- Messages

- 34,573

- Reaction score

- 5,847

- Points

- 288

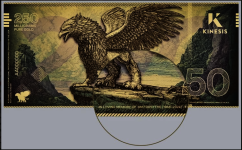

BATON ROUGE, La. (May 15, 2024) – Today, the Louisiana House unanimously passed a bill that would make gold and silver legal tender in the state.

Sen. Mark Abraham filed Senate Bill 232 (SB232) on March 1. Under the proposed law, “any gold or silver coin, specie or bullion issued by any state or the United States government as legal tender shall be recognized as legal tender in the state of Louisiana.”

On May 15, the House passed SB232 by a 92-0 vote with some technical amendments. The Senate previously passed the bill by a 39-0 vote. It now goes back to the Senate for final consideration.

blog.tenthamendmentcenter.com

blog.tenthamendmentcenter.com

Sen. Mark Abraham filed Senate Bill 232 (SB232) on March 1. Under the proposed law, “any gold or silver coin, specie or bullion issued by any state or the United States government as legal tender shall be recognized as legal tender in the state of Louisiana.”

On May 15, the House passed SB232 by a 92-0 vote with some technical amendments. The Senate previously passed the bill by a 39-0 vote. It now goes back to the Senate for final consideration.

Louisiana House Passes Bill to Make Gold and Silver Legal Tender | Tenth Amendment Center

Under the proposed law, “any gold or silver coin, specie or bullion issued by any state or the United States government as legal tender shall be recognized as legal tender in the state of Louisiana.”