You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tin Foil Hats, Economic Reality and the Total Perspective Vortex

- Thread starter pmbug

- Start date

- Featured

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

Changes to the Uniform Commercial Code (UCC) are not usually headline news, but recent changes around the UCC’s definition of money have been catching attention across the country. Concerns have erupted around the idea that states are quietly banning Bitcoin and paving the way for central bank digital currencies (CBDCs).

...

More:

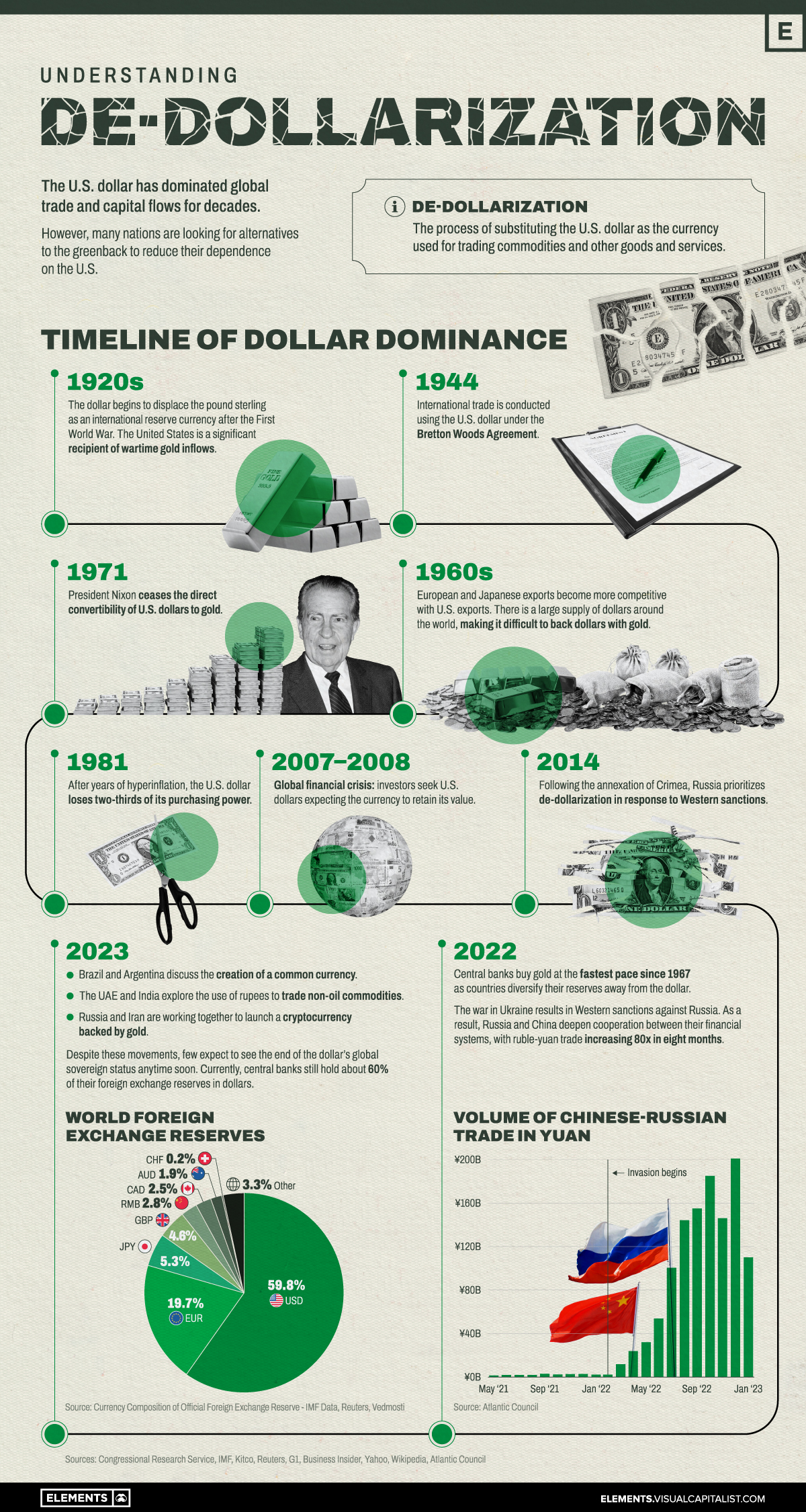

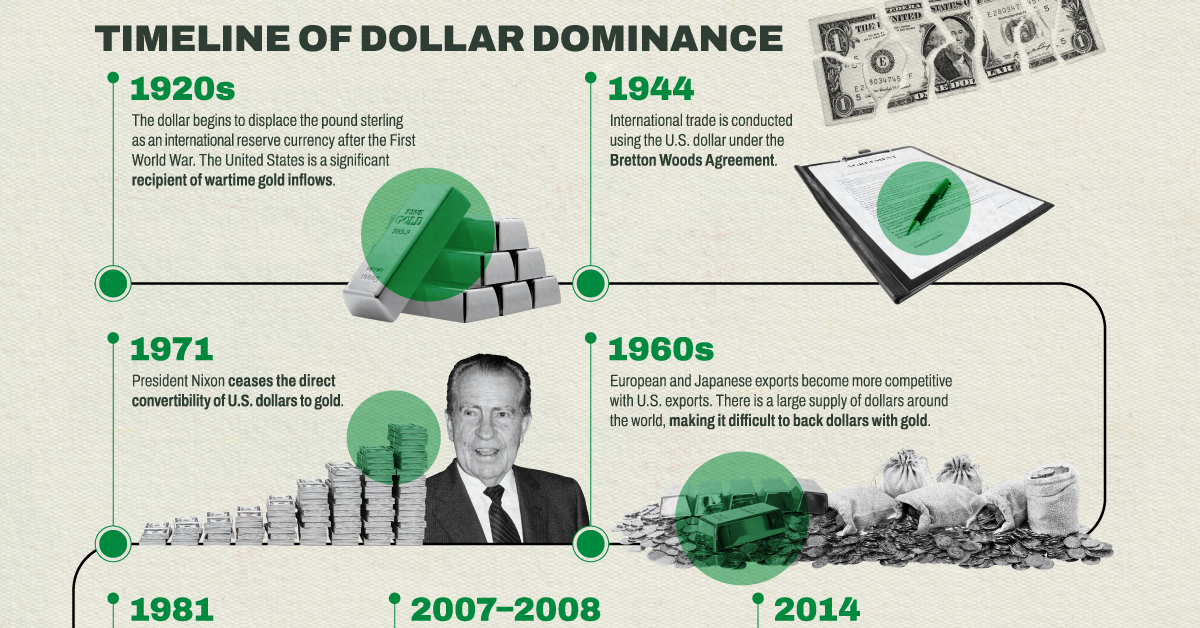

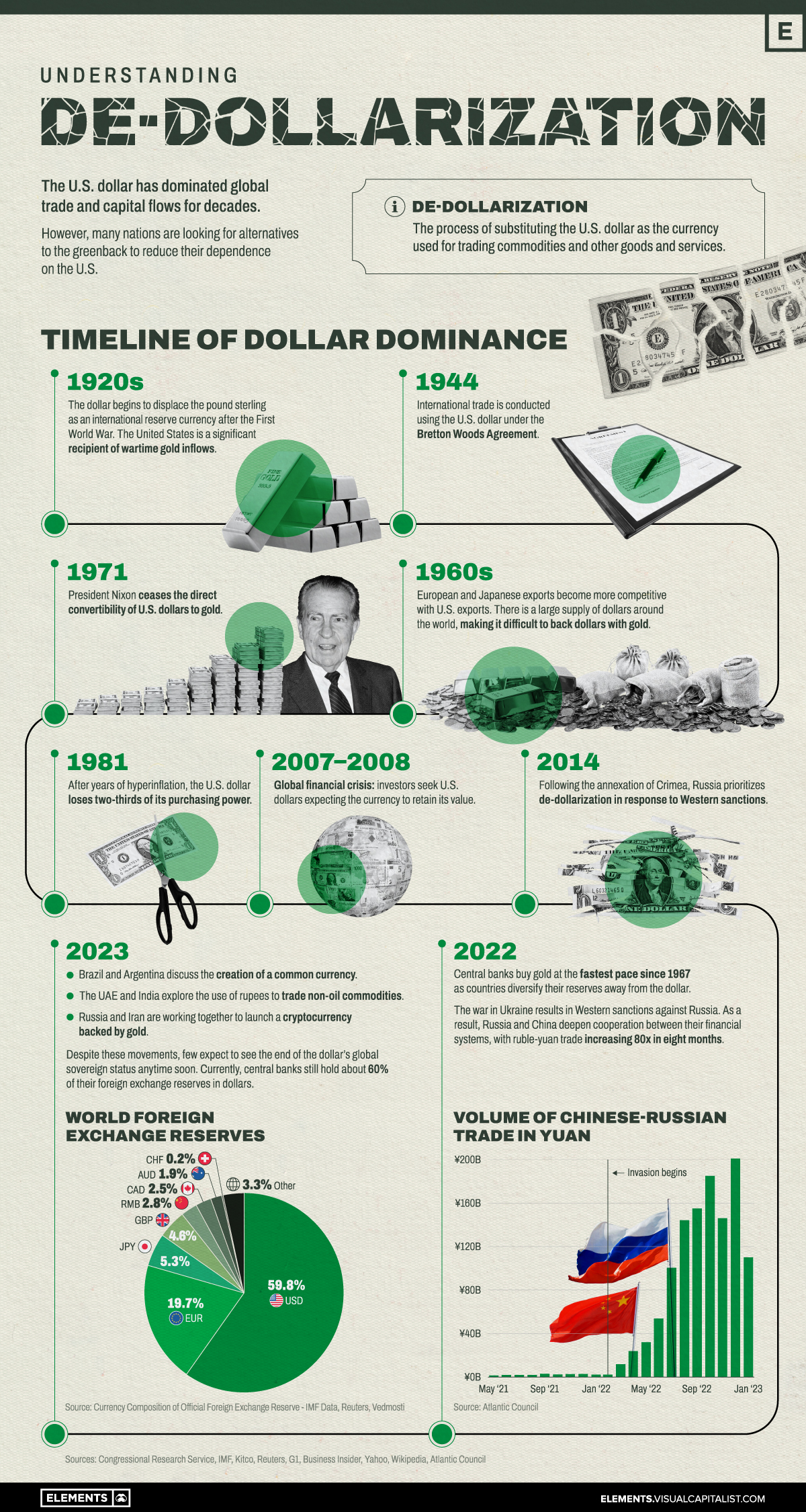

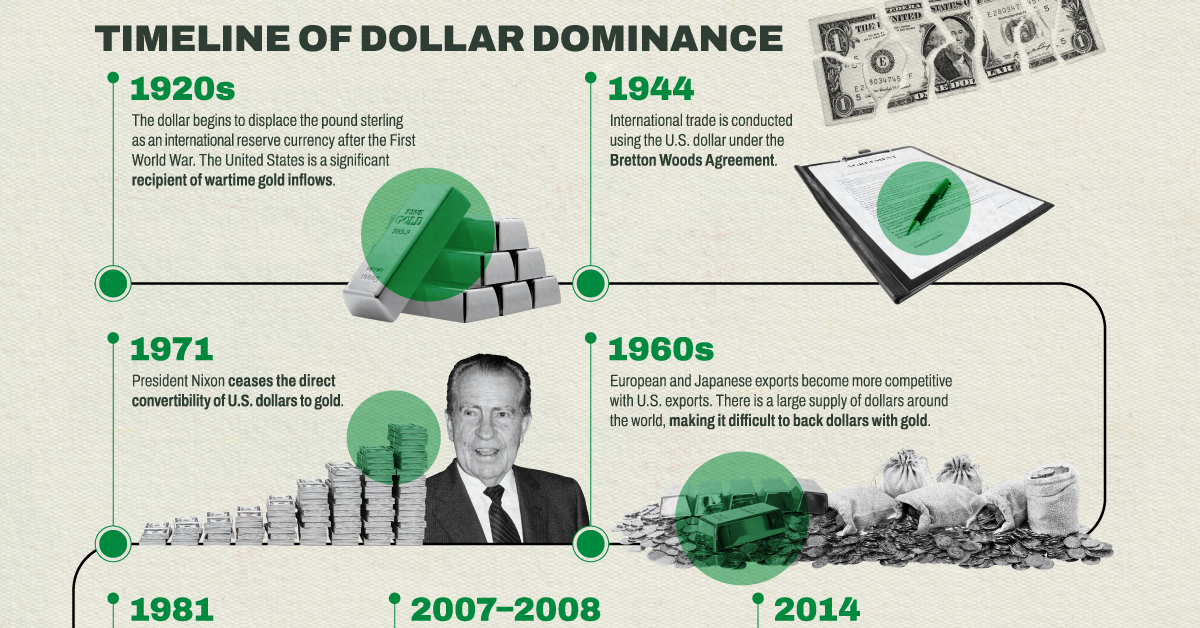

Nothing really new here, but it's sometimes interesting to see a story visualized this way...

elements.visualcapitalist.com

elements.visualcapitalist.com

De-Dollarization: More Countries Seek Alternatives to the U.S. Dollar

The U.S. dollar is the dominant currency in the global financial system, but some countries are following the trend of de-dollarization.

... The kingdom's cabinet approved a plan to join the Shanghai Cooperation Organisation as a "dialogue partner," a precursor to being granted full membership, state news agency SPA announced today. ...

Is your tin foil hat on? You should put it on before reading...

Former Goldman Sachs chief economist Jim O'Neill is calling on the BRICS bloc to expand and challenge the dominance of the U.S. dollar. China's recent actions with the yuan are already doing just that.

O'Neill said that the dollar's dominance destabilizes other nations' monetary policies, which is why the bloc — made up of Brazil, Russia, India, China, and South Africa — should counter it.

"The U.S. dollar plays a far too dominant role in global finance," he wrote in a paper published in the Global Policy journal. "Whenever the Federal Reserve Board has embarked on periods of monetary tightening, or the opposite, loosening, the consequences on the value of the dollar and the knock-on effects have been dramatic."

...

The ex-Goldman chief economist, who coined the group's name, is now calling on BRICS to expand to create a fairer, multi-currency global system by including emerging nations such as Mexico, Turkey, Egypt, Indonesia, Bangladesh, Vietnam, Pakistan and the Philippines.

At the same time, O'Neill urged the group to apply strict criteria when accepting new members, focusing on climate finance, healthcare, and trade.

...

FT shining a spotlight on the issue...

Financial Times said:... During a visit by Xi Jinping to Moscow last week, Vladimir Putin pledged to adopt the renminbi for "payments between Russia and countries of Asia, Africa, and Latin America," in a bid to displace the dollar. And this comes as Moscow is already increasingly using the renminbi for its swelling trade with China and embracing it in its central bank reserves, to reduce its exposure to "toxic" -- American -- assets.

Does this matter? Until recently, most Western economists would have said "heck, no." After all, it has long been assumed that the closed nature of China's capital account is an impediment to wider use of its currency.

But right now Putin's announcement is packing an unusually emotional punch. One reason is that concerns are afoot that this month's U.S. banking turmoil, inflation, and looming debt ceiling battle is making dollar-based assets less attractive. "The dollar is being debased in order to fund the bank bailouts," Peter Schiff, the libertarian economist, thundered this week, echoing a view widespread on the American right.

