TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

Zed, am I seeing things, or is the Aussie Silver showing a nice bull flag? Same with Euro.

Only thing I don't like is it broke below the 50-DMA, so technically bearish

View attachment 6351

WTF happened here after the close in Gold?View attachment 6342

Thursdays high was 1949.80?Thats what I was thinking as well but then I went to kitco and they show a high of 1949 as well. View attachment 6356

April became the near active month. My chart is the 'continuous' contract, so rolls to the next month on a continuous basis. There is always some difference between the next month and the active month. Unless of course the next month is the active month.Might have figured it out. For some reason my system switched to the April futures contract. View attachment 6360

SPX Daily - Proper trend break, just, but the diverging rate of change is flashing a warning. Correction due? Golden cross or golden retreat? Roll right up folks and place your bets!

View attachment 6344

Bulls Beware – this rally is about liquidity, not fundamentals

Greg Canavan explains how liquidity flows are driving equity markets higher to start the year, and why they may not last

With the market firing on all cylinders to start the year, it’s important to ask why.

Has the fundamental picture improved? Or is something else going on?

The obvious answer is that the market is calling the Fed’s bluff on interest rates. It’s pricing in easier than expected monetary policy this year. That’s leading to a noticeable easing in financial market conditions now.

Along with the China reopening story, the market loves this.

But the market and the economy are hardly ever in synch. The market moves ahead of the economy. And the market is also influenced by short-term liquidity flows.

And it’s this topic of market liquidity that we need to look at because it explains the recent movements in the S&P 500 nicely and will give us some clues about what comes next.

Let’s take a look…

Bulls beware – this rally is about liquidity, not fundamentals

Greg Canavan explains how liquidity flows are driving equity markets higher to start the year, and why they may not lastwww.livewiremarkets.com

Might be sooner than later....

Eventually.

Might be sooner than later....

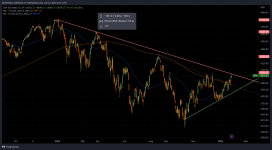

WTF was that today NVidia? Intel has horrific results and it decides to rip $20-22 this week. Clearly broke that SPY weekly descending highs, but will this be a breakout or a fakeout?

That could happen. I mean, who ever thought the US policy was never ending wars?China doesn't let gold leave the country. Is this going to be a new policy?

How much of this bad news has already been priced in though?

Wolf says central banks will raise rates and markets will be shocked: