Lancers32

Often Wrong Never In Doubt

- Messages

- 1,837

- Reaction score

- 2,104

- Points

- 298

Joe Blow bearish don't make it a bottom.Most everyone except a few left here have already thrown in the towel. Along with the rest of the laundry basket some shoes and heck a hair dryer or two.

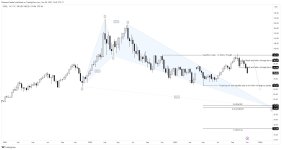

GDX looks like an inverse H&S playing out very slowly. I'd get concerned below $28 and really $27.50

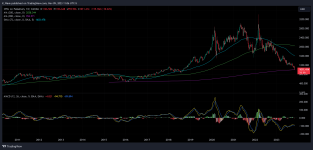

The Gold Price is Dropping!Notes From the Rabbit Hole

The gold price is taking a hit but importantly, crude oil is taking a harder hit Let us hear no ghost stories about Banksters attacking gold or as Larry would say inflicting a “take down̶…

nftrh.com

nftrh.com