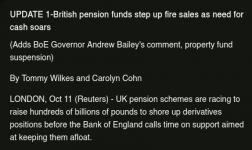

Jeez. The Brits are screwed.

Jeeves Six-pack just about to retire. Has big mortgage. Retirement dividends will not cover half his new expenses re: home heating this winter, food, auto payments and gas, etc.

No prob: Them retirement dividends won't show up now, either.

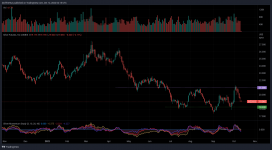

Brings it to a whole 'nother level, donnit? We could be there very, very soon also.

Ummm ya... someone want to break the bad news to Unca? We are like ... maybe 3 months behind.