Meanwhile, Jim O'Neill, the former Goldman Sachs economist who launched the "Brics" tag (short for the Brazilian, Russian, Indian, and Chinese bloc), published a paper this week arguing that "the dollar plays far too dominant a role in global finance" and calling on emerging markets to cut their risks.

But the other factor sparking unease is that even before Xi's visit to Moscow, the Saudi government announced that it will start invoicing some oil exports to China in renminbi. Separately, France just did its first liquid natural gas sale in RMB and Brazil has embraced the currency for some of its trade with China.

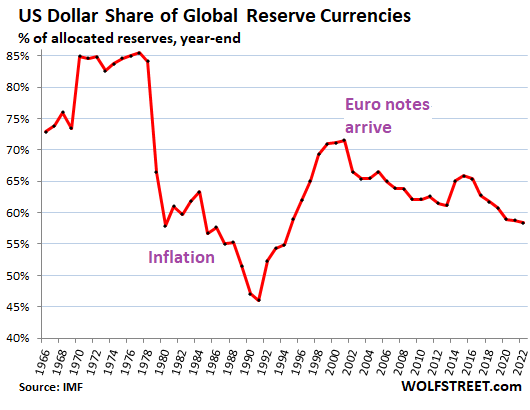

There is absolutely no sign that these token gestures are hurting the greenback right now. Yes, the dollar's proportion of global reserves has sunk from 72% in 1999 to 59%, as central banks increasingly diversify their investment funds and discard currency pegs. And it is also true that the advent of wholesale (bank-to-bank) central bank digital currencies could theoretically accelerate this diversification by making it easier for non-American central banks to deal directly with each other in their own currencies.

...

... some thought-provoking research on trade invoicing published last year by the Centre for Economic Policy Research.

A decade ago, it was widely assumed that another factor underpinning the dollar was the "stickiness" of trade invoicing patterns, as Gita Gopinath, deputy head of the International Monetary Fund, has noted. But the CEPR paper suggests this might now be slowly shifting -- as Chinese trade has expanded in recent years, RMB use has risen too.

