You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Commodities (Business & Shipping)

- Thread starter searcher

- Start date

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more. You can visit the forum page to see the list of forum nodes (categories/rooms) for topics.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

U.S. Cattle on Feed Up Slightly, Placements Down 7% | Weekly Livestock Market Update for 2/23/24

Feb 23, 2024Brownfield Anchor/Reporter Brent Barnett and University of Missouri Market Analyst Scott Brown give a weekly recap of the markets and discuss how it can impact farmers’ bottom lines. 12 mins long.

- Find more agriculture news here: https://brownfieldagnews.com/

- Learn more about what's happening in the agriculture markets here: https://brownfieldagnews.com/markets/

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

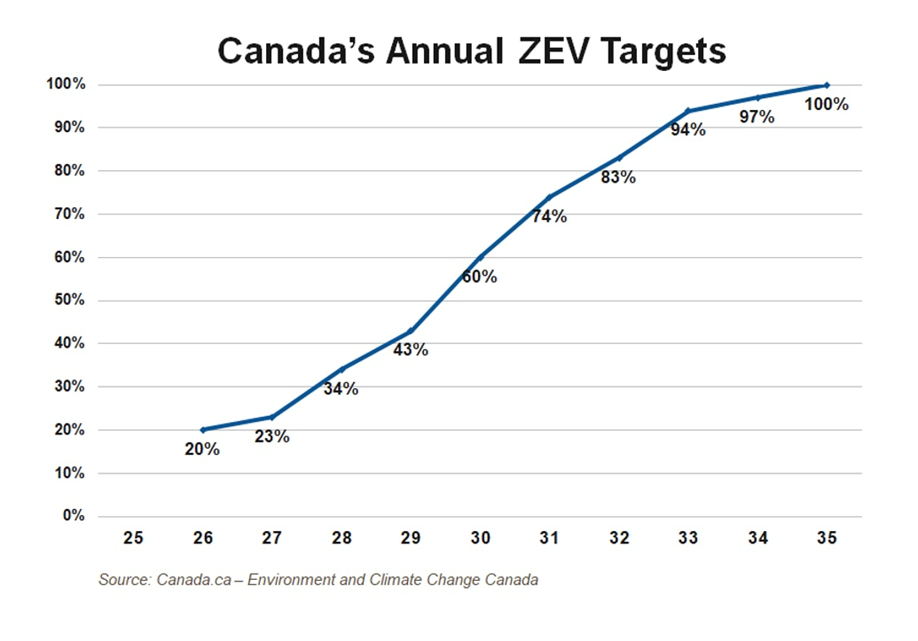

How Governments Can Help Accelerate the Mining of Critical Minerals, and the Obstacles in the Way

The shift from fossil fuels to renewable energies and electrification means a need for the minerals that go into these new technologies.

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

Borderlands: Shifting supply chains boost trade in California-Baja mega-region

This week in Borderlands: Shifting supply chains boost trade in California-Baja mega-region; Union Pacific opens expanded Phoenix intermodal terminal; Radiant Logistics expands air cargo operations in Texas; and avocado workers in Mexico file labor complaints. Foreign companies looking to...

www.freightwaves.com

www.freightwaves.com

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

Morning Bid: Booming stocks step back as PCE hoves into view

February 26, 2024 6:02 AM ESA look at the day ahead in U.S. and global markets from Mike Dolan

Chastened interest rates markets are now inclined to doubt there will be any U.S. monetary easing in the first half of this year, prompting a minor stepback in record high stock indexes into a new week dominated by the latest critical inflation update.

Before we get to the Federal Reserve's favored PCE price gauge release on Thursday, U.S. Treasury yields slipped back somewhat - ahead of 2- and 5-year debt auctions later in the day and partly soothed by ebbing crude oil prices.

