You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Real Estate and foreclosure thread

- Thread starter BackwardsEngineer

- Start date

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Messages

- 18,204

- Reaction score

- 10,967

- Points

- 288

Heck, just get yourself a real estate license! They're a couple three grand and you'll save that on the first house you buy!If I call up a Listing Agent to show me the house they have listed I'm not signing crap with them. it's their job to show off the property they have under contract. Now, if I'm really serious and want my own agent then that's another story and I'll have to go find a good buyers agent.

Bold is mine:

This is absolutely shocking...

UBS is attempting to sell a Midtown Manhattan office building via an ONLINE AUCTION, signaling the excruciating challenges of commercial real estate in NYC...

The starting bid for the 920k SF building located at 135 W 50th St will be $7.5M, or $8 per SF

- Messages

- 34,186

- Reaction score

- 5,804

- Points

- 288

Ever hear anything like this before?

$500K Hawaiian home accidentally built on wrong plot overrun by pooping squatters — as developer sues owner

AHawaiian property owner was left baffled when a half-million-dollar home was accidentally built on her plot — and the real estate developer slapped her with a lawsuit as the vacant home is being overrun by pooping squatters.

“You already make a mistake, and then you build on my land without my permission. And then now you’re suing me for it,” Annaleine “Anne” Reynolds told The Post about the nightmare ordeal.

“I was so mad. I was so mad that day … that’s a really big mistake to make.”

Now, the three-bedroom, two-bath home in Hawaii’s fastest-growing development zone is running rampant with squatters as Reynolds and the developers remain locked in a legal battle.

The bewildering saga began in 2018 when Reynolds bought the one-acre plot in Puna’s Hawaiian Paradise Park for just $22,500 at a county tax auction.

More:

MSN

www.msn.com

Update:

Court orders deconstruction of house on wrong lot on the Big Island

HAWAIIAN PARADISE PARK, Hawaii (Island News) -- A Hawaii County judge ordered an "illegal" house, built by mistake on the wrong lot, to be removed.

Judge Grants Order to Tear Down House Built on Wrong Lot

Jun 25, 202425:38

Bold is mine:

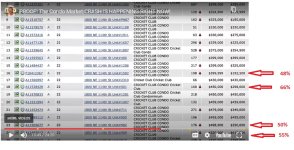

That twitter account has so many accounts of HUGE loses on properties all over the place. I do NOT understand how the banks are still able to paper over and hide these loses.

Condo's are just getting crushed in Florida. Will they end up a negative value like Time-Shares? I'll bet some end up that way.

- Messages

- 34,186

- Reaction score

- 5,804

- Points

- 288

This one is an interesting story out of England.

In the shopping streets and housing estates of the south London town of Croydon, some once-derelict buildings are slowly coming back to life.

At a former school, peeling walls are getting a fresh coat of paint, and laundry hangs on a line to dry. Over at a disused youth centre, there is laughter in the gymnasium-turned-dormitory, and a vase of purple flowers decorates a scrubbed kitchen counter.

The Reclaim Croydon collective, a squatters’ group, has taken over disused commercial premises to provide beds for the homeless, saying it is providing a community-based solution to a broken housing market.

“The government is failing homeless people,” said one of the youth centre’s new occupants, who goes by the name Leaf.

More:

Squatters take London’s housing crisis into their own hands

Filed June 28, 2024, 07:00 a.m. GMTIn the shopping streets and housing estates of the south London town of Croydon, some once-derelict buildings are slowly coming back to life.

At a former school, peeling walls are getting a fresh coat of paint, and laundry hangs on a line to dry. Over at a disused youth centre, there is laughter in the gymnasium-turned-dormitory, and a vase of purple flowers decorates a scrubbed kitchen counter.

The Reclaim Croydon collective, a squatters’ group, has taken over disused commercial premises to provide beds for the homeless, saying it is providing a community-based solution to a broken housing market.

“The government is failing homeless people,” said one of the youth centre’s new occupants, who goes by the name Leaf.