So much so, in fact, that it now exceeds euro use for trade invoicing, which is “striking, given China's low degree of capital account openness," the CEPR says. And it argues that "contrary to conventional wisdom, lack of capital account openness may not fully prevent the RMB from playing a stronger role as an international and reserve currency."

After all, it notes, a $200 billion offshore RMB market has already emerged -- and the currency is being used "in invoicing and settling China's foreign trade and payments" and "a global network of clearing and payments."

The net result, the CEPR predicts, is that a "multipolar" currency world could emerge in the coming years, of the sort that O’Neill is now calling for. That would not be as dramatic a switch as Putin or Xi might like to see, or that Washington alarmists fear.

But to my mind it seems a sensible medium-term bet. And even "just" a multipolar pattern could come as a shock to American policymakers, given how much external financing the U.S. needs.

So investors and policymakers alike need to watch the geeky details of trade invoicing in the coming months. Putin's bluster may turn out to be toothless; but it could also be a straw in the wind.

Last edited:

^^^^ from the article:

"Does this matter? Until recently, most Western economists would have said "heck, no."

Only the short sighted ones. Anyone with a lick of sense to 'em could always see where/how this ride ends.

From the very start of what has been 100 years of monetary and fiscal insanity, it's always been a matter of when, not if.

"The net result, the CEPR predicts, is that a "multipolar" currency world could emerge in the coming years, of the sort that O’Neill is now calling for.

Of course it'll go multipolar prior to returning to unipolar. That's how these things (fall and rise of currencies) always work.

"And even "just" a multipolar pattern could come as a shock to American policymakers, given how much external financing the U.S. needs."

...and will increasingly need in coming years.

For example, just to pay back SS will require a yearly average of about $350B in new gov debt to be issued. (SS holds about $3.5T in gov debt)

The SS trust fund, they say, will be depleted in 10 years.

That fund is comprised of gov debt that has to first be paid back in order for it to be spent to the point of depletion.

...and our gov doesn't pay any of its debts. It rolls 'em over into new debt.

So who is gonna be the buyer over the next Decade of all that extra debt our gov is gonna need buyers for?

"Does this matter? Until recently, most Western economists would have said "heck, no."

Only the short sighted ones. Anyone with a lick of sense to 'em could always see where/how this ride ends.

From the very start of what has been 100 years of monetary and fiscal insanity, it's always been a matter of when, not if.

"The net result, the CEPR predicts, is that a "multipolar" currency world could emerge in the coming years, of the sort that O’Neill is now calling for.

Of course it'll go multipolar prior to returning to unipolar. That's how these things (fall and rise of currencies) always work.

"And even "just" a multipolar pattern could come as a shock to American policymakers, given how much external financing the U.S. needs."

...and will increasingly need in coming years.

For example, just to pay back SS will require a yearly average of about $350B in new gov debt to be issued. (SS holds about $3.5T in gov debt)

The SS trust fund, they say, will be depleted in 10 years.

That fund is comprised of gov debt that has to first be paid back in order for it to be spent to the point of depletion.

...and our gov doesn't pay any of its debts. It rolls 'em over into new debt.

So who is gonna be the buyer over the next Decade of all that extra debt our gov is gonna need buyers for?

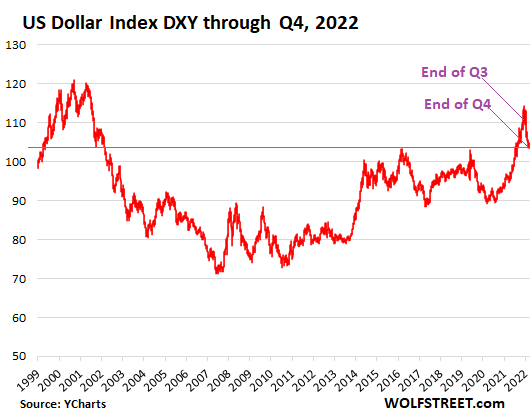

Status of US Dollar as Global Reserve Currency and Exchange Rates: Slow Long-Term Decline on Track

But the Chinese Renminbi didn’t make any progress at all last year.

wolfstreet.com

ASEAN makes big push to use local currencies

Reduced dependence on US dollar seen as increasing economic resilience

The decision by Southeast Asian countries to use local currencies in intraregional trade will help reduce external risks because it will lessen dependence on international currencies such as the US dollar, experts say.

Members of the Association of Southeast Asian Nations will be creating a task force that will design the transition that will help ASEAN economies gradually shift from using international currencies to local currencies in financial transactions, said the Governor of the Indonesian Central Bank, Perry Warjiyo.

"With the use of local currencies in the transactions across the region we will be able to strengthen our resilience in supporting regional cross-border trade and investment, which now are still relying on major international currencies," Xinhua News Agency quoted Warjiyo as saying.

He made the announcement at the end of the ninth ASEAN Finance Ministers and Central Bank Governors Meeting on Friday. Indonesia, this year's rotating ASEAN chairperson, hosted the meeting on the resort island of Bali.

V. Bruce Tolentino, a private-sector member of the Philippine central bank's monetary board, said it is "high time that international trade becomes less dominated by the US dollar and US banks and payment systems".

"Painful experiences" with supply chain disruptions caused by the pandemic and the Russia-Ukraine conflict have highlighted the need to build alternative trade finance and payment systems, he said.

...

ASEAN makes big push to use local currencies

The decision by Southeast Asian countries to use local currencies in intraregional trade will help reduce external risks because it will lessen dependence on international currencies such as the US dollar, experts say.

global.chinadaily.com.cn

global.chinadaily.com.cn

Saudi Arabia’s and Iran’s Foreign Ministers met in Beijing on Thursday to discuss key details in the resumption of their relations following a landmark agreement mediated by China last month.

In the highest-level meeting between the two sides in more than seven years, Iran’s Hossein Amir-Abdollahian and Saudi Arabia’s Prince Faisal bin Farhan Al Saud signed an agreement to reopen embassies and consulates in their mutual countries, according to Iran’s Ministry of Foreign Affairs.

