Thought so.

Nobody understands what he says but everybody believes that what he says makes sense because if it does we are going to make money.

Apparently this Bob just did an interview on Youtube with Arcadia. He talks about this exactly about 18 mins into the video.

I listened only to the 18 min. mark. He talks about silver being shipped from London to NY in order to be delivered to the comex longs.

He phantasises about the silver arriving too late in NY.

First, this has nothing to do with EFP. Actually this is exactly what EFP is designed to avoid.

EFP is this: you are long at the comex, comes expiration day, you ask for delivery. Instead of giving you metal they give you a EFP note that allows you to get the metal in London.

Through EFP the comex doesn't deliver.

Through EFP there is no need to get metal shipped from London to NY.

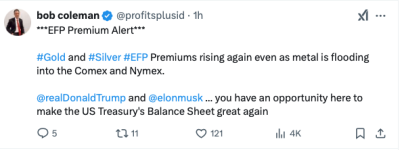

Based on what he says there is the theory that EFP premiums are high because silver needs to be shipped to NY.

There is no silver being shipped to NY.

There is no silver being shipped to NY precisely because of the EFP.

He gets people all excited when they hear him talking about EFP but at the end nobody knows what EFP is.

EFP premiums? There is no market, no exchange for EFP. It's a private transaction. You have your EFP note, you deal with some London's bullion bank manager.

None of his followers knows yet where to look at for those EFP premium rates he keeps talking about.

Furthermore, the idea itself of silver being shipped from London to NY so that the comex can deliver...

The comex doesn't deliver. The whole comex complex is designed in order to not deliver, to not be an exchange for physical gold and silver.

And even when it does, don't forget that the comex has warehouses all around the world, in the major trading hubs - Dubai, Singapore, London, HK etc.

You know Kinesis, so you know the Allocated Bullion Exchange. The ABX has warehouses in the 7 major trading hubs. So does the comex.

If the holder of comex futures asks for delivery and he wants the metal delivered in Africa, the metal gets delivered in Dubai, not in NY.

If the holder of comex futures is a company located in Asia, the metal will be delivered in Singapore or Hong Kong, not in NY.