The housing market is showing signs of ‘normalizing,’ according to a new report.

The latest monthly report by Realtor.com, which tracks the housing market as of December, said that the number of home listings were growing and were also spending more time on the market.

...

The active inventory number is in part increasing as more homes spend a longer time on the market.

According to Realtor.com, the typical home spent 67 days on the market, which is 11 days more than it did over the same period last year.

Homes that spent the longest time on the market were in Raleigh, Phoenix, and Las Vegas.

Prices have also begun to reflect the weakness in demand. According to Realtor.com, home price growth fell to single digits for the first time since December 2021.

In December 2022, the median list price in the U.S. was $400,000. That was only 8.4% more than last year.

Across the country, about 14% of active listings saw their prices slashed in December.

...

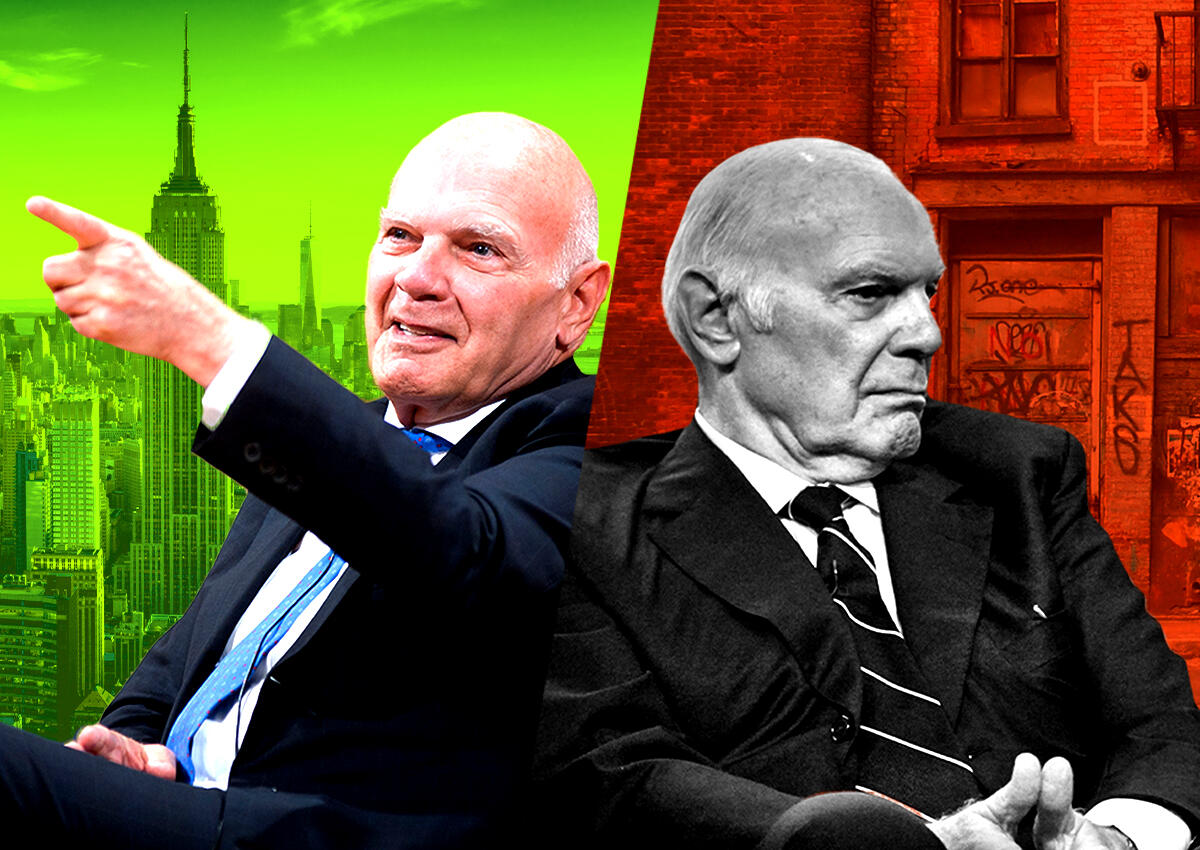

Good news for homebuyers: The housing market is showing signs of ‘normalizing'

A new report from Realtor.com says that the housing market is tipping in the buyers' court as listing price growth slows, and inventory grows.