You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Lunatic Fringe - Market and Trade Chat

- Thread starter TheRealZed

- Start date

-

- Tags

- markets

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Status

- Not open for further replies.

Crypto train is starting to choo choo. Hope some of you got your feet wet back when I posted the getting started primer. If not, it's not too late to jump in. Barring a hard landing that sinks all boats, crypto looks to (at least) double from today's position by year end. $.02 FWIW

This morning’s hotter-than-anticipated U.S. CPI report for January sparked declines across the broader market, and precious metals in particular took a pounding. According to a video post from Jeff Christian, Managing Director of the CPM Group, a detailed unpacking of the CPI components shows why higher-for-longer rates likely mean lower-for-longer gold and silver prices.

...

and the physical metals will continue to flow from west to east.

also:

Bai answered me and said, "no".

- Messages

- 15,779

- Reaction score

- 10,093

- Points

- 288

Now you tell me...!Crypto train is starting to choo choo. Hope some of you got your feet wet back when I posted the getting started primer. If not, it's not too late to jump in. Barring a hard landing that sinks all boats, crypto looks to (at least) double from today's position by year end. $.02 FWIW

Now you tell me...!

Pretty sure I've been beating the drum for a while (in the crypto markets thread). I mentioned it here for the folks who don't pay attention to the crypto threads. Opportunity knocks.

Silver and especially Palladium catching a bid today... what does that mean? I have no idea.

I mean I'm gonna give two Name Removed earnings plays today. One up and one down. Just to show how much of a joke/controlled market we have.

Company #1 - Zillow, which is up 6.6% today

Market Cap - 13.37 Billion. P/E undefined

Quarterly revenues increased to $474 million from $435 million (9% growth, i think y/y)

GAAP net loss in the quarter was $73 million or a loss of 32 cents per share compared with a net loss of $72 million or a loss of 31 cents per share in the prior-year quarter. The marginal increase in losses despite higher revenues was due to higher operating expenses.

Company #2 - Barrick Gold, which is down 0.56% today

Market Cap - ~24.77 Billion P/E 476

posted revenues of $3.06 billion for the quarter ended December 2023, missing the Zacks Consensus Estimate by 2.32%. This compares to year-ago revenues of $2.77 billion. (10.5% growth y/y)

quarterly earnings of $0.27 per share, beating the Zacks Consensus Estimate of $0.21 per share. This compares to earnings of $0.13 per share a year ago.

Company #1 - Zillow, which is up 6.6% today

Market Cap - 13.37 Billion. P/E undefined

Quarterly revenues increased to $474 million from $435 million (9% growth, i think y/y)

GAAP net loss in the quarter was $73 million or a loss of 32 cents per share compared with a net loss of $72 million or a loss of 31 cents per share in the prior-year quarter. The marginal increase in losses despite higher revenues was due to higher operating expenses.

Company #2 - Barrick Gold, which is down 0.56% today

Market Cap - ~24.77 Billion P/E 476

posted revenues of $3.06 billion for the quarter ended December 2023, missing the Zacks Consensus Estimate by 2.32%. This compares to year-ago revenues of $2.77 billion. (10.5% growth y/y)

quarterly earnings of $0.27 per share, beating the Zacks Consensus Estimate of $0.21 per share. This compares to earnings of $0.13 per share a year ago.

Duquesne Family Office, the investment vehicle belonging to famed macro investor Stanley Druckenmiller, dumped shares of Alphabet Inc., Amazon.com AMZN and Broadcom Inc. AVGO while scooping up shares of beaten-down gold miners Barrick Gold Corp. GOLD and Newmont Corp. NEM, according to a Wednesday filing with the Securities and Exchange Commission.

...

Druckenmiller dumps Alphabet, Amazon and Broadcom but Nvidia remains largest holding

The chipmaker, which Druckenmiller touted early last year, comprised roughly 16% of his total stock holdings.

This post may contain affiliate links for which PM Bug gold and silver discussion forum may be compensated.

- Messages

- 383

- Reaction score

- 852

- Points

- 268

Michael Burry Liquidates Semiconductor "Big Short" During Epic Meltup; Here's What He Bought | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Even geniuses miss a turn at bat.

It seems like all the "experts" are now turning Bearish gold in the short-term. The market sniper (who's been wrong at least the last 2-3 videos on gold) just put one out today saying he shorted gold on the CPI numbers. And maybe they did and will close it soon for a profit. Martin Armstrong also posted a blog saying that January should have been a high. I'll take these as bullish signs.

I think the problem is that all of these guys Only can watch the Price. And it's far too easy for the people rigging the system to let price give all the Wrong signals, because they understand what people look at and can trap them easily.

On the monthly chart I still see a breakout, on the 4th attempt, and a retest of the breakout. The next two monthly closes will be important.

I think the problem is that all of these guys Only can watch the Price. And it's far too easy for the people rigging the system to let price give all the Wrong signals, because they understand what people look at and can trap them easily.

On the monthly chart I still see a breakout, on the 4th attempt, and a retest of the breakout. The next two monthly closes will be important.

Druckenmiller bought Barrick and Newmont.

Yep (I mentioned it in my last post here). The news of his buy is spreading, so it could very well be a FOMO spark...

Now will he loan me a Million or two to follow his lead?

Jodster

Fly on the Wall

Not like my opinion amounts to a hill of beans, but I too, am waiting to enter the miners.Druckenmiller bought Barrick and Newmont.

However the folks stating the bottom (or double bottom) is in, FOMO is taking over, charts, stochastic, chicken entrails are all signalling a breakout … nobody says they’re right.

Now if you can look in the mirror and say yes that inflation is falling, the debt is under control, Global tensions have lessened or the Democrats will allow a peaceful election to happen, then you go right ahead and buy some of those stocks.

The 2008/9 financial crash, 2013-2015 bottoms and 2020 Covid lows will be taken out with force. And for that reason I’m placing stink bids and sitting in cash.

My $0.02 worth.

- Messages

- 383

- Reaction score

- 852

- Points

- 268

jelly

Predaceous Stink Bug

- Messages

- 159

- Reaction score

- 265

- Points

- 188

Reading around the internet, doesn't seem like there's anyone bullish left in gold right now. The most bullish have gone silent the past couple weeks.

For me, it's starting to look a bit like Tuesday might have actually been a bottom. Gold miners looking like exhaustion, noone else left to sell. Silver showing strength the past couple days. So, Im not yet ready to stick my neck out and say we've bottomed, but it's looking an awful lot like we did. However, we also might not go straight up immediately. Could see a couple more months sideways before the real move higher starts.

Remember - The market is now predicting the first rate cut in June. Gold could just keep churning sideways until June.

For me, it's starting to look a bit like Tuesday might have actually been a bottom. Gold miners looking like exhaustion, noone else left to sell. Silver showing strength the past couple days. So, Im not yet ready to stick my neck out and say we've bottomed, but it's looking an awful lot like we did. However, we also might not go straight up immediately. Could see a couple more months sideways before the real move higher starts.

Remember - The market is now predicting the first rate cut in June. Gold could just keep churning sideways until June.

Theres little ole medoesn't seem like there's anyone bullish left in gold right now.

I just look at a ten year gold chart when it gets like it is right now .

Anything close to £1600/ oz is good enough for my long and lonley haul .

And come on, everything out there in the world of fiat is screaming sumtingwong ..........

Jodster

Fly on the Wall

Just having some fun here Jelly, but what happens if that rate cut doesn’t happen? More of the same?Reading around the internet, doesn't seem like there's anyone bullish left in gold right now. The most bullish have gone silent the past couple weeks.

For me, it's starting to look a bit like Tuesday might have actually been a bottom. Gold miners looking like exhaustion, noone else left to sell. Silver showing strength the past couple days. So, Im not yet ready to stick my neck out and say we've bottomed, but it's looking an awful lot like we did. However, we also might not go straight up immediately. Could see a couple more months sideways before the real move higher starts.

Remember - The market is now predicting the first rate cut in June. Gold could just keep churning sideways until June.

How does that pan out specifically for miners?

The cabal has the power to take silver back to $13 and gold back to $1200, at least on paper. Miners then?

jelly

Predaceous Stink Bug

- Messages

- 159

- Reaction score

- 265

- Points

- 188

Your question proves my point. This kind of talk is all you hear right now.Just having some fun here Jelly, but what happens if that rate cut doesn’t happen? More of the same?

How does that pan out specifically for miners?

The cabal has the power to take silver back to $13 and gold back to $1200, at least on paper. Miners then?

Gold went up $300 just a few months ago without any rate cuts. Why do you think we need a rate cut for it to go up another 300?

The most frustrating thing about the past few years is that everyone thinks gold is tied to rate cuts . But much of the 2000 gold gold market occurred without cuts. The biggest moves in the 1970s bull occurred without rare cuts. Why does everyone think we need rate cuts for gold to go up? Rate cuts are just an aid sometimes. Sometimes gold just goes up because it’s a bull market.

(Foreign) Central banks are buying gold. I think it's just the (domestic) institutional traders that are rate sensitive in their gold trading. In the meantime, there does seem to be some real movement in vault inventories of physical, so who knows how long that goes before big interventions are necessary to stem the flow.

