- Messages

- 34,926

- Reaction score

- 5,940

- Points

- 288

Sal talks about predictions.

12:53

Big Bank Makes Bold Prediction For Silver & Makes Stunning Statement

Jun 7, 2024 #silver #gold #preciousmetals12:53

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

New Delhi: India's gold and silver imports from its free trade agreement (FTA) partner UAE have skyrocketed 210 per cent to USD 10.7 billion in 2023-24 and there is a need to potentially revise the concessional customs duty rates under the pact to mitigate the arbitrage driving this surge, a report said on Monday. ...

...

GTRI Founder Ajay Srivastava said the current import of gold and silver from the UAE is unsustainable as the UAE does not mine gold or silver or add sufficient value to imports.

...

Further, the report stated that silver imports from the UAE increased multifold to USD 1.74 billion in 2023-24 from a meagre USD 29.2 million in 2022-23 due to India charging an 8 per cent duty under the CEPA versus a 15 per cent duty from other countries.

"The large 7 per cent tariff arbitrage resulted in a loss of revenue for India of Rs 1,010 crore in FY24. Revenue loss will increase as India has committed to make tariffs zero on unlimited quantities of silver from the UAE within next 8 years," it added.

It said this trade is unusual because the UAE just imports large silver and gold bars, melt and convert these into silver grains and unwrought gold for exports.

...

On gold bars, the report said India agreed to import 200 metric tons of gold annually from the UAE with a 1 per cent tariff concession and due to this gold imports rose 147.6 per cent from USD 3 billion in FY23 to USD 7.6 billion in FY24, causing India to lose Rs 635 crore in revenue in FY24.

...

...

Imports of gold hit a three-month high of $3.33 billion in May, although this was 9.7% lower than the gold import bill a year ago. Gold imports had tripled year-on-year in April to $3.11 billion. The value of silver imports shot up by over 400% ...

...

His assertion is, there are several TONS of silver into each cruise missile ...

...

Thoughts? Likely? Pure BS? I have no way of validating this.

I hear ya. The amount grows with repetition.It's TONS now? Last I saw, the claim making the rounds of social media was 500 ounces. Of course, no one can produce any documentation or evidence to support the claim.

It was 100oz in the cruise missiles from the gulf war. The old block point missiles have likely had weight savings and electronics updates since then. So it’s likely less than 100oz per cruise missile now. Wouldn’t surprise me if they squeeze out half the content in the last 30 years of upgrades.It's TONS now? Last I saw, the claim making the rounds of social media was 500 ounces. Of course, no one can produce any documentation or evidence to support the claim.

What I know to be true though, is that the government is having to source silver on the open market so they do have an interest in buying silver as cheap as possible:

https://www.pmbug.com/threads/silver-demand-drivers.6364/post-101889

India's silver imports are on course to nearly double this year due to rising demand from solar panel and electronics makers, and as investors bet the metal will give better returns than gold, leading importers said on Friday.

Higher imports by the world's biggest silver consumer could give further support to global prices , which are close to their highest level in more than a decade. India imported 3,625 metric tons of the white metal last year.

This year's purchases could rise to between 6,500 and 7,000 tons due to the rising industrial demand, said Chirag Thakkar, CEO of Amrapali Group Gujarat, a leading silver importer.

India's silver imports in the first half of 2024 jumped to 4,554 tons from 560 tons a year ago, trade ministry data showed.

...

Silver prices rise above $31.00, fueled by robust Indian festive demand and a significant reduction in import duties from 15% to 6%.

India’s silver imports surged to $1.33 billion in August 2024, marking a sharp increase from $158 million during the same period in 2023.

...

I have a few things I have been thinking about that I will share.Yesterday silver -5%, is it a long or short term downturn?

Western silver has been following Shanghai's with a 10-12% discount for some time now, so the answer to that question lays in China.

imo

~33.42 currently in China. I expect that will rise if expectations of big stimulus efforts in China come true...

I could get it done in 2 years if I had the power.There is no way the debt will get paid down in any significant amoint in 4 years. They need to balance the budget first.

That can be dealt with pretty easily. Right now China bans the exports of precious metals. We can do the same in the west. In fact we should do that now. Why are we sending our wealth to the east? Makes no sense. They can buy our treasuries instead.@Cigarlover I agree on everything, but imo you are considering pm price as a function of US policy/economy. This is less and less the case. Brics are impacting more and more pm prices.

We who, CLWe have the entire north and south American continents

We have very limited natural resources - and even less the capacity of extracting and processing them. Importing natural resources from East is much cheaper and more efficient than from West.We need to build relationships with all of America and work out free trade deals with all of them to compete with China and the Brics nations.

@Cigarlover I agree on everything, but imo you are considering pm price as a function of US policy/economy. This is less and less the case. Brics are impacting more and more pm prices.

Wrong, they have one: The Dubai Gold & Commodities Exchange (“DGCX”).They don't have an Exchange, it's more like the London market.

The underlying asset of each DSSC contract, which has been Certified by prominent Shari’ah scholars, is a 999.9 purity 900-ounce silver bar of “UAE Good Delivery” specification. Delivery of the contract is made seamlessly through DMCC Tradeflow, a flexible and customised online platform to register possession and ownership of commodities stored in UAE-based facilities

So they import gold from London - at spot - and export it to India - at spot.Dubai's gold trade was boosted by India favoring them with lower import duties than anywhere else.

...

So they import gold from London - at spot - and export it to India - at spot.

How do they make money?

This or the spot price applies only to little players whereas serious ones trade it at a different rate (as confirmed by gold broker A. Maguire).I assume that there must be some arbitrage in the import duty (ie. spot + import duty from London < spot + export duty to India).

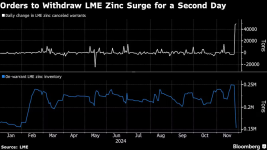

But nervousness about supply has grown in recent weeks, with data showing that a single entity bought more than half of the readily available stock in the LME’s warehousing network.

...

Commodities strategists at TD Securities wrote in their 2025 outlook that the strengthening economies of the United States and China in the second half of 2025 will stimulate demand and tighten the undersupplied silver market, with excess inventories getting absorbed over the coming year.

“The white metal may get squeezed, as recovering Asian demand absorbs recent inventory builds in the aftermath of the Chinese slowdown and the base metal concentrate processing capacity increases,” they wrote. “We project the metal to average $36/oz in the final months of next year, making it a commodity outperformer as the XAU/XAG ratio challenges yearly lows.”

The analysts added that “the #silversqueeze you can buy into was the most exciting trade across the entire commodities complex” in 2024, but they still see massive growth potential for the precious metal during the year to come.

“Make no mistake, silver's rally over the course of the last year has overwhelmingly been tied to gold's, but we note an explosive convexity in the set-up which points to a legitimate case for the erosion and eventual depletion of free-floating inventories on the horizon,” they said.

TD believes that the increased ETF buying activity that comes with a typical Fed cutting cycle “could dramatically shorten the time span to depletion” of existing silver inventories.

...

I would agree if inflation were under control and the fed could keep cutting but the government isn't going to slow spending and Trump wants an end to the debt ceiling. Thats inflationary and the fed cant possibly cut rates with rising inflation . Or can they?TD believes that the increased ETF buying activity that comes with a typical Fed cutting cycle “could dramatically shorten the time span to depletion” of existing silver inventories.