All we need is an "event" this weekend and things get bad in a hurry. I'm not real surprised the market is rug-pulling everyone.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Lunatic Fringe - Market and Trade Chat

- Thread starter TheRealZed

- Start date

-

- Tags

- markets

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Status

- Not open for further replies.

Oldmansmith

Fly on the Wall

- Messages

- 50

- Reaction score

- 170

- Points

- 103

I listened to Powell, and I didn’t hear dovish, actually the opposite. So I bought SPXS and the market is dumping. I’m up 4.5 % on the trade but I sold before the close. This market has a way of jerking you out of a winning position overnight.Got the 75 basis point raise and some dovish language. We are heading into hyper-inflation. Hurray.

I listened to Powell, and I didn’t hear dovish, actually text opposite. So I bought SPXS and the market is dumping. Up 4.5 % on the trade but I’m out before the close. This market has a way of jerking you out of a winning position overnight.

Certainly the first move is usually wrong. The up move was because they added a paragraph about a "lag effect" suggesting they were going to slow. But he comes out and talks 30 mins after they release that statement and he sounded more hawkish not offering a when to stop hiking. It warms my heart to see Commie stocks GOOG, AMZN, and META just get wrecked. I'd hold some of that trade to tomorrow or Monday.

- Messages

- 383

- Reaction score

- 852

- Points

- 268

AND..... Stock market no likey!!My Weekend Trend Trader 20 stock portfolio is going up on the news. Thanks, Fed.

- Messages

- 383

- Reaction score

- 852

- Points

- 268

Congratulations! *NICE TRADE!!*I listened to Powell, and I didn’t hear dovish, actually the opposite. So I bought SPXS and the market is dumping. I’m up 4.5 % on the trade but I sold before the close. This market has a way of jerking you out of a winning position overnight.

Oldmansmith

Fly on the Wall

- Messages

- 50

- Reaction score

- 170

- Points

- 103

I am learning, I lose as much as I win but it’s a peanuts account and just for fun. Still feels good when you actually feel like you know what you are doing!

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

I am learning, I lose as much as I win but it’s a peanuts account and just for fun. Still feels good when you actually feel like you know what you are doing!

Cut losses fast and let profits run, it will turn 50/50 into win/win.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

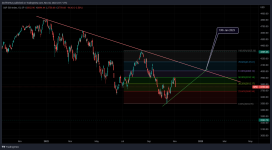

The market was discounting rates @ middle 4's.

Powell: Ultimate rate level higher than previously expected.

= Market surprise that was not being discounted.

Now we look for the right stock floor at the next market aggregate guess for rates ---> 5.5% ?

Powell: Ultimate rate level higher than previously expected.

= Market surprise that was not being discounted.

Now we look for the right stock floor at the next market aggregate guess for rates ---> 5.5% ?

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

Cigarlover

Yellow Jacket

- Messages

- 1,435

- Reaction score

- 1,659

- Points

- 283

I bought qqq puts. Was very nice insurance for the rest of my account. I also closed out before end of day.I listened to Powell, and I didn’t hear dovish, actually the opposite. So I bought SPXS and the market is dumping. I’m up 4.5 % on the trade but I sold before the close. This market has a way of jerking you out of a winning position overnight.

Cigarlover

Yellow Jacket

- Messages

- 1,435

- Reaction score

- 1,659

- Points

- 283

2600

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

2600

Not on this leg... maybe later. --> JMO

jelly

Predaceous Stink Bug

- Messages

- 159

- Reaction score

- 265

- Points

- 188

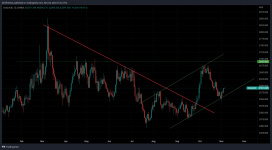

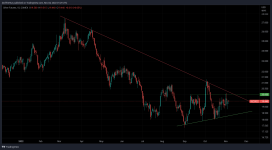

So sad. Just a week ago people were saying "look, a double bottom"Gold triple bottom on the daily. We can't hold here I think we can get mid 1500's really quickly. Careful.