- Messages

- 153

- Reaction score

- 265

- Points

- 198

I sold my June SLV calls for a 60% profit in 9 days today. If silver pulls back again I will consider reentry.

I'm not gonna turn into a rich man with these piddling trades, but it never hurts to book profit.

I still have some longer term SLV calls just in case silver wakes up and doesn't look back from here.

I'm not gonna turn into a rich man with these piddling trades, but it never hurts to book profit.

I still have some longer term SLV calls just in case silver wakes up and doesn't look back from here.

Cigarlover

Yellow Jacket

- Messages

- 1,440

- Reaction score

- 1,663

- Points

- 283

Nothing wrong with small trades. keeps my account green most weeks even with miners in the toilet. Most of the time I am taking 10-30% profits on my options trades. If the miners ever turn around I will feel rich even if they just get back to even. LOL.

- Messages

- 383

- Reaction score

- 852

- Points

- 268

My Weekend Trend Trader system just sold CBAY for a gain of 75.27%.

There was no sell signal, but CymaBay Therapeutics, Inc. was under contract to be purchased by Giliad Sciences, Inc. Therefore the price should go exactly nowhere for a while as the buyout proceeds. This is a situation where I break the rules and sell.

There was no sell signal, but CymaBay Therapeutics, Inc. was under contract to be purchased by Giliad Sciences, Inc. Therefore the price should go exactly nowhere for a while as the buyout proceeds. This is a situation where I break the rules and sell.

Jodster

Fly on the Wall

Elliot wave theory. 5 numbers up. 3 letters down. This is B. Watch it happen.Silver leading here. 3 nice white candles. A good sign

Once again, good humoured chirping; no malice.

This is one of the few places that debate and contrarian views are productive.

Lancers32

Often Wrong Never In Doubt

- Messages

- 1,835

- Reaction score

- 2,102

- Points

- 298

Prechter the guy who wrote the book and who did win Timer of the Year twice running couldn't make the theory work long term. You can't say for certain the pm complex has bottomed here and while it may go lower even a lot lower the risk/reward from here favors the bulls. Miners are in a 3 1/2 year bear market and few think they will ever go up again. I am lightly long GDX and SILJ.Elliot wave theory. 5 numbers up. 3 letters down. This is B. Watch it happen.

Once again, good humoured chirping; no malice.

This is one of the few places that debate and contrarian views are productive.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

This is a drive by shooting... the real world has me tied up for now.

Weekly gold chart, long tail, large volume on a low. I'm gonna call that a capitulation week, this smells like a low. Keep stops tight, the other possibility is we are on the verge of a real gold wipe out, being a goldbug I can't reconcile that with the fundies but, dyed in the wool and all that!!!!!!

Good luck!

Weekly gold chart, long tail, large volume on a low. I'm gonna call that a capitulation week, this smells like a low. Keep stops tight, the other possibility is we are on the verge of a real gold wipe out, being a goldbug I can't reconcile that with the fundies but, dyed in the wool and all that!!!!!!

Good luck!

chieftain

Ground Beetle

This is a drive by shooting... the real world has me tied up for now.

Weekly gold chart, long tail, large volume on a low. I'm gonna call that a capitulation week, this smells like a low. Keep stops tight, the other possibility is we are on the verge of a real gold wipe out, being a goldbug I can't reconcile that with the fundies but, dyed in the wool and all that!!!!!!

Good luck!

Welcome back mate, where you been hiding?

- Messages

- 153

- Reaction score

- 265

- Points

- 198

ZED!!!!This is a drive by shooting... the real world has me tied up for now.

Weekly gold chart, long tail, large volume on a low. I'm gonna call that a capitulation week, this smells like a low. Keep stops tight, the other possibility is we are on the verge of a real gold wipe out, being a goldbug I can't reconcile that with the fundies but, dyed in the wool and all that!!!!!!

Good luck!

Don't be a stranger in your own home, mate. C'mon and visit with the family every once in a while.

Phew, was starting to think they got ya and threw you in a gulag.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

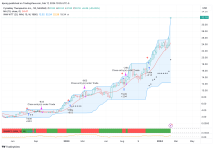

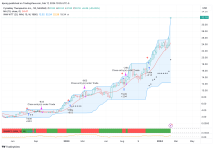

Check out the defence sector, volume and price. Looks like we are heading to war.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

Zed I actually checked the obituaries for any sailers lost at sea???

I'm gonna fall off the back of a boat in preference to anything else I can think of.

- Status

- Not open for further replies.