You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Real Estate and foreclosure thread

- Thread starter BackwardsEngineer

- Start date

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Messages

- 551

- Reaction score

- 458

- Points

- 238

After I bought my last house, I looked for insurance, but the local dealer gave me a "F U GO AWAY" price.Fortune

Uninsurable homes are selling for all cash at a deep discount

There’s an incredibly risky two-pronged trend in the housing market. Insurance companies are refusing to cover properties because they’re located in severe weather zones or because the housing stock is old.

I know the insurance industry is always taking more than they are giving. They are parasites, sometimes they are closely clipping corners and not a bad deal, and sometimes they are trying to take your money for the minimum payout.

Here, it looks like the insurance companies may be following resale value, and their estimates may be actually based on reality. Who has an opinion on this?

- Messages

- 34,599

- Reaction score

- 5,858

- Points

- 288

- Messages

- 34,599

- Reaction score

- 5,858

- Points

- 288

Philadelphia’s office buildings have lost over $1 billion in assessed value

The assessed value of Center City office buildings fell by over $1 billion in recent years, the Office of Property Assessments (OPA) reported to City Council on Monday afternoon. That spells trouble for the City of Philadelphia’s tax revenue.The assessed value fell from $9.82 billion in tax year 2023 to $8.78 billion in tax year 2025, OPA stated, amid persistent office vacancies and recent transactions that have seen buildings selling for far below their previously assessed value.

“There are a lot of buildings in Center City that are considered to be distressed, and a number of buildings that are in bankruptcy,” said Councilmember Jeffery Young Jr., who called the hearing and represents much of the Center City office district. “Our tax base depends on Center City.”

Center City’s vacancy levels have been around 20% for over a year — more than double pre-pandemic rates — as many firms downsize their office space for the era of hybrid work.

That means lost taxes on food and beverage sales downtown as well as less wage tax paid by workers who live in the suburbs and a smaller service sector workforce. Real estate transfer tax dollars downtown have shriveled, too, as few buildings have changed hands since the pandemic and those that have commanded substantially smaller asking prices than they did when last sold.

More:

"There are a lot of buildings in Center City that are considered to be distressed, and a number of buildings that are in bankruptcy,”

“Our tax base depends on Center City.”

Looks like your screwed buddy.

“Our tax base depends on Center City.”

Looks like your screwed buddy.

- Messages

- 34,599

- Reaction score

- 5,858

- Points

- 288

Hurricane Helene changed Everything! (Insurance insolvency)

Oct 1, 2024There is so much going on with the damage in North Carolina, Tennessee, Georgia and Florida.

20:52

- My last condo video- 80% of Condos in Florida could be worthless! Part 1

- Check this video out!- Florida Drops bombshell on Condo Owners-

- Messages

- 34,599

- Reaction score

- 5,858

- Points

- 288

Florida MASSIVE INSURANCE FRAUD CONFIRMED!

Oct 3, 2024What I've been talking about on my channel for the last couple of years has now been confirmed to be happening without a doubt. Property tax fraud confirmed insurance fraud being committed by the insurance companies confirmed. A lot of people like to think that these things aren't really happening, but now we have proof of both. This is gonna have major implications on the future of the housing market.

22:01

- Messages

- 34,599

- Reaction score

- 5,858

- Points

- 288

It's Time For EVERYONE TO DECIDE WHAT YOU BELIEVE...

Oct 6, 2024The most recent jobs report has been the most suspicious one all year and it's timing couldn't be more suspicious with the election one month away. It's time for everyone to stand up and decide what they believe. Do you believe these phony government numbers that are constantly revised downwards in the coming months or do you believe what you see happening with real people and real businesses today? That's the real economy.

15:41

- Messages

- 34,599

- Reaction score

- 5,858

- Points

- 288

Politico opinion piece.

But the number of housing units in the nation has grown faster than the number of households since the turn of the century. Something else is happening here. It is not just a supply problem. And it is not just a demand problem caused by an increase in households, whether they are immigrants or not.

More:

Opinion | Undocumented Workers Aren’t Raising Home Prices. Undocumented Cash Is.

The nation’s housing affordability crisis has become so acute that even our presidential candidates are paying attention to it. Former President Donald Trump blames immigrants for driving up prices and vows he will reduce demand by banning mortgages for “illegal immigrants” and deporting them. For her part, Vice President Kamala Harris promises to increase supply by building 3 million new homes.But the number of housing units in the nation has grown faster than the number of households since the turn of the century. Something else is happening here. It is not just a supply problem. And it is not just a demand problem caused by an increase in households, whether they are immigrants or not.