More:

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

Impact to Global Trade Due to Disruptions of Shipping in the Red Sea, Black Sea and Panama Canal

Feb 25, 2024In this episode, Sal Mercogliano - maritime historian at Campbell University (@campbelledu) and former merchant mariner - examines the recent report entitled Navigating Troubled Waters: Impact to Global Trade of Disruption of Shipping Routes in the Red Sea, Black Sea and Panama Canal. 17 mins long.

00:00 Introduction

00:41 A Single Attack on Commercial Shipping Has Worldwide Impacts

03:13 Impact of Disruption in Key Global Waterways

05:47 Interruption of trade in the Red Sea and Suez Canal - Impacts and Implications

14:44 Way Forward

- NAVIGATING TROUBLED WATERS: IMPACT TO GLOBAL TRADE OF DISRUPTION OF SHIPPING ROUTES IN THE RED SEA, BLACK SEA AND PANAMA CANAL https://unctad.org/publication/navi...rade-disruption-shipping-routes-red-sea-black

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

Gold rebounds as US dollar, yields slip with eyes on Fed guidance

- PCE inflation data due Thursday

- About 10 Fed officials due to speak this week

- Solid physical demand, cenbank purchases keeping gold above $2,000/oz-analyst

Spot gold was up 0.2% at $2,035.23 per ounce as of 1022 GMT, hovering near its highest since Feb. 7 hit on Friday. U.S. gold futures rose 0.3% to $2,044.80 per ounce.

More:

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

US FTC suing to block $25 bln Kroger-Albertsons supermarket deal

WASHINGTON, Feb 26 (Reuters) - The U.S. Federal Trade Commission and eight states said on Monday they are suing to block supermarket chain Kroger's (KR.N), opens new tab $24.6 billion deal to buy smaller rival Albertsons (ACI.N), opens new tab, saying it would boost grocery prices for millions of Americans.The deal, which would create a grocery empire with more than 4,000 stores, has drawn tough scrutiny from lawmakers and consumer groups worried about higher grocery prices, job losses, store closures and diminishing choice for consumers.

More:

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

Morning Bid: Anxious bonds catch a bid as Mideast eyed

February 27, 2024A look at the day ahead in U.S. and global markets from Mike Dolan

With stocks holding the bulk of recent stellar gains, more anxious bonds are back in focus - but Treasuries caught a decent break Tuesday during a heavy week for new debt sales and inflation updates.

Debt markets were unsettled on Monday as a record $127 billion of coupon debt was sold at two auctions of two- and five-year Treasury notes, with another $42 billion of seven-year notes under the hammer on Tuesday.

More:

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

They're Ready, Are You? Simon Hunt on How To Prepare For The Next Global Order

Feb 27, 2024New interview with expert commentator #SimonHunt

As ever this is a wide-ranging chat with the financial and #globalmarkets expert. His insights into (and contacts within) the #geopolitical sphere are fascinating. The conclusions he draws are concerning, but his advice (for gold investors) is reassuring.

Whether you're looking to learn more about the intentions of the BRICs, who will win in the Russia-Ukraine war or how to prepare for the next change in financial order, then this will be a fascinating conversation for you to listen to.

Don't forget to let us know what you thought about the interview. And, if there is anyone you would like us to speak to, email us!

28:02

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

Indian-classed fleet more than doubles since Putin’s full-scale invasion of Ukraine - Splash247

In the two years since Russia’s full-scale invasion of Ukraine, the number of ships classified as shadow or dark has leapt, and Western service providers have pulled back from working with a significant tranche of the merchant fleet for fear of being hit by sanctions. However, the total amount...

Shipping’s largest, most fragmented sector faces up to consolidation realities - Splash247

Shipping’s largest sector – dry bulk – has experienced some very significant merger moves in recent months, which many believe is just the start of a period of consolidation for the highly fragmented industry. Analysis of dry bulk mergers as an ongoing trend forms the lead for the February issue...