More:

- Messages

- 34,186

- Reaction score

- 5,804

- Points

- 288

You don't enforce "normal" ownership or common rights. This is what happens. Shit gets real.

- Messages

- 539

- Reaction score

- 448

- Points

- 238

I was thinking that If I were on a jury, a bullet would be just fine. Thieves and bullets go together like ivory and ebony. That sounds like a good song.You don't enforce "normal" ownership or common rights. This is what happens. Shit gets real.

- Messages

- 34,186

- Reaction score

- 5,804

- Points

- 288

Not news, this one is an opinion piece I found interesting.

In the 2010s, the capital of Texas grew faster than any other major U.S. metro, pulling in movers from around the country. Initially, downtown and suburban areas struggled to build enough apartments and single-family homes to meet the influx of demand, and housing costs bloomed across the region. Since the beginning of the pandemic, even as rent inflation has gone berserk nationwide, no city has experienced anything like Austin’s growth in housing costs. In 2021, rents rose at the most furious annual rate in the city’s history. In 2022, rent growth exceeded every other large city in the country, as Austin’s median rent nearly doubled.

This might sound like the beginning of a familiar and depressing story—one that Americans have gotten used to over the past few decades, especially if they live in a coastal blue state. California and New York, anchored by “superstar” clusters in Silicon Valley, Hollywood, and Wall Street, have pulled in some of the nation’s most creative workers, who have pushed price levels up. But a combination of stifling construction regulations, eternal permitting processes, legal tools to block new development, and NIMBY neighbors restricted the addition of more housing units. Rent and ownership costs rose in America’s richest cities, until families started giving up and moving out. As the economics writer Noah Smith has argued, California and New York are practically driving people out of the state “by refusing to build enough housing."

More:

America’s Magical Thinking About Housing

If you want to understand America’s strange relationship with housing in the 21st century, look at Austin, where no matter what happens to prices, someone’s always claiming that the sky is falling.In the 2010s, the capital of Texas grew faster than any other major U.S. metro, pulling in movers from around the country. Initially, downtown and suburban areas struggled to build enough apartments and single-family homes to meet the influx of demand, and housing costs bloomed across the region. Since the beginning of the pandemic, even as rent inflation has gone berserk nationwide, no city has experienced anything like Austin’s growth in housing costs. In 2021, rents rose at the most furious annual rate in the city’s history. In 2022, rent growth exceeded every other large city in the country, as Austin’s median rent nearly doubled.

This might sound like the beginning of a familiar and depressing story—one that Americans have gotten used to over the past few decades, especially if they live in a coastal blue state. California and New York, anchored by “superstar” clusters in Silicon Valley, Hollywood, and Wall Street, have pulled in some of the nation’s most creative workers, who have pushed price levels up. But a combination of stifling construction regulations, eternal permitting processes, legal tools to block new development, and NIMBY neighbors restricted the addition of more housing units. Rent and ownership costs rose in America’s richest cities, until families started giving up and moving out. As the economics writer Noah Smith has argued, California and New York are practically driving people out of the state “by refusing to build enough housing."

More:

- Messages

- 34,186

- Reaction score

- 5,804

- Points

- 288

Renters in New York City fight back against real estate broker fees

City is one of few in the US where tenants can be forced to pay fees, despite a landlord having hired the broker

- Messages

- 18,204

- Reaction score

- 10,967

- Points

- 288

Moody's Predicts 24% Of Office Towers Will Be Vacant By 2026

Moody's Predicts 24% Of Office Towers Will Be Vacant By 2026 | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

- Messages

- 34,186

- Reaction score

- 5,804

- Points

- 288

They bought properties at Philadelphia sheriff sales ... but they never got the deed

Last November, Dave Brown bought a rowhouse in Oxford Circle at a sheriff sale as a first-time renovation project.Brown, 54, who works for a local utility company, borrowed some of the $143,429 needed for the purchase. The deed was supposed to have been transferred within 60 to 90 days.

It ended up taking seven months, because of unexplained delays in the Sheriff’s Office. He was still seeking to get a copy of the deed last week, which was finally recorded only recently. Meanwhile, he’s paying interest on the loan.

