prices.

One question the recent unusual futures contract long positioning answers is the perennially question of why doesn’t someone step up and buy silver in decent quantities? And buying COMEX futures contracts would be the preferred method if one chose to buy silver on a leveraged-basis (not something I ever recommended) and in the form least disruptive to price. Stated differently, I don’t think that 30 million oz of physical silver could be purchased outright or through the purchase of shares of silver ETFs over five weeks with prices falling by $2. Real physical silver? No. Paper silver on the COMEX? Yes.

I can’t help but believe that the notable increase in buying by the new reporting traders is largely a reaction to the remarkably-bullish developments in the physical silver market and the increasingly obvious deepening physical shortage.

One of the most encouraging signs about the big increase in the number of new long traders and the overall increase of 6000 long contracts in the Other Large Reporting Trader category, is that it wasn’t the collusive and crooked COMEX commercial traders which sold to them. Over the course of the past five reporting weeks the total commercial net short position fell by 14,700 contracts, from 48,800 contracts to 34,100 contracts.

So, even though it appears to be good news that so many traders previously classified as non-reporting traders stepped up to add to their existing long positions enough to push them into large reporting trader status; it’s even better news that the crooked and collusive COMEX commercials weren’t the counterparties selling.

As to who were the sellers, the data make it clear it was primarily the braindead managed money traders, who sold more than 17,500 net contracts over the five reporting weeks in question. This is a profoundly-bullish combination.

A Big New Development

On the discovery of the sharp increase of 60% in the number of new long traders (29) and the total gross longs of 30 million oz. of silver over the past five reporting weeks: such an occurrence most likely involves collusion.