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

The Great Cashout—Jeff Bezos, Leon Black, Jamie Dimon, and the Walton family have now sold a combined $11 billion in company stock this month— some for the first time ever

High-profile CEOs, founders, and heirs are selling stock by the bucketload in the companies that made them billionaires. For nearly the entire bunch, shares prices are trading near all-time-highs.Jeff Bezos sold Amazon shares worth $8.5 billion in multiple transactions this month. Meanwhile, Jamie Dimon, CEO and chairman of JPMorgan Chase, sold $150 million in stock last week, his first cashing out since taking the top job at the bank 18 years ago. Around the same time, Leon Black, co-founder and former CEO of Apollo Global Management, shed $172.8 million in stock—also a first-ever stock sale.

In dozens of trades since the beginning of February, Mark Zuckerberg unloaded about 1.4 million shares of Meta stock worth roughly $638 million, according to an analysis from insider stock sales data firm Verity. This latest batch of sales came after previously culling 588,200 shares in November, 688,400 in December, and 447,200 in January. He sold nearly $600 million in the three months leading up to February and his proceeds from combined sales during the past four months have reached $1.2 billion.

Similarly, the trust for the Walton family, heirs to Walmart’s founder, sold $1.5 billion in Walmart stock this month. The family owns about 45% of Walmart’s shares, according to Bloomberg.

More:

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

Dispensary Owners Caught On Tape Bragging They Don't Pay Their Vendors: Industry Vet Says Black Market Has More Integrity Than Legal

"Integrity has no need of rules." Albert Camus, French philosopher (1913-1960)

Today, unfortunately, it seems that we have more rules and less integrity. At least this seems to be the case for one section of the California cannabis industry. Recently, a video went viral of dispensary owners in a meeting talking about how much money they saved by not paying their "mom-and-pop" vendors.

"You know what’s so cool," one owner asked. "How much money we’ve saved by not paying the vendors that have gone out of business…I’m talking about these mom-and-pop brands that come and go.”

More:

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

Morning Bid: US tracking 3%+ growth; Apple downshifts, Kiwi surprise

February 28, 2024A look at the day ahead in U.S. and global markets from Mike Dolan

With world markets partly frozen ahead of this week's U.S. inflation update, attention swung elsewhere from Cupertino to New Zealand.

But the prospect of U.S. economic growth coming in above 3% again in Q1 for the third quarter in a row is perhaps the big picture everyone needs to keep tabs on.

Even though weather-distorted data updates so far this year look mixed - not least a retreat in consumer confidence in February - the Atlanta Federal Reserve's real-time GDP tracker has climbed back up to 3.1% for the current quarter.

More:

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

On The Ground at the 2024 Commodity Classic | BASF is launching Xarvio Field Manager

Feb 28, 2024Live from Houston, Texas at the 2024 Commodity Classic, Brownfield's Meghan Grebner talks with Justin Gayliard, Director of Digital Farming at BASF, about the launch of Xarvio Field Manager, a digital data-driven farming solution.

4:44

Find more coverage of the 2024 Commodity Classic here: https://brownfieldagnews.com/2024comm...

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

You Want to Own Commodities 'In a Big Way' After the Crash: Michael Pento

Feb 28, 2024Michael Pento thinks commodities will be a great place to be, just not right now. A confluence of factors including untenable government debt, a weak banking sector, and extreme overvaluation in the broad market means that stocks are set for a brutal correction, and Michael believes it's better to play defense for the time being, and then look to gold, silver, uranium and other commodities when there's blood in the streets. 35 mins long.

00:00 Introduction

01:45 Brutal Market Downturn

05:58 Fed Reaction to Crash

07:38 State of the US Economy

12:30 Where do Commodities Come In?

15:43 Which Commodities Will Shine?

17:48 Thoughts on Gold and Silver

22:16 How is Michael Positioned?

26:30 Defensive Stocks

28:15 Time in the Market or Timing the Market?

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

Weekly iScrap Report: Market Dynamics - Copper’s Decline & Steel’s Ongoing Struggle

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

Fearnleys Week 9

tradingeconomics.com

tradingeconomics.com

Commodities - Live Quote Price Trading Data

Trading Economics provides data for several commodities including live bid/ask quotes, last trading prices, forecasts, charts with historical time series and news. This table was last updated on Friday, April 26, 2024.

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

Morning Bid: Yen pops on Leap Day as PCE inflation looms

February 29, 2024A look at the day ahead in U.S. and global markets from Mike Dolan

February's extra 'leap year' day saw the yen jump to two-week highs on hawkish Bank of Japan noises and bitcoin surge again to within 10% of new records - but the big hurdle for U.S. markets is the critical PCE inflation readout later today.

The yen rose to its best levels since mid-February and the Nikkei (.N225), opens new tab ended in the red again after BOJ board member Hajime Takata said the central bank must consider overhauling its ultra-loose policy, including an exit from negative interest rates and bond yield caps.

More:

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

Podcast, nothing to see. Can listen in one tab, surf the forum in a different tab. This is an opinion piece, take it fwiw and dyodd.

Tom welcomes back Paul from the Sirius Report to update you on the continued geopolitical shift from a unipolar world to a multipolar world. Paul highlights the failure of the traditional unipolarity model for economic reasons, particularly since the financial crisis of 2008. The global South wants to assert its autonomy and make its own decisions, which has led to a push for de-dollarization and the development of alternative payment mechanisms. The Ukraine war and the imposition of sanctions on Russia have shown that it is possible to function outside the SWIFT system and conduct transactions in local currencies. The global South also points out that it has a real economy based on manufacturing and production, unlike the West, which is heavily dependent on financialization. The economies of the BRICS countries, in total, are now higher than the G7 economies, further highlighting the shift towards multipolarity. 1 hour, 3 mins long.

London Paul: Part One - Debt Levels & Instability, The Achilles Heel of the West's Financial System

Feb 28, 2024Tom welcomes back Paul from the Sirius Report to update you on the continued geopolitical shift from a unipolar world to a multipolar world. Paul highlights the failure of the traditional unipolarity model for economic reasons, particularly since the financial crisis of 2008. The global South wants to assert its autonomy and make its own decisions, which has led to a push for de-dollarization and the development of alternative payment mechanisms. The Ukraine war and the imposition of sanctions on Russia have shown that it is possible to function outside the SWIFT system and conduct transactions in local currencies. The global South also points out that it has a real economy based on manufacturing and production, unlike the West, which is heavily dependent on financialization. The economies of the BRICS countries, in total, are now higher than the G7 economies, further highlighting the shift towards multipolarity. 1 hour, 3 mins long.

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

^^^^^^

Part 2. Take it fwiw and dyodd.

In the second half of this interview, London Paul dives into the recent interview with Tucker Carlson, London Paul reflects on the significance of Vladimir Putin's discussion on a range of topics. While many expected the interview to be a game changer, Paul argues that it did not provide any new information and criticizes Putin's history lesson as self-indulgent. He suggests that Carlson could have asked tougher questions. Paul believes that the interview, while it may have rattled some in the West, was not as groundbreaking as people believed. He points out that other events, such as Putin's 2018 speech on Russia's military capabilities, have had more significant implications.

Paul then discusses the lessons NATO has learned from the war in Ukraine. He argues that NATO initially underestimated Russia's military capability and has now come to realize its strength. He also dismisses the belief that Russia wants to recreate the Soviet Union and invade the Baltic republics. Paul predicts that if Ukraine loses the war, NATO will face division and its future will be in doubt. He also suggests that there will be political fallout within Ukraine and among European nations, potentially leading to the rise of populist governments and questioning the future of the European Union.

Paul explains the difference between a war and a special military operation and emphasizes that Russia is conducting a special military operation in Ukraine. He highlights the importance of avoiding a situation where Russia declares war on Ukraine to prevent further escalation and a potential global nuclear war. He acknowledges growing concerns within the US about financing the war and emphasizes the need to end the conflict due to its devastating impact on the Ukrainian people.