“A debacle,” said Brown, describing his experience buying a home through an auction run by Sheriff Rochelle Bilal’s office.

Buyers like Brown who sometimes drop hundreds of thousands of dollars on a foreclosed property at auction are left without a deed for many months, according to an Inquirer analysis of city records and interviews with bidders, real estate attorneys, and real estate agents. The buyers in limbo can’t access the properties, make repairs, or rent them out.

The deed-recording process, which historically took around six to eight weeks to conclude after a Philadelphia sheriff sale, can now take about seven months — or more.

More:

Trusting government - on ANYTHING - is never wise.

His loy-yeh should have stipulated, delivery of the deed at closure (or other timeframe).

His loy-yeh should have stipulated, delivery of the deed at closure (or other timeframe).

Doesn't work that way buying Sherriff Deeds. This is just one of many reasons why doing so is more risky.

What, you can't stipulate that buying out of a foreclosure option includes paperwork to prove ownership?Doesn't work that way buying Sherriff Deeds. This is just one of many reasons why doing so is more risky.

That's insane. I'm going to arrange a mortgage secured by a property, and then pay the full amount with the borrowed funds, and then find, I have no document of ownership? So the bank can pursue me for fraud, and the county (corrupt, in Philly) takes the money and delivers nothing?

Yes, buying a property at a Sherriff auction is very risky.

Even if you wait till the end of the whole process you Still don't get the same Deed. I bought a foreclosure from Fannie Mae back in like 2012. We never got a Warranty Deed. You get a Special Warranty Deed from the government. It's not the same and you get less protection (hence you can't have a Warranty). Does this matter much? Probably not until there was a problem from long ago.

Very evident collapse getting going in Florida. I even saw a big spike in listings here in my county the last 3 weeks. This thing is over. I think Real Estate will be a horrid investment for at least 10 years now.

Very evident collapse getting going in Florida. I even saw a big spike in listings here in my county the last 3 weeks. This thing is over. I think Real Estate will be a horrid investment for at least 10 years now.

I've been waiting for this.

It's not for nothing that we used to call Florida, "God's Waiting Room" (late 1970s, when we all were dismissive of Florida as a place to live). There's really not much work there, apart from retail customer-service jobs, hospitality, and medical/elder care work.

So young people don't go there. Plus, of course, the landscape, the scenery, is boring. I mean, apart from Spring Break at the beach, it's boring.

It's the dying-off Boomers who're down there, and the dying-off Boomers are dying off a lot faster. That's thanks to the miracle of Pfizer and Moderna. Eventually, the shortened life-expectancies of those True-Believer, Circle-D voting, Face-Diaper-wearing Boomers, are gonna translate into a glut of housing.

It may also translate into a rapid political shift down there. Red Florida, Florida Man, may not be so red or so manly in the near future. We tend to forget, before DeSantis, there was Gubbernor Jebster Shrub - a beta in an alpha job, a true squish where a spine should be a job requirement.

I'm watching. When I can buy my cinder-block pillbox beach house on what I have saved, I'm down there. Probably not until.

- Messages

- 34,186

- Reaction score

- 5,804

- Points

- 288

Flood victims' heartbreaking fight against insurance companies | 60 Minutes Australia

Jul 3, 2024 #60MinutesAustralia*Synopsis | High & Dry (2011)*Talk about kicking people when they're down. Flood victims go through absolute hell, and often all that keeps them going is the sure belief they could pick up the pieces and start again. But in the aftermath of the 2010-11 Queensland floods, the big insurance companies did everything they could to worm their way out of paying up. It's in the fine print, and it all comes down to the f-word - flooding.

16:15

- Messages

- 34,186

- Reaction score

- 5,804

- Points

- 288

- Messages

- 34,186

- Reaction score

- 5,804

- Points

- 288

Office vacancies hit an all-time high

Jul 8, 2024 #office #yahoofinance #vacancyAccording to a Moody's report, office sector vacancy rates have set a new record at over 20% in the second quarter. The author behind the report and Moody's head of CRE economics, Tom LaSalvia, joins Market Domination to give insight into the report and detail what's behind these record numbers.