The two sides – previously staunch adversaries who’d severed diplomatic relations in 2016 – also agreed to examine ways to expand their cooperation, including the resumption of flights, mutual trips from official delegations and the private sector, and facilitating visas, according to their statement, released by Iran.

“The two sides emphasized their readiness to eliminate all the obstacles facing the expansion of cooperation between the two countries,” the statement read.

Embassies would be opened in Riyadh and Tehran and consulates in Jeddah and Mashhad.

...

The two countries have also supported opposite sides of a civil war in Yemen, which has been described by the United Nations as one the world’s worst humanitarian crises.

Saudi Arabia has, however, been engaged in direct talks with the Iran-aligned Houthi movement, and an unofficial ceasefire appears to be holding.

The statement released Thursday afternoon did not mention that conflict, but included a pledge to “expand their cooperation in any field that can ensure the security and stability of the region and realize the interests of its nations and countries.”

Saudi Arabia and Iran agree to reopen embassies during Beijing talks on resumption of diplomatic ties | CNN

Saudi Arabia's and Iran's Foreign Ministers met in Beijing on Thursday to discuss key details in the resumption of their relations following a landmark agreement mediated by China last month.

It sounds like they are serious about ending their squabbles.

Wall Street Journal said:...

In an unannounced visit to Saudi Arabia earlier this week, CIA Director William Burns expressed frustration with the Saudis, according to people familiar with the matter. He told Saudi Crown Prince Mohammed bin Salman that the U.S. has felt blindsided by Riyadh’s rapprochement with Iran and Syria—countries that remain heavily sanctioned by the West—under the auspices of Washington’s global rivals.

A U.S. official said Mr. Burns discussed cooperation on intelligence and counterterrorism with Saudi officials.

...

Saudi, Iranian Foreign Ministers Meet in Beijing to Discuss Ties - WSJ

archived 6 Apr 2023 05:18:29 UTC

CIA Director William Burns expressed frustration with the Saudis, according to people familiar with the matter. He told Saudi Crown Prince Mohammed bin Salman that the U.S. has felt blindsided by Riyadh’s rapprochement with Iran and Syria—

Sounds a lot like when someone who was previously clueless, finally discovers that their spouse has turned their affections to another.

Ie: they express frustration that the relationship is ending, and are powerless to stop it.

I know! We should send ol' sleepy Joe over there again. He'll fix everything with another fist bump. Lol

All I gotta say, is that if the orange man were still in office, the Saudi's wouldn't be doing this. They loved 'em some Trump.

Sounds a lot like when someone who was previously clueless, finally discovers that their spouse has turned their affections to another.

Ie: they express frustration that the relationship is ending, and are powerless to stop it.

I know! We should send ol' sleepy Joe over there again. He'll fix everything with another fist bump. Lol

All I gotta say, is that if the orange man were still in office, the Saudi's wouldn't be doing this. They loved 'em some Trump.

The Digital Currency Monetary Authority (DCMA) Launches an International Central Bank Digital Currency (CBDC)

Apr 10, 2023, 09:27 ET

WASHINGTON, April 10, 2023 /PRNewswire/ -- Today, at the International Monetary Fund (IMF) Spring Meetings 2023, the Digital Currency Monetary Authority (DCMA) announced their official launch of an international central bank digital currency (CBDC) that strengthens the monetary sovereignty of participating central banks and complies with the recent crypto assets policy recommendations proposed by the IMF.

Universal Monetary Unit (UMU), symbolized as ANSI Character, Ü, is legally a money commodity, can transact in any legal tender settlement currency, and functions like a CBDC to enforce banking regulations and to protect the financial integrity of the international banking system.

Banks can attach SWIFT Codes and bank accounts to a UMU digital currency wallet and transaction SWIFT-like cross-border payments over digital currency rails completely bypassing the correspondent banking system at best-priced wholesale FX rates and with instantaneous real-time settlement.

In an IMF interview with Tobias Adrian, Financial Counsellor at the International Monetary Fund, he states "Cross-border payments can be slow, expensive, and risky. In today's world of payments, counterparties in different jurisdictions rely on costly trusted relationships to offset the lack of a common settlement asset together with common rules and governance. But imagine if a multilateral platform existed that could improve cross-border payments—at the same time transforming foreign exchange transactions, risk sharing, and more generally, financial contracting."

According to Darrell Hubbard, the Executive Director of the DCMA, and the chief architect of UMU, "This vision expressed by the IMF is the exact solution the DCMA is delivering to central banks worldwide."

Adopting a global localization public monetary system architecture, UMU can be configured to operate according to the central banking regulations of each participating jurisdiction.

George Walker, a Partner at Practus, LLP, specializing in international law, facilitated meetings between the DMCA and the IMF, states "Although the IMF has not officially endorsed Universal Monetary Unit, in reviewing the DCMA's Whitepaper and in weekly team discussions, the IMF has yet to state any objections to UMU's FX premium rates and its monetary sovereignty approach."

According to Darrell, "UMU is not attempting to disrupt the international monetary system. If fact, it strengthens it by helping the IMF achieve its stated mandate to provide economic and financial stability to its member states. UMU is a game-changer in how cross-border payments are transacted and mitigates against seasonal and systemic local currency depreciation."

Universal Monetary Unit Model Law legislation has been drafted in collaboration with several sovereign states. In this proposed legislation, UMU should not be enacted as legal tender for negotiating domestic prices or international trade agreements. Instead, the legislation proposes UMU to be enacted as a complementary money commodity for the store of value, mitigating against potential seasonal and systemic local currency depreciation, and tendered as a payment currency at the time of settlement.

Merchants and trading partners could accept UMU for the equivalent market value for their good and services priced in any national legal tender. UMU has premium exchange rates built into its wallet and can convert any settlement currency amount to the equivalent UMU amount.