More:

- Messages

- 34,599

- Reaction score

- 5,858

- Points

- 288

"I Lost My Job, Have No Savings And Can’t Pay The Mortgage"

Oct 21, 2024Losing a job while having a mortgage and no savings can be a terrifying experience. If you act carefully, you can make it through the other side without losing your house. However, if you don't take the right steps quickly, you could end up in a foreclosure situation.

14:22

Articles Mentioned in the Video

https://apple.news/AmeYcUiM7TV6Pxo3KP...

https://apple.news/AnckWxqNSTJmcbkern...

- Messages

- 34,599

- Reaction score

- 5,858

- Points

- 288

FWIW (dyodd)

These storms are the latest in a series of climate-driven disasters that have stretched insurance markets to the breaking point. As wildfires sweep through the West, hurricanes batter the Gulf and floods inundate inland areas, homeowners insurance markets are facing unprecedented disruption — and it’s only getting worse.

More:

An ‘Obamacare’ for homeowners insurance could protect against climate change

In the wake of the devastation caused by Hurricanes Milton and Helene, it has become painfully clear that the financial security of millions of Americans is under threat, not just from extreme weather, but from the crumbling homeowners insurance system.These storms are the latest in a series of climate-driven disasters that have stretched insurance markets to the breaking point. As wildfires sweep through the West, hurricanes batter the Gulf and floods inundate inland areas, homeowners insurance markets are facing unprecedented disruption — and it’s only getting worse.

More:

...

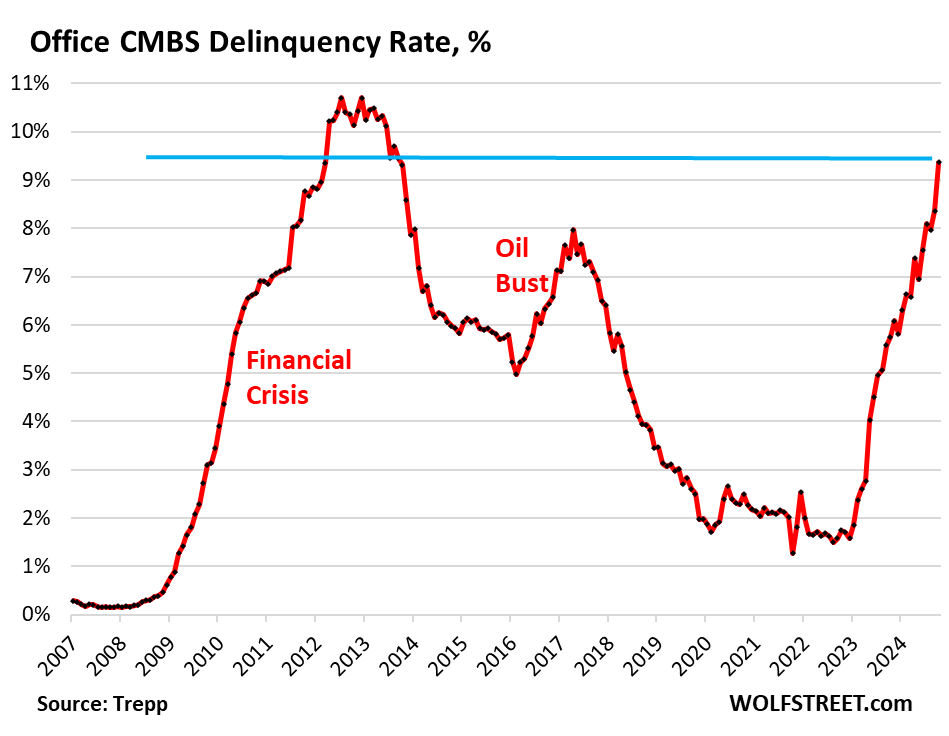

The delinquency rate of office mortgages backing commercial mortgage-backed securities (CMBS) spiked to 9.4% in October, up a full percentage point from September, and the highest since the worst months of the meltdown that followed the Financial Crisis. The delinquency rate has doubled since June 2023 (4.5%), according to data by Trepp, which tracks and analyzes CMBS.

Office CRE fund managers have spread the rumor that office CRE has bottomed out, but the CMBS delinquency rate doesn’t agree with this bottomed-out scenario; it’s aggressively spiking.

...