LaSalvia elaborates on the shift of office space use: "The way we're thinking about this as obsolescence, that there is a good 10 to 20% of office buildings out there that really just will not be able to compete in this new era, this era of remote work, this era of new offices, this era of new, let's say, centers of power in terms of where office-centric locations are, right? You're getting migration into the Sunbelt. You're seeing even within metropolitan areas like New York, certain submarkets doing much better than others. And so what you're left with is 10 to 20% of obsolete offices that are going to have to find some new life in this new era."

6:01

Man where do they find these bozos. The problem is Clearly not that the offices are getting older, the DEMAND is gone, or rather shrinking rapidly. I guess Offices got the jab too and are experiencing Rapid aging, lol. Soon to be 30% vacancies plus.

Yahoo Nooze is appropriately named. It's the Party Line for yahoos - and clowns.Man where do they find these bozos. The problem is Clearly not that the offices are getting older, the DEMAND is gone, or rather shrinking rapidly. I guess Offices got the jab too and are experiencing Rapid aging, lol. Soon to be 30% vacancies plus.

The point here is to SPIN things - delude the sheeple, a bit longer.

- Messages

- 34,186

- Reaction score

- 5,804

- Points

- 288

- Messages

- 34,186

- Reaction score

- 5,804

- Points

- 288

Real Estate Newsletter Articles this Week: A Discussion of the Housing Market

At the Calculated Risk Real Estate Newsletter this week: Click on graph for larger image. • 2nd Look at Local Housing Markets in June •...

- Messages

- 34,186

- Reaction score

- 5,804

- Points

- 288

Targeting Corporate Landlords, Biden to Unveil National Rent Control Plan | Common Dreams

"The rent is too damn high—and rent control is a real fix," one group said, praising the proposal.

www.commondreams.org

www.commondreams.org

Gee...Rent Control.

Such a novel idea...how come no one's ever tried it before?

Such a novel idea...how come no one's ever tried it before?

- Messages

- 34,186

- Reaction score

- 5,804

- Points

- 288

The Biggest Scam among Real Estate Agents right now! (Must Watch!)

Jul 21, 2024Scams like this are starting to pop up everywhere! Do not be fooled by Agents pulling this scam.

16:20

Channel: https://www.youtube.com/@YakMotley/videos

A nice little tour of some Distressed Houston CRE properties.

- Messages

- 18,204

- Reaction score

- 10,967

- Points

- 288

US Existing Home Sales Puked (Again) In July...

US existing home sales slumped for the fourth straight month in June, plunging a worse than expected 5.4% MoM (the worst MoM drop since Nov 2022) and dragging sales down 5.4% YoY...

Source: Bloomberg

Notably, existing home sales have not risen on a YoY basis since July 2021, with the SAAR total back below 4mm, near COVID lockdown lows...

US Existing Home Sales Puked (Again) In July... | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

- Messages

- 34,186

- Reaction score

- 5,804

- Points

- 288

This one's a bit different. It's an eviction gone wrong story out of Philly.

Linky stuff:

A landlord-tenant officer shot a woman in the head during an eviction process on Wednesday morning in Philadelphia's Fairmount neighborhood, officials said.

According to law enforcement officials, the incident occurred just after 9 a.m., when the rent server – an employee of the landlord tenant office – was serving eviction paperwork at the Girard Court Apartments along the 2100 block of N. College Avenue.

The landlord tenant office is a private entity that carries out court orders. The officer is not a servant of the City's municipal court. A spokesperson for the court explained that a landlord-tenant officer is instead paid by a landlord.

Landlord-Tenant Officer Shoots Woman in the Head During Eviction

A Philadelphia landlord-tenant officer shot a woman once in the head on Wednesday morning during an eviction, according to police.www.nbcphiladelphia.com

________________________________________

Where I live evictions are carried out by uniformed constables and uniformed cops. And in all of the cases I've heard about, the peeps are given at least one chance to catch up (maybe more depending on circumstances), a good bit of time to get things together and split, and are long gone before the required date.

Update:

Philly’s private eviction system could shut down by end of September over insurance woes

The city’s beleaguered Landlord-Tenant Office is on the brink of losing its insurance and could stop evicting people on behalf of landlords as soon as next month, according to a memo obtained by The Inquirer.Philadelphia is the only county in Pennsylvania that relies primarily on a private attorney — known as a landlord-tenant officer — to handle the notification and enforcement of evictions, in exchange for millions in fees paid by landlords.

For more than a year, city officials have scrutinized the office, after a string of eviction-related shootings by security contractors hired by the office. Just last month, City Council passed a slate of reforms requiring more-intensive training for the contracted deputies.

In an email circulated this week among city officials and landlords, Landlord-Tenant Officer Marisa Shuter said that her office will stop accepting new court-ordered eviction cases on Aug. 12, after failing to find an insurance carrier.

More:

- Messages

- 34,186

- Reaction score

- 5,804

- Points

- 288

List your House for sale... Lose your Home Insurance! (Must Watch!)

Jul 30, 2024Here is what happened to a Florida man when he listed his house for sale on the MLS. Must Watch!

5:56

Check this video out-

List your House for sale... Lose your Home Insurance! (Must Watch!)

Jul 30, 2024

Here is what happened to a Florida man when he listed his house for sale on the MLS. Must Watch!

5:56

Check this video out-• Florida homeowner says his insurer dr...

What to take from this (having not watched the vid, as I'm out of the market for million-dollar homes):

HOME OWNERSHIP - with clear title, legal protection, the option to borrow to buy in an orderly, protected manner - all depends on Rule of Law. That is, that the law is codified (written out plainly) and universally enforced (the protections extended others must be given to you in similar circumstances).

This is obvious stuff, but something we tend not to think about - as tyranny is alien to most of our experiences. We know, a home bought with borrowed money must be fully insured - and we know we need insurance quotes and a binder before committing to a loan and a purchase.

And insurance companies are obligated to demonstrate a need for rate hikes to regulators - rather than just arbitrarily doubling insurance rates, say.

And conditions under which policies may be cancelled, absent claims, should be spelled out. Maybe they were, maybe not; but if you cannot advertise to sell, without losing insurance on a mortgaged home...then you cannot sell.

If this was in policies when purchased, it is of course the fault of the insurance purchaser. If it is a new provision, slipped in under legal blather...it is capricious, and intended to force short-sales. Cui bono? Who benefits?

What we are living through, now, is a period of tyranny - of capricious State and NGO power (which insurance monoliths have) designed to strip properties of owners, for the benefit of banks and the well-connected. What it does, is make ownership of property an unworkable risk to most people, and inconsiderable for informed persons who would otherwise be buyers.

We become just as other Third-World nations...who can have "their" property seized or stripped away with the whim of a public official. No different from corrupt Federales, taking the 4x4 truck of a young owner who thought a tour of Baja might be fun. In the Navy, I'd seen it happen - and what happens when the property turns up (repainted in Tijuana Police livery, and no one in Mexico cared enough to reimburse or return it).

Welcome to the USSA.

Cigarlover

Yellow Jacket

- Messages

- 1,687

- Reaction score

- 1,943

- Points

- 283

Fl and TX have special issues because of insurance issues. The reinsurance companies have basically said F it. How many times do we have to replace a roof and or home in the same area because of hurricanes and storms? Then you have all the fraud from the roofers trying to game the system and it just isn't profitable for insurance companies to do business there anymore. If all insurance companies pull out completely then eventually the market becomes an all cash market since banks require insurance for a mortgage. In an all cash market prices drop to about 10% of current values. then we see the man behind the curtain exposes the fact that the only reason real estate or anything else is so expensive is because banks are willing to loan money on it. Take them out and go to all cash on everything and the cost of everything drops and just like that, everything becomes affordable in the US again.

Sure, the insurance companies loved all of it. The more costs they cover the MOAR they can charge in the future.