Universal Monetary Unit is cryptocurrency reimagined from the ground up to support central banking and regulated financial institutions. It features a trusted consensus protocol, Staked Proof of Trust (SPOT) Protocol, and a multi-dimensional DLT (mDLT) capable of supporting any asset or liability ledger enabling full-service digital banking and international trade payments.

The DCMA introduces Universal Monetary Unit as Crypto 2.0 because it innovates a new wave of cryptographic technologies for realizing a digital currency public monetary system with a widespread adoption framework encompassing use cases for all constituencies in a global economy.

About the Digital Currency Monetary Authority (DCMA) –

The DCMA is a world leader in the advocacy of digital currency and monetary policy innovations for governments and central banks. Membership within the DCMA consists of sovereign states, central banks, commercial and retail banks, and other financial institutions.

Digital Currency Monetary Authority (DCMA)

The DCMA is a world leader in the advocacy of digital currency innovations for monetary authorities.dcma.io

About Universal Monetary Unit (UMU) –

Universal Monetary Unit (UMU), also known as Unicoin, is an innovation in store of value cryptography powered by artificial intelligence (AI). It adopts a central banking monetary policy framework to ensure it has continuous purchasing demand, minimal price volatility, and annual asset pricing targets.

A copy of the UMU Whitepaper is available on its website.

Universal Monetary Unit

Universal Monetary Unit (UMU) for digital banking, digital payments, and digital trade. We guarantee banks the best money rates.umu.cash

The Digital Currency Monetary Authority (DCMA) Launches an International Central Bank Digital Currency (CBDC)

/PRNewswire/ -- Today, at the International Monetary Fund (IMF) Spring Meetings 2023, the Digital Currency Monetary Authority (DCMA) announced their official...

...

Banks will be able to utilize the new currency by attaching SWIFT Codes and bank accounts to a UMU digital currency wallet. This enables them to conduct SWIFT-like cross-border payments entirely over digital currency rails, accessing the best-priced wholesale FX rates and achieving instantaneous, real-time settlement while bypassing the correspondent banking system.

“Cross-border payments can be slow, expensive, and risky,” said Tobias Adrian, Financial Counsellor at the International Monetary Fund. “In today's world of payments, counterparties in different jurisdictions rely on costly trusted relationships to offset the lack of a common settlement asset together with common rules and governance. But imagine if a multilateral platform existed that could improve cross-border payments—at the same time transforming foreign exchange transactions, risk sharing, and more generally, financial contracting.”

...

In the proposed UMU Model Law legislation, Unicoin would be enacted as a complementary money commodity and function as a store of value, helping to mitigate against potential seasonable and systemic local currency depreciation and function as a payment currency at the time of settlement.

Merchants and trading partners will be able to accept UMU as a form of payment for their goods and services priced in any national legal tender. “UMU has premium exchange rates built into its wallet and can convert any settlement currency amount to the equivalent UMU amount,” the press release said.

...

Sounds an awful lot like Bitcoin, Etherium or any decentralized crypto, except this one is centralized.

...

How far is the talk of de-dollarization going to proceed? Probably not very.

...

What De-Dollarization? The Dollar Rules the World

Dollar hegemony is beneficial for the US, its government and most of its citizens — and is likely to last for the foreseeable future.

The International Monetary Fund (IMF) is putting together a Central Bank Digital Currency (CBDC) handbook to assist central banks and governments throughout the world in their CBDC rollouts. ...

IMF to Develop 'CBDC Handbook' for Central Bank, Govt Rollouts

The International Monetary Fund (IMF) is putting together a Central Bank Digital Currency (CBDC) handbook to assist central banks and governments throughout the world in their CBDC rollouts.

De-dollarization starting to permeate mainstream media...

thehill.com

thehill.com

... a former high-level U.S. government official, now a CEO, someone who sits on the boards of directors for multiple companies. He has massive real-world and business experience and believes the United State may be on the verge of collapse. ...

Is there a worldwide run on the Bank of the United States of America?

In talking this week with a friend about the United States seemingly imploding from within across multiple sectors, my friend stressed: “It’s not just from within. There is a run on the United Stat…

Yea, but only because they can't hide it anymore. The clear signs of it coming have been there for quite a long time now, but anyone pointing it out have been previously labeled as crazy and not knowing what they were talking about. That America and the dollar would be on top for Decades to come.De-dollarization starting to permeate mainstream media...

We're at the point where it starts going faster, and therefore more noticeable to those who were previously only worried about silly things, such as orange man bad. Ie: those with the attention span of a flea.

An admission of the obvious...

news.yahoo.com

news.yahoo.com

Economic sanctions imposed on Russia and other countries by the United States put the dollar's dominance at risk as targeted nations seek out an alternative, Treasury Secretary Janet Yellen said Sunday.

"There is a risk when we use financial sanctions that are linked to the role of the dollar that over time it could undermine the hegemony of the dollar," Yellen said on CNN.

...

Yellen says sanctions may risk hegemony of US dollar

Economic sanctions imposed on Russia and other countries by the United States put the dollar's dominance at risk as targeted nations seek out an alternative, Treasury Secretary Janet Yellen said Sunday.Yellen noted that sanctions are an "extremely important tool," all the more so when used by...

Any U.S. central bank digital currency (CBDC) will involve trade-offs among important values — including between security and privacy. Many presume there is a clever tool for such balancing. In privacy “tiering,” transactions below a certain threshold of value would be generally private. Those above it would be subject to surveillance through some mix of identity requirements, preemptive data collection, and such.

But a tiered system would not protect privacy as imagined. Because of likely evasions, it would ultimately require identification of all users and tracking of their transactions.

...

Recent remarks by U.S. Treasury Under Secretary for Domestic Finance Nellie Liang illustrate the theory of the privacy-tiered CBDC. “[O]ne way of reconciling privacy with illicit finance concerns in a retail CBDC,” she said, ”might be to have a tiered structure in which less data are collected for small dollar transactions or small volume accounts.”

The digital euro, for example, is likely to include tiering, according to remarks of Ireland’s finance minister reported last year. Neither commentator, it is worth noting, appears to be contemplating any wholly private transactions on a par with physical cash. A recent Hoover Institution report described China’s e-CNY as including a five-tier system, but the People’s Bank of China can trace the entire flow of money.

With so much buy-in, why does privacy tiering fail? In a recent AEI report, former CFTC Chairman Christopher Giancarlo and I described how such a system can be gamed — inevitably producing a full-surveillance response:

If transactions can be anonymous below a certain threshold, someone wanting to move value privately or illicitly would create multiple accounts and route multiple small transactions through those accounts. Recognizing that avoidance technique, the authorities would likely control the number of accounts or wallets any one person could create. That requires identification of all users and connections between all wallets and users. There is no obvious way to prevent a coin adopting the small-value privacy compromise from rapidly becoming a surveillance coin.

...

Privacy in an American CBDC is not for policymakers to establish. The constitutional slider that determines when privacy gives way to security is the Fourth Amendment’s requirement that government searches and seizures be reasonable. U.S. Supreme Court doctrine creates two tiers of such activities: In Terry v. Ohio, the Court ruled that reasonable suspicion based on articulable fact justifies a modest invasion of privacy or property. More intensive searching and seizing requires a neutral arbiter to agree that there is probable cause to believe particularized evidence or fruits of crime will be revealed or collected.

The Fourth Amendment doesn’t have a place for the kind of universal surveillance assumed by privacy tiering. Indeed, the Fourth Amendment is in the Constitution to bar general warrants. Our founding law does not permit unspecified government authority to rummage people’s things or monitor their activities without suspicion.

...

'Financial surveillance in the West is more like China’s' than we admit, digital dollar concern reveals

Creating a U.S. central bank digital currency pits national security against individual privacy concerns.

Economic sanctions imposed on Russia and other countries by the United States put the dollar's dominance at risk as targeted nations seek out an alternative, Treasury Secretary Janet Yellen said SundayAn admission of the obvious

Yet anyone saying that at the time, was loudly accused of being Putin's puppet and of supporting Russia.

....and much of the nation bought it.

More intensive searching and seizing requires a neutral arbiter to agree that there is probable cause to believe particularized evidence or fruits of crime will be revealed or collected

The (anti) patriot act says otherwise, and they'll just go with that definition instead.

Indeed, the Fourth Amendment is in the Constitution to bar general warrants. Our founding law does not permit unspecified government authority to rummage people’s things or monitor their activities without suspicion.

Saw an interview with Elon and he says the gov had access to rummage through peoples DM's. Why doesn't the 4th Amendment protect us from that?

....and more importantly, why do so many people in society not see these actions as a direct violation of their Rights?

Saw an interview with Elon and he says the gov had access to rummage through peoples DM's. Why doesn't the 4th Amendment protect us from that?

....and more importantly, why do so many people in society not see these actions as a direct violation of their Rights?

Lagarde drops some truth bombs, but nothing that folks around here don't already know...

mishtalk.com

mishtalk.com

Christine Lagarde Made 10 Key Points Today and I Agree With All of Them.

Central Banks in a Fragmenting WorldPlease consider a speech by Christine Lagarde, President of the ECB, on Central Banks in a Fragmenting WorldThe global economy has been undergoing a period of tr…

She wasn't much on solutions though.Lagarde drops some truth bombs, but nothing that folks around here don't already know...

Christine Lagarde Made 10 Key Points Today and I Agree With All of Them.

Central Banks in a Fragmenting WorldPlease consider a speech by Christine Lagarde, President of the ECB, on Central Banks in a Fragmenting WorldThe global economy has been undergoing a period of tr…mishtalk.com

Do you think she'll ever realize that her and her ilk's (and their predecessors) mismanagement is the primary cause of the issues she points out?

That's easy to say, but cooperation requires all parties involved to want to cooperate. We don't have that.Mish didn't quote her whole speech. She advocates for more global cooperation. Surprise!

In fact, it's been the lack of cooperation all along, thats led us to this point of now needing more cooperation in order to fix things.

Fed Governor Bowman casts doubt on the need for a U.S. digital dollar

A CBDC could intrude on the privacy of users and harm banks while otherwise providing few benefits, Bowman said in a speech.

I hope she isn't an outlier amongst her peers.

Pure speculation for now, but an issue worth watching...

www.gainesvillecoins.com

www.gainesvillecoins.com

Rumors are making rounds that Saudi Arabia is selling oil for yuan, which it converts into gold on the Shanghai International Gold Exchange (SGEI). Such a development would make sense as large parts of the world want to de-dollarize, but the renminbi is not suitable to be used as a reserve currency. China has a closed capital account and a weak rule of law. Not using the dollar could be done by using the renminbi as a trade currency and converting yuan revenue into gold on the SGEI. ...

Is Saudi Arabia Selling Oil to China for Gold?

Rumors are making rounds that Saudi Arabia is selling oil for yuan, which it converts into gold on the Shanghai International Gold Exchange (SGEI).

...

According to Jen's calculations, the greenback's share of official global reserve currencies dropped from 73% in 2001 to about 55% in 2021. And in 2022, it tumbled to 47% of total global reserves.

...

The note added that analysts are failing to notice these changes because the nominal value of the world's central banks' dollar holdings is usually used in calculations and changes in the price of the dollar go unaccounted for.

"Adjusting for these price changes, the dollar, we calculate, has lost some 11 percent of its market share since 2016 and double that amount since 2008," Jen wrote.

...

Source report:

Last edited:

I didn't post a snippet from the source report last night as i was on my phone and it wasn't convenient. There is really too much info in there to parse into snippets and capture all the salient info, but I wanted to capture some of it for posterity, so I'll post the conclusion:

The authors didn't touch on the sea change in the relationship between the USA and Saudi Arabia, but it's a huge lever in the use of the dollar as an international currency. If they fully embrace the BRICS alternative currency project, the dollar will face a serious challenge a few years down the road.

...

Bottom line

The dollar’s global dominance should be assessed along two distinct lines: reserve and international currency status. Adjusting for exchange rate (price) changes, the dollar suffered a stunning collapse in 2022 in its market share as a reserve currency, presumably due to its muscular use of sanctions. While it is well understood that the dollar had, for close to 20 years, suffered a quiet erosion in its reserve currency status, in 2022, the dollar’s share in global reserves – in real terms – collapsed at 10 times the average speed. Global reserve managers sold a lot of dollars in 2022 when the dollar rallied. The prevailing view of ‘nothing-to-see-here’ on the USD as a reserve currency seems too innocuous and complacent. Having said this, the dollar still enjoys substantial network advantages as an international currency, mainly because of its huge, liquid, and reasonably well-functioning financial markets. The persistence of these preconditions, however, is not preordained. If the US makes more policy errors and abandons the culture of self-examination, there will likely come a time when much of the rest of the world will actively avoid using the dollar. Finally, what needs to be appreciated by investors is that, while the Global South is unable to totally avoid using the dollar, much of it has already become unwilling to do so.

The authors didn't touch on the sea change in the relationship between the USA and Saudi Arabia, but it's a huge lever in the use of the dollar as an international currency. If they fully embrace the BRICS alternative currency project, the dollar will face a serious challenge a few years down the road.

Russia is exploring the use of digital currencies such as crypto for international settlements. The Central Bank of Russia is reportedly drafting a law to pave the way for the use of digital assets for external payments.

While speaking at an event with representatives of the New People party, the Chairman of the Central Bank, Elvira Nabiullina, revealed that the regulator opposes the use of crypto within the state. However, it is open to using it for international settlements, Nabiullina revealed. Therefore, separate Russian institutions are likely to be established to carry out cryptocurrency mining and transfer to foreign entities. According to the report, these groups will also work with other forms of digital finance.

The Central Bank is currently consulting with the government on which institutions will be allowed to engage in mining and crypto transfer to foreign structures. According to the report, state-owned institutions will be the first to be entrusted with this task, with private enterprises being added to the picture in due course.

Russia has also been making strides in the development of a Central Bank Digital Currency (CBDC). Russian banks are expected to start testing the digital ruble CBDC on customers once the regulatory framework is adopted by the end of April-May.

...

Russia Prepares Draft Legislation to Permit the Use of Crypto in Global Trade Settlements - InsideBitcoins.com

Russia is preparing draft law to allow the use of crypto in international trade settlements. What should the crypto community expect?

It's not clear what the reporting means by "digital currencies such as crypto". Do they mean decentralized tokens like Bitcoin, Ethereum, etc. or is this restricted to CBDCs?

The yuan became the most-used currency in China's cross-border payments in March, surpassing the U.S. dollar for the first time, Reuters cited official data. This development aligns with China's plans to increase the use of the yuan internationally.

Yuan cross-border transactions and receipts were at a record of $549.9 billion last month, up from February's $434.5 billion, Reuters referred to the numbers released by the State Administration of Foreign Exchange.

The yuan-based transactions represented 48.4% of all cross-border payments. In comparison, the dollar-based transactions fell to 46.7% in March from 48.6% in February.

...

China has been on a mission to expand the use of the yuan internationally.

But according to SWIFT's data, the yuan has a long way to go, with its share of global currency transactions representing 4.5% in March, while the dollar's share is at 83.71%.

...

The last (quoted) paragraph relates directly to the point raised in the report referenced in post #748.

When are the BRICS supposed to be coming out with their new currency we've been hearing talk of?

If they actually do that and it is shown to work as intended, and if it really is backed by gold or other commodities, that's when the real test will come.

If they actually do that and it is shown to work as intended, and if it really is backed by gold or other commodities, that's when the real test will come.

They have a meeting scheduled for August where they are going to discuss it. They are all going to have to agree on terms, technological system(s), management/governance, funding, etc. They are still a long ways out from actually creating it IMO.When are the BRICS supposed to be coming out with their new currency we've been hearing talk of?

...

- Messages

- 23,763

- Reaction score

- 4,353

- Points

- 288

MOSCOW, April 26 (Reuters) - Russian state-owned bank VTB (VTBR.MM) will launch a digital bank within the mobile messaging app of leading social network VKontakte, Russia's answer to Facebook, as Moscow seeks technological solutions to disrupted banking transfers.

www.reuters.com

www.reuters.com

Russia's VTB to launch digital bank on VKontakte social network

Russian state-owned bank VTB will launch a digital bank within the mobile messaging app of leading social network VKontakte, Russia's answer to Facebook, as Moscow seeks technological solutions to disrupted banking transfers.

- Messages

- 15,685

- Reaction score

- 10,045

- Points

- 288

This is from a Russian news site tsargrad about halfway down reporting on when Sergey Lavrov chaired the UN Security Council and talked to the press.

Dedollarization cannot be stopped

The head of the Russian Foreign Ministry stated that the transition to settlements in national currencies bypassing the dollar, the emergence of digital currencies can no longer be stopped. This process, Lavrov pointed out, was "launched" by the Americans themselves. There is no reverse. The "big question" is what "will happen next with the international monetary financial system, including with the International Monetary Fund, with the World Bank ..."...

Krugman vehemently disagrees with this premise. First off, he doesn't view the greenback as in danger of losing its global dominance. And on top of that, the benefits of having this global reserve currency status are highly overrated.

...

Pic of Krugman:

If he's sayin' that there's no danger to the dollar, then batten down the hatches 'cause she's about to blow.

The BIS published guidance for central banks wanting to implement a CBDC that can facilitate offline transactions. I did not think such a thing would work. I'll have to explore this handbook when I get a chance.

BIS releases handbook for offline CBDC payments

The Bank of International Settlements has released a comprehensive handbook to help countries develop systems for offline CBDC payments.

www.kitco.com