Cigarlover

Yellow Jacket

- Messages

- 1,440

- Reaction score

- 1,663

- Points

- 283

Good to see you back Mr Z

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

Crypto train is starting to choo choo. Hope some of you got your feet wet back when I posted the getting started primer. If not, it's not too late to jump in. Barring a hard landing that sinks all boats, crypto looks to (at least) double from today's position by year end. $.02 FWIW

You would think that 200 an oz would be enough to offset their higher input costs.Gold at 2,033, yet miners have fallen to the same price they were at when gold bottomed at $1,820 in October '23. Gold has gone up $200, yet miners are selling off. I've never seen this before in the gold market, truly baffling.

View attachment 12190

Gold at 2,033, yet miners have fallen to the same price they were at when gold bottomed at $1,820 in October '23. Gold has gone up $200, yet miners are selling off. I've never seen this before in the gold market, truly baffling.

View attachment 12190

The market can remain irrational longer than you can remain solvent.Gold at 2,033, yet miners have fallen to the same price they were at when gold bottomed at $1,820 in October '23. Gold has gone up $200, yet miners are selling off. I've never seen this before in the gold market, truly baffling.

View attachment 12190

Dave Collum said:"I think Biden is treasonous"

...

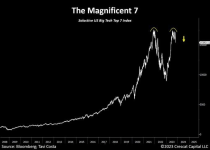

I define a bubble market as one that has a combination of the following in high degrees:I apply these criteria to all markets to see if they’re in bubbles. When I look at the US stock market using these criteria (see the chart below), it—and even some of the parts that have rallied the most and gotten media attention—doesn’t look very bubbly. ...

- High prices relative to traditional measures of value (e.g., by taking the present value of their cash flows for the duration of the asset and comparing it with their interest rates).

- Unsustainable conditions (e.g., extrapolating past revenue and earnings growth rates late in the cycle when capacity limits mean that that growth can’t be sustained).

- Many new and naïve buyers who were attracted in because the market has gone up a lot, so it’s perceived as a hot market.

- Broad bullish sentiment.

- A high percentage of purchases being financed by debt.

- A lot of forward and speculative purchases made to bet on price gains (e.g., inventories that are more than needed, contracted forward purchases, etc.).

This was good!

i.e., comon down... the water's fine... meanwhile he's heading for the door....Ray Dalio says US stock market does not look like a bubble:

i.e., comon down... the water's fine... meanwhile he's heading for the door....

All that cash swashing about like water in a tub doesn't make the market more valuable.I keep hearing doom talk, which probably means there is enough cash on the sidelines already to fuel a "rip your face off" rally. They pumped a ridiculous amount of cash into this system, that always leaves the possibility of ridiculous counterintuitive flows. Think unstable system, just be prepared for anything.

+ the general internutz has rarely calls a crash correctly.

All that cash swashing about like water in a tub doesn't make the market more valuable.

I think after Trump wins they'll pull the plug on the market once he resides in the WH.

I keep hearing doom talk, which probably means there is enough cash on the sidelines already to fuel a "rip your face off" rally. They pumped a ridiculous amount of cash into this system, that always leaves the possibility of ridiculous counterintuitive flows. Think unstable system, just be prepared for anything.

+ the general internutz has rarely calls a crash correctly.

The old Kondratieff, Crack Up Boom. I always thought we need the earthquake and then get a boom.

There is NO cash without debt. And new debt creation via home loans and auto loans, etc is crashing. The government is creating new huge amounts of debt, however. So

To heck with my opinion. It's going up until it ain't.

Government debt creates cash, private debt levers it up. There will be some multiple of the base cash floating around, even @ a depressed private loan creation rate. IMO it will be hot and nervous, easier to be wrong @ these rates.