Lastly, Paul argues that the US has lost its military power and is facing numerous challenges and conflicts that it cannot effectively manage. Despite this, he believes that if the US faces reality and adapts, it can still be a great nation amongst equals. He encourages listeners to be informed about global events and mentions his podcast, which releases five episodes per week.

54 mins long.

Part 2. Take it fwiw and dyodd.

In the second half of this interview, London Paul dives into the recent interview with Tucker Carlson, London Paul reflects on the significance of Vladimir Putin's discussion on a range of topics. While many expected the interview to be a game changer, Paul argues that it did not provide any new information and criticizes Putin's history lesson as self-indulgent. He suggests that Carlson could have asked tougher questions. Paul believes that the interview, while it may have rattled some in the West, was not as groundbreaking as people believed. He points out that other events, such as Putin's 2018 speech on Russia's military capabilities, have had more significant implications.

Paul then discusses the lessons NATO has learned from the war in Ukraine. He argues that NATO initially underestimated Russia's military capability and has now come to realize its strength. He also dismisses the belief that Russia wants to recreate the Soviet Union and invade the Baltic republics. Paul predicts that if Ukraine loses the war, NATO will face division and its future will be in doubt. He also suggests that there will be political fallout within Ukraine and among European nations, potentially leading to the rise of populist governments and questioning the future of the European Union.

Paul explains the difference between a war and a special military operation and emphasizes that Russia is conducting a special military operation in Ukraine. He highlights the importance of avoiding a situation where Russia declares war on Ukraine to prevent further escalation and a potential global nuclear war. He acknowledges growing concerns within the US about financing the war and emphasizes the need to end the conflict due to its devastating impact on the Ukrainian people.

Lastly, Paul argues that the US has lost its military power and is facing numerous challenges and conflicts that it cannot effectively manage. Despite this, he believes that if the US faces reality and adapts, it can still be a great nation amongst equals. He encourages listeners to be informed about global events and mentions his podcast, which releases five episodes per week.

54 mins long.

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

Want to Revitalize American Shipbuilding? Change the Shift Schedule

Popular history and historians in public service have encouraged the public to view the production capacity of the United States during as World War I...

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

A Modern-day CDL Renaissance Man

Michael Lombard, President of Lombard Trucking, joins Jeremy Reymer as they discuss his experience as a CDL driver, his passion for driver advocacy and health, as well as his growth as an industry influencer. 30 mins long.- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

What China's Slowdown Means for Us All

Mar 1, 2024For decades, China’s economic growth was tremendous. But now the nation is seeing a significant slowdown. Its housing sector is in its third year of decline, the stock market is touching new lows and youth unemployment remains high. These issues may be a major headache not only for the Chinese people and President Xi Jinping, but they also have big consequences for the rest of the world.

With China’s National People Congress approaching, Bloomberg journalists analyze what the end of China’s boom times means for other countries, companies and you. 10 mins long.

00:00 Introduction

01:20 China’s growth miracle

03:04 The end of the boom

04:24 Young Chinese cut spending

07:25 Consequences for the world, Xi Jinping

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

Morning Bid: March back up to record highs

March 1, 2024A look at the day ahead in U.S. and global markets from Mike Dolan

A new month and new stock market records are giving way already - underpinned by some relief on inflation, stabilising business surveys worldwide and slightly more dovish central banks.

Wall St's major indexes (.SPX), opens new tab, (.IXIC), opens new tab clocked new record closes on the final day of February and March kicked off with fresh highs for Japan's Nikkei (.N225), opens new tab and Germany's DAX (.GDAXI), opens new tab.

More:

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

The Chinese digital octopus spreading its tentacles through smart port ambitions - Splash247

Andre Wheeler carries a warning today about China’s LOGINK digital platform. As the world of shipping has moved towards smart ports, China has quietly been strengthening its position of power over global trade via its data aggregation platform that has been embedded into port and terminal...

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

FWIW (dyodd)\

Chris Vermeulen believes that we are facing down a stage 4 market decline up ahead and although caution is warranted at the moment, once the broad market has corrected, commodities will be a fantastic place to find value. Chris pulls up the charts and brings his technical analysis skills to bear on gold, silver, uranium, energy, and much more in this insightful interview.

34:17

Market Decline Will Lead to Huge Opportunity in Commodities: Chris Vermeulen

Mar 1, 2024Chris Vermeulen believes that we are facing down a stage 4 market decline up ahead and although caution is warranted at the moment, once the broad market has corrected, commodities will be a fantastic place to find value. Chris pulls up the charts and brings his technical analysis skills to bear on gold, silver, uranium, energy, and much more in this insightful interview.

34:17

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

Weekly Livestock Market Update: March 1st, 2024

Mar 1, 2024• This week in the markets – Live fed cattle prices are $2.25 higher on the week, while feeder cattle prices were steady to $4.00 higher this week. April live cattle were up $0.45 on the week, and April feeder cattle were down $1.90 on the week. Choice box beef was $4.85 higher this week. Cash hogs are up $0.70 this week. April lean hog futures were up $0.90 on the week. Pork cutout values were marginally lower this week.

• Weekly Slaughter – At the end of the week, cattle slaughter was 599,000 head, down 6,000 on the week and down 27,000 for the year. Hog slaughter was 2.549 million head, down 29,000 from the previous week and up 26,000 on the year.

• Cold Storage – January 2024 cold storage stocks of beef were down 11.2% relative to one year ago at 475 million pounds. Pork ending stocks for January were down 9.8% at 468 million pounds. Bellies, hams, and loins were all lower relative to year-ago levels.

• Restaurant Performance Index – Lower same-store sales and customer traffic led to a 1.1% decline in the January 2024 restaurant performance index. Weakness has led to four months of the current situation index being in the contraction range. The weaker customer traffic trend may suggest consumers need to make choices to reduce spending as their budgets tighten.

• Quarterly Trade Report – USDA increased their FY2024 agricultural trade value by $1.0 billion relative to their November estimates. They also increased the value of imports for FY2024 by $1 billion, leaving net exports unchanged. The bright spot for the livestock industry was a $0.5 billion increase in pork export value relative to their November forecast.

14:20

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

Shifting Energy: The Nuclear Energy Comeback and Uranium Powering it!

Mar 2, 2024In this debut episode of Shifting Energy (Season 1), Thalia Hayden @etfguide talks with John Ciampaglia, the CEO at Sprott Asset Management about the resurgence of nuclear power, why it's happening, the uranium needed to keep it going and the investment opportunities right now and yet ahead.

12:10

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

"A dream. It's perfect": Helium discovery in northern Minnesota may be biggest ever in North America

For a century, the U.S. Government-owned the largest helium reserve in the country, but the biggest exporters now are in Russia, Qatar and Tanzania. With this new discovery, Minnesota could be joining that list.

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

How America’s once great department stores became a dying breed

New York CNN —Macy’s announcement Tuesday that it will close 150 stores, or nearly a third of its total, is the result of a once-great department store industry in decades of decline.

The gradual demise of the American department store can be blamed on many factors: competition from big box retailers, a shift to online shopping and activist shareholders fighting for control of the company’s board.

Another key problem: The retail industry has been split in two as inflation has taken its toll. That means brands like Walmart that are focused on inexpensive items are succeeding, as are luxury brands for people who still have means to afford finer items. But department stores, focused on America’s middle class, are fading.

More:

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

RUBYMAR Sinks in the Red Sea due to Houthi Attack | Impact on Undersea Cables & Global Shipping

Mar 2, 2024In this episode, Sal Mercogliano - maritime historian at Campbell University (@campbelledu) and former merchant mariner - discusses the sinking of the bulk carrier Rubymar by the Houthi. 14 mins long.

00:00 Introduction

00:50 Background on Houthi Attacks on Shipping

03:40 Rubymar Sunk

06:34 Impact on Undersea Cables

09:03 What it Means for Shipping in the Red Sea

11:15 Conclusion

- EUNAVFOR Maritime Security Threat - Red Sea https://on-shore.mschoa.org/piracy-si...

- Rubymar Has Sunk, Yemeni Government Says https://gcaptain.com/rubymar-has-sunk...

- Ship sunk by Houthis threatens Red Sea environment, Yemeni government says https://www.reuters.com/world/freight...

- Red Sea Conflict Threatens Key Internet Cables https://www.wsj.com/business/telecom/...

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

Gibson Tanker Report

www.gibsons.co.uk

www.gibsons.co.uk

Weekly Shipping Market Report - Week 9

A Passage to the Panama Canal - Gibson

The Panama Canal stands as one of the world's most vital intercontinental waterways, playing an important role in facilitating global trade, particularly along the routes connecting the Americas and Asia. However, in recent years, a combination of climate change and structural factors have posed...

www.gibsons.co.uk

www.gibsons.co.uk

Weekly Shipping Market Report - Week 9

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

Asian Markets

With the MSCI World, Japanese Nikkei 225, opens new tab, Nasdaq, S&P 500 and Europe's STOXX 600 indexes all finishing last week at record highs, Asian markets kick off the new week on Monday with a strong global tailwind behind them.

The resilience of the U.S. economy, cooling inflation and an artificial intelligence-fueled frenzy in big tech are setting the positive tone globally, which should put a spring in Asian markets' step on Monday.

More:

Morning Bid: Global mood buoyant, China's 2024 plan looms

March 4 (Reuters) - A look at the day ahead in Asian markets.With the MSCI World, Japanese Nikkei 225, opens new tab, Nasdaq, S&P 500 and Europe's STOXX 600 indexes all finishing last week at record highs, Asian markets kick off the new week on Monday with a strong global tailwind behind them.

The resilience of the U.S. economy, cooling inflation and an artificial intelligence-fueled frenzy in big tech are setting the positive tone globally, which should put a spring in Asian markets' step on Monday.

More:

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

RUBYMAR Sinks in the Red Sea due to Houthi Attack | Impact on Undersea Cables & Global Shipping

Mar 2, 2024

In this episode, Sal Mercogliano - maritime historian at Campbell University (@campbelledu) and former merchant mariner - discusses the sinking of the bulk carrier Rubymar by the Houthi. 14 mins long.

00:00 Introduction

00:50 Background on Houthi Attacks on Shipping

03:40 Rubymar Sunk

06:34 Impact on Undersea Cables

09:03 What it Means for Shipping in the Red Sea

11:15 Conclusion

- EUNAVFOR Maritime Security Threat - Red Sea https://on-shore.mschoa.org/piracy-si...

- Rubymar Has Sunk, Yemeni Government Says https://gcaptain.com/rubymar-has-sunk...

- Ship sunk by Houthis threatens Red Sea environment, Yemeni government says https://www.reuters.com/world/freight...

- Red Sea Conflict Threatens Key Internet Cables https://www.wsj.com/business/telecom/...

Rubymar’s sinking poses ‘major environmental crisis’ in the Red Sea - Splash247

The Red Sea shipping crisis has entered a new chapter with the sinking of the bulk carrier early on Saturday morning. The insurance situation regarding the Lebanese-owned, Greek-managed, Belize-registered ship remains unclear. The vessel has become the first constructive total loss since the...

- Messages

- 11,753

- Reaction score

- 2,566

- Points

- 238

Secondhand ship prices and sales volumes scale heights - Splash247

Secondhand tanker and bulker prices are at highs not seen for more than a decade, with owners scrambling for all available tonnage, pushing secondhand prices close to newbuild levels. According to Clarksons Research, secondhand tanker prices are at a 15-year high, while secondhand bulk carrier...