- Messages

- 34,599

- Reaction score

- 5,858

- Points

- 288

This Colorado man’s property tax tripled, despite his home being razed to the ground in a huge fire — and his appeal was denied without explanation

John Pellouchoud hasn’t had good luck with his 35-acre lot in Boulder County, Colorado. In 2013, floods ripped through Lefthand Canyon and swept him away. Somehow, the firefighter survived. Then, in 2017, when he was away helping a friend recover from a flood in California, a fire destroyed his home. Since then, he's battled both cancer and strokes.More:

- Messages

- 34,599

- Reaction score

- 5,858

- Points

- 288

Florida Home Prices FALLING BACK TO REALITY FAST!

Nov 14, 2024Florida starting to see some major year over year price declines in multiple markets and the markets that remain flat or slightly going up or seeing big spikes in inventory leading to a buyers market. You're also seeing a lot of people getting hit with higher HOA and condo fees across the country that are even starting to force people to sell their homes.

30:49

- Messages

- 34,599

- Reaction score

- 5,858

- Points

- 288

This change could collapse the Florida Real Estate Market!

Nov 15, 2024Here are my thoughts on the changes in the Florida Real Estate world after the hurricanes.

17:22

Check this video out- Hurricane Helene Changed Everything!

The $750 FEMA Failure! - FEMA is Insolvent! (Must Watch!)

- Messages

- 34,599

- Reaction score

- 5,858

- Points

- 288

How to be a Real Estate Agent in 2025!

Nov 15, 2024Here are my thoughts becoming a new Real Estate Agent in 2025.

17:59

My Real Estate Agent Profile!- https://www.adoorrealestate.com/jack-...

- Messages

- 34,599

- Reaction score

- 5,858

- Points

- 288

New York City Tenants Kiss Broker Fees Goodbye

The City Council approved the FARE (Fairness in Apartment Rentals) Act, which stops landlords from imposing broker fees on tenants.

www.realtor.com

www.realtor.com

- Messages

- 34,599

- Reaction score

- 5,858

- Points

- 288

Going downtown or to the ’burbs? Nope. The exurbs are where people are moving

Not long ago, Polk County’s biggest draw was citrus. The Florida county produces more boxes of citrus than any other in the state.

- Messages

- 34,599

- Reaction score

- 5,858

- Points

- 288

"I Inherited MILLIONS AND IT RUINED MY LIFE..."

Nov 15, 2024I've heard a lot of crazy things in this world, but never that inheriting millions of dollars will ruin your life. This is something that everybody wishes that happened to them on a daily basis instead, most people are stuck working until they're dead. Also, there's gonna be some massive government spending cuts coming once Trump becomes president again.

24:12

- Messages

- 34,599

- Reaction score

- 5,858

- Points

- 288

Vacant Home and Rental Tax COMING FOR ALL HOMEOWNERS!

Nov 18, 2024More more local governments are collecting fees to register properties as rental properties that of course are due yearly, as well as some places are charging egregious property tax increases for anyone who has a vacant home. Some places are even going as far as checking your utility bill usage to determine which homes are vacant to be sure everyone is paying the correct amount of tax!

19:23

You don't own your house, the government does.

True enough...You don't own your house, the government does.

- Messages

- 34,599

- Reaction score

- 5,858

- Points

- 288

If the Fed is cutting interest rates, why are mortgages and business loans costing more?

While the Federal Reserve has cut its short-term interest rate target by three-quarters of a percentage point since mid-September, 30-year fixed-rate home mortgage rates rose by almost as much during that period and have lately averaged around 6.8%, higher than they were when the Fed began...

- Messages

- 34,599

- Reaction score

- 5,858

- Points

- 288

Florida's Citizens Insurance NOW DENYING OVER HALF OF ALL CLAIMS!

Nov 21, 2024Florida has rose to the top of the most expensive state when it comes to Home insurance over the past couple of years. But as if that's not bad enough, our state run insurance company Citizens is now denying over half of all of the insurance claims that have come in over the past 12 months. Floridians were also the least likely to see an insurance payout in the year of 2022. How is any of this Legal and how is it sustainable for the housing market?

17:28

- Messages

- 34,599

- Reaction score

- 5,858

- Points

- 288

Locally.

They have not fixed it.

Four months after Philadelphia Sheriff Rochelle Bilal’s office pledged to take “corrective action” to resolve widespread delays in recording deeds after property auctions, the process remains broken. For some buyers, it’s gotten even worse.

More:

‘I feel like I’ve been robbed’: The sheriff’s office still has massive delays in processing deeds from auctions.

First, they said there was no problem. Then, they acknowledged there was a major problem, but promised to fix it.They have not fixed it.

Four months after Philadelphia Sheriff Rochelle Bilal’s office pledged to take “corrective action” to resolve widespread delays in recording deeds after property auctions, the process remains broken. For some buyers, it’s gotten even worse.

More:

- Messages

- 34,599

- Reaction score

- 5,858

- Points

- 288

Chicago woman loses home despite paying property taxes on time — sold for ‘delinquent taxes.’

Key Takeaways

- Robin McElroy, a Chicago homeowner, received a letter stating her home was sold for delinquent taxes despite having proof of consistent payments since 2012.

- The issue arose due to a mix-up involving her property identification number (PIN) being swapped with her next-door neighbor's PIN on the assessor's website, causing her tax payments to be misapplied.

- The error was flagged in 2019, but the correction was never made, leading to her home being sold at a tax auction, and McElroy is now fighting to reclaim her home.

- Homeowners are advised to keep detailed records of tax payments and correspondence and follow up on unresolved issues to avoid similar consequences.

- Messages

- 34,599

- Reaction score

- 5,858

- Points

- 288

When I tried buying (seemingly) perfect land in Alaska #alaskaliving

Nov 24, 2024One of the many things I was busy doing this summer was trying to buy some raw land up here in Alaska. It had a ton of potential, but ultimately….well I’ll let you watch the video to see how it turned out.

14:12

Channel: https://www.youtube.com/@alaska_realtor

- Messages

- 34,599

- Reaction score

- 5,858

- Points

- 288

Three Bay Area Real Estate Professionals Sentenced To Federal Prison For Their Roles In $55 Million Mortgage Fraud Conspiracy

SAN FRANCISCO – Tjoman Buditaslim, Jose De Jesus Martinez, and Jose Alfonso Tellez were sentenced today to 24 months, 14 months, and 12 months in prison, respectively, for their participation in a mortgage fraud conspiracy. The sentences were handed down by the Honorable Charles R. Breyer, Senior U.S. District Judge.Buditaslim, 52, of San Francisco, Martinez, 59, of Daly City, Tellez, 27, of San Jose, and a fourth defendant, Travis Holasek, 52, of San Francisco, were indicted in November 2023 on charges of conspiracy to commit wire fraud and wire fraud. All four defendants pleaded guilty to conspiracy to commit wire fraud.

More:

Three Bay Area Real Estate Professionals Sentenced To Federal Prison For Their Roles In $55 Million Mortgage Fraud Conspiracy

SAN FRANCISCO – Tjoman Buditaslim, Jose De Jesus Martinez, and Jose Alfonso Tellez were sentenced today to 24 months, 14 months, and 12 months in prison, respectively, for their participation in a mortgage fraud conspiracy. The sentences were handed down by the Honorable Charles R. Breyer...

- Messages

- 34,599

- Reaction score

- 5,858

- Points

- 288

2025: How To Buy A House WHEN YOU’RE FLAT BROKE!

Nov 28, 2024You can always count on the government to make it easier for people to borrow money who really can't afford to pay it back in tough times. That's what they do best now FHA is looking at doing exactly that to open up homeownership possibilities to more people. They think it's gonna be a good idea to allow up to 30% of someone's income to be coming from rental income from the home that they plan to buy which basically means they need to have a roommate to afford the house. How does this end well?

20:07

Articles Mentioned in the Video

- https://apple.news/ATVu4R0I4SR2Zkjn85...

- https://apple.news/AifjVaWczTbK_FLBtk...

- https://apple.news/A6qZ2rXAmSH25bagat...

- https://www.floridarealtors.org/news-...

- https://apple.news/ANN8aZjAKRj60YAzt8...

- https://www.bls.gov/cpi/

- Messages

- 34,599

- Reaction score

- 5,858

- Points

- 288

Real Estate Newsletter Articles this Week: National House Price Index Up 3.9% year-over-year in September

At the Calculated Risk Real Estate Newsletter this week: Click on graph for larger image. • Case-Shiller: National House Price Index Up ...

Those domino's fell over and gathered dust at this point, so I would have thought. They can hide things for much longer than I expected.

I've been waiting for this.

It's not for nothing that we used to call Florida, "God's Waiting Room" (late 1970s, when we all were dismissive of Florida as a place to live). There's really not much work there, apart from retail customer-service jobs, hospitality, and medical/elder care work.

So young people don't go there. Plus, of course, the landscape, the scenery, is boring. I mean, apart from Spring Break at the beach, it's boring.

It's the dying-off Boomers who're down there, and the dying-off Boomers are dying off a lot faster. That's thanks to the miracle of Pfizer and Moderna. Eventually, the shortened life-expectancies of those True-Believer, Circle-D voting, Face-Diaper-wearing Boomers, are gonna translate into a glut of housing.

It may also translate into a rapid political shift down there. Red Florida, Florida Man, may not be so red or so manly in the near future. We tend to forget, before DeSantis, there was Gubbernor Jebster Shrub - a beta in an alpha job, a true squish where a spine should be a job requirement.

I'm watching. When I can buy my cinder-block pillbox beach house on what I have saved, I'm down there. Probably not until.

I think its pretty clear that Desantis threw condo owners in Florida under the bus. Probably for some Hedge Fund buddies if I had to guess. There will be a lot of buildings that will be scooped up by Hedgies. No way in hell I own one of these now or anytime in the near future.

If I had to guess this is all part of the you'll own nothing crowd's way of starting to take the valuable land.

- Messages

- 34,599

- Reaction score

- 5,858

- Points

- 288

How Shopping Malls Are Being Transformed Into Apartments In The U.S.

Dec 5, 2024 #CNBCWhile many U.S. malls face anchor store closures and empty parking lots, some are finding new life by becoming housing. Real estate developers are building housing inside of or next to shopping malls as department stores like Macy’s, JCPenney and Sears shrink or cease to exist. At least 192 U.S. malls planned to add housing to their footprint as of January 2022. Dozens of apartment projects at malls are underway in California, Colorado, Florida, Arizona and Texas. The trend not only helps to chip away the housing shortage in the U.S., but also brings people closer to the remaining retail and restaurant spaces in shopping centers. CNBC visited a Macerich housing project at Flatiron Crossing Mall in Broomfield, Colorado as well as the Arcade Mall in Providence, Rhode Island to find out what it is like to live inside a mall.

9:13

Chapters:

0:00 Introduction

2:13: Chapter 1 - Living in a mall

4:45: Chapter 2 - The new anchor store: housing

6:59: Chapter 3 - Challenges

- Messages

- 551

- Reaction score

- 458

- Points

- 238

When I was a kid, the mall was pretty fun. It was maybe a half hour drive (?) and we went maybe once or twice a year. The bookstore was great, the toy store was fun (but certainly NOT Toys'R'Us), and ... Damn if I can remember anything else good. The food court was okay, it had variety. I think once or twice I got to ice skate in the rink.

When I was no longer a kid, I don't think I went anywhere but the book stores. The shops seemed to decay from uninteresting clothes and stupid knick-knacks to even stupider versions. The names were stupid. "Chess" and "Guess" were two that deserve a holy water burial. My name for these types was "Things Best Forgotten". That should have been on their sign.

I will admit that Sears was a solid draw. Their tools and sometimes other products often took me to a mall. Park by their entrance, walk in to Sears, buy, and then walk straight out to the parking lot.

A few times as an adult, I went to a mall specifically to go to the bookstore to buy software. Again, shortest path in and out.

As the video suggests, malls do have an incredible advantage in being a comfortable environment. But the claimed price of $200/ft is insane. And the mix of businesses "serving" the tenants does not make sense. Really, how valuable is it having a hair salon in walking distance? A store selling daily staples would be more sensible. Maybe they should examine the systems of residence and commerce in European cities? Or at least NYC?

When I was no longer a kid, I don't think I went anywhere but the book stores. The shops seemed to decay from uninteresting clothes and stupid knick-knacks to even stupider versions. The names were stupid. "Chess" and "Guess" were two that deserve a holy water burial. My name for these types was "Things Best Forgotten". That should have been on their sign.

I will admit that Sears was a solid draw. Their tools and sometimes other products often took me to a mall. Park by their entrance, walk in to Sears, buy, and then walk straight out to the parking lot.

A few times as an adult, I went to a mall specifically to go to the bookstore to buy software. Again, shortest path in and out.

As the video suggests, malls do have an incredible advantage in being a comfortable environment. But the claimed price of $200/ft is insane. And the mix of businesses "serving" the tenants does not make sense. Really, how valuable is it having a hair salon in walking distance? A store selling daily staples would be more sensible. Maybe they should examine the systems of residence and commerce in European cities? Or at least NYC?

- Messages

- 34,599

- Reaction score

- 5,858

- Points

- 288

Questioning the Housing Crisis: Introduction to a Series

In the aftermath of the COVID-19 pandemic, the United States experienced a much higher rate of inflation than at any time during the prior few decades. Like the prices of many goods and services, the cost of housing rose rapidly. The median home price, for instance, jumped from less than $350,000 to almost $450,000. (Figure 1.)So, it is unsurprising that potential homebuyers were—and still are—shocked and upset.

It is also not surprising that many politicians have latched on to this issue. For instance, during the 2024 presidential campaign, both Donald Trump and Kamala Harris offered their own proposals for quashing rising home prices, ranging from subsidies to selling federal land.

More: