Little bit of everything in this one. Nothing to see, can listen in one tab, surf the forum in a different tab. 59 mins long.

Thriving in a Broken Financial System | Lyn Alden Ep.119

Let's take a deep dive on the economy, our money system, BITCOIN, and investment ideas with Lyn Alden, macroeconomic analyst focused on monetary systems and energy markets.

"Who Controls The Ledger?"

We talk about the state of the economy and markets, our debt crisis, inflation, liquidity, investing, and markets.

We go beyond the headlines and discover what is really going on in the markets and economy. Massive fiscal spending has mitigated QT and effects of higher rates. Where are we in this economic cycle? Are we headed for a recession or stagflation?

Want to find out some investing ideas and strategies that can grow and protect our money during these times? You cannot afford to miss this episode!

Chapters:

00:00:00 - Historical Analogies and Unique Situations

00:02:28 - The Global Financial System and Its Imbalances

00:04:39 - The Rising Problem of Interest Expense

00:06:52 - Concerns about Public Debt and Inflation

00:09:14 - The Decline in Purchasing Power and Alternative Forms of Inflation

00:11:40 - The Changing Dynamics of Credit Growth

00:13:43 - The Quantitative Rhyme of the 1920s and 1930s

00:16:06 - Inflationary and deflationary forces during economic crises

00:18:23 - The Fiscal Decade and Global Inflation

00:20:47 - Currency Debasement and Higher Prices

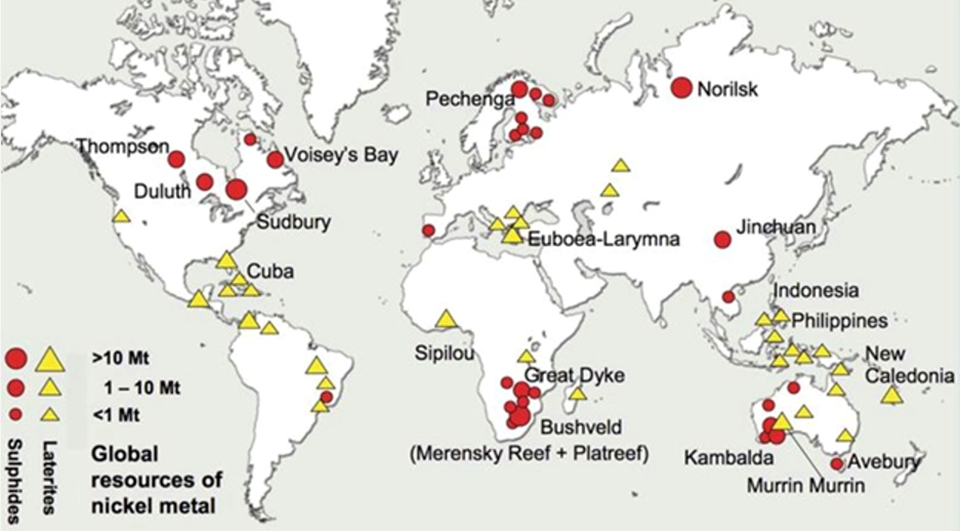

00:23:05 - Investing in Real Assets for Inflation Protection

00:25:26 - Investing in Real Assets

00:27:48 - The Future of Gold and Bitcoin

00:30:07 - Investing in AI Companies

00:32:21 - Valuing Tech Companies and Liquidity in the Market

00:34:37 - Treasury's Liquidity Injection

00:36:51 - Factors Influencing Global Liquidity

00:38:57 - The Fed's Policy on Interest Rates and Inflation

00:41:05 - Liquidity and the Balance Sheet

00:43:17 - Historical Analogues and the Future of Markets

00:45:36 - Investing in Energy Stocks for Inflationary Environment

00:47:48 - Thoughts on a Recession and Emerging Market Landing

00:50:08 - Bitcoin and the Decentralized World

00:52:20 - The Rise of Decentralization

00:54:28 - The Collapse of Fiat and the Coexistence of Bitcoin

00:56:44 - The Global Reserve Currency Comparison