All I know is there won't be a quadruple bottom

- Messages

- 15,764

- Reaction score

- 10,087

- Points

- 288

If you didn't know... I had a Scottrade account... new email that came today

From Scottrade to

The big fish eating the little fish.... or hiding the collapse?

From Scottrade to

Your move from TD Ameritrade to Schwab.

Dear TD Ameritrade clients,

When Charles Schwab acquired TD Ameritrade in 2019, our aim was to create something special for clients of both firms—best-in-class strength and stability, a wider array of products and services available, industry-leading low costs, and a larger team of professionals with a shared passion for helping clients achieve their goals.

The big fish eating the little fish.... or hiding the collapse?

If you didn't know... I had a Scottrade account... new email that came today

From Scottrade to

Your move from TD Ameritrade to Schwab.Dear TD Ameritrade clients,When Charles Schwab acquired TD Ameritrade in 2019, our aim was to create something special for clients of both firms—best-in-class strength and stability, a wider array of products and services available, industry-leading low costs, and a larger team of professionals with a shared passion for helping clients achieve their goals.

The big fish eating the little fish.... or hiding the collapse?

Etrade was bought by.... Morgan Stanley about the same time. I think the Hood created problems because they all started to go commission free about that time with the payment for order flows.

ErrosionOfAccord

Fly on the Wall

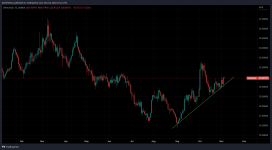

Call me a retard but GOLD looks tempting.

Call me a retard but GOLD looks tempting.

I'm a smooth-brain Ape myself. Diamond hands. In other words anytime is a good time to buy. There is no other option.

ErrosionOfAccord

Fly on the Wall

Thought about it while showering. I do kind of like it at this price but… diesel is the biggest input. The diesel market needs to stabilize. I need to see more than a twenty day supply before I pull the trigger.I'm a smooth-brain Ape myself. Diamond hands. In other words anytime is a good time to buy. There is no other option.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

All things considered gold did ok today.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

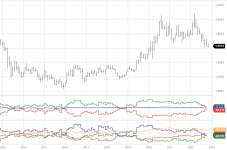

Gold triple bottom on the daily. We can't hold here I think we can get mid 1500's really quickly. Careful.

On the plus side the downswing came in the illiquid globex hours and there was no follow through today.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

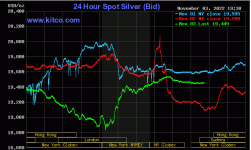

Silver is where the pressure should come from into December delivery.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

ASX gold tribe relatively flat today.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

IF the SPX holds 3657 into next week it's tracking OK.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

This is all you need to understand. Do I need to out run the bear... no, I need to out run YOU.

Our currency, your problem, heads I win, tales you lose.

Our currency, your problem, heads I win, tales you lose.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

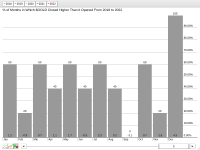

Here is a idea on the size of the EuroDollar loan market that is driving the USD higher.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

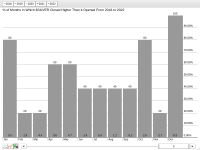

The nature of a grinding bear market...

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

Down to 6962 contracts worth of silver in registered. OI sits @ ~105K for December and we have exceeded 6962 at least twice in the last year.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

Christmas gift giving?

I hear that within the 'financial class' private buying of precious metals is significantly up. I can't swear that is true but the data is supposed to come from a London dealers book.

I'm noticing that a number of the people I listen too outside the 'bug world' are taking note of gold.

I dunno... but December looks like a decision point.

Looking a lot like late 2018 on the COT front.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

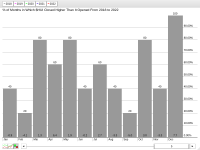

Setting records...

- Status

- Not open for further replies.