You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Lunatic Fringe - Market and Trade Chat

- Thread starter TheRealZed

- Start date

-

- Tags

- markets

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Status

- Not open for further replies.

Not really, its been over a month again. Hope he just gets really nice long vacations.

IMO, both of those tweets are dumb. Advertisers definitely are sensitive to customer outrage these days. The Bud light fiasco "woke them up". Elon stepped in some shit and Jewish folk are rather sensitive on the issue.Remains to be seen...

If the Treasuries market goes tits up on Monday, my god it will be one hell of a ride.

www.ecb.europa.eu

www.ecb.europa.eu

What is TARGET2-Securities (T2S)?

The European Central Bank (ECB) is the central bank of the European Union countries which have adopted the euro. Our main task is to maintain price stability in the euro area and so preserve the purchasing power of the single currency.

ISO 20022 is a messaging standard. It's not some catastrophic market event. It has been discussed here:

https://www.pmbug.com/threads/fedno...aring-and-settlement-platform.4166/post-84824

https://www.pmbug.com/threads/fedno...aring-and-settlement-platform.4166/post-84824

T2S is just a trading platform. From @chieftain 's link:

This is supposed to stoke fear?... Currently 23 European countries use T2S. ...

jelly

Predaceous Stink Bug

- Messages

- 159

- Reaction score

- 265

- Points

- 188

I suspect Rick Rule was a draft dodger based on what little bits of his past that he's let out in his interviews. Though I can't confirm. And yes, All his public appearances are to make him money is some sort of fashion. Advertising what private placements he makes so people can drive the stock up. He woos us with his knowledge/experience and ends up playing us all.

Last edited:

- Messages

- 18,479

- Reaction score

- 11,124

- Points

- 288

Sounds a bit like a RICO case to me...IMO, both of those tweets are dumb. Advertisers definitely are sensitive to customer outrage these days. The Bud light fiasco "woke them up". Elon stepped in some shit and Jewish folk are rather sensitive on the issue.

Short the perps? Sounds like it could be 'profitable'...

It's gonna get interesting!

Just how massive was this mistake by MEDIA MATTERS and DAVID BROCK?

They tried the old playbook on somebody who knows all about how they've used this tactic to smear other companies.

Elon Musk and his tech staff were able to instantly suss out exactly how Media Matters invented their 'antisemitism' evidence'.

Understand: this civil litigation is not going to be 'he said, she said'.

Far from it.

Elon & his tech staff are going to have the logs, the documented records, the IP's, how the content was manipulated, the whole ten yards.

How fucking stupid was this?

They came onto Elon's servers, using Elon's app, where they were being watched by Elon's staff, and they tried to pull a fast one, then coordinate a massive exodus of advertisers from the platfrom based on the fraud.

Brock & MM are quickly going to try to settle. They can't have this case go to court. The digital forensic evidence X has is damning. They can't have it come out in a courtroom.

They're gonna come RUNNING to kiss Elon's feet and throw cash at him. Watch it happen.

No fear, just pointing out what they are.

Could he be saying that the 20022 system is where the news of the collapse will initially come from, with the collapse triggered on T2S?

There's a thread on that here:Nothing to see here.... (Dutch Central Bank tweet)

Gold stock (revaluation) can be used to rebuild if TSHTF (Dutch Central Bank)

I saw this posted at ZH. I didn't attach the same level of importance to it that ZH did, but I do find it curious. Someone at the DNB probably going to lose their job after letting this get published (emphasis is mine):... Shares, bonds and other securities are not without risk, and prices can...

Remains to be seen... interesting if true. ... ( "the U.S. Treasury bond market will collapse on Monday" tweet)

So, how's that working out?

- Messages

- 153

- Reaction score

- 266

- Points

- 198

Right. It's the same ol Sh:t. Always another date closing on the horizon when it all breaks loose...except that day doesn't come and it is business and beatdown as usual. This morning in London and New York was a perfect case in point. Dollar down and metals are still smashed. Probably holding it down for options expy. Despite all the banking f>ckery the price of gold is holding up remarkably well. That is because the fundamentals are all screaming the reality of gold over fiat despite the banking games being played. It won't really take off until most are looking the other way and no one is expecting it. You can bet that when the banks let go they will be sure find a way to profit from that as well. Stay tuned, stay sound.So, how's that working out?

- Messages

- 18,479

- Reaction score

- 11,124

- Points

- 288

Waiting for the close....So, how's that working out?

Cigarlover

Yellow Jacket

- Messages

- 1,715

- Reaction score

- 1,994

- Points

- 283

Ai got hammered this afternoon. Glad I sold my calls this morning that I bought last week. Up 55%. I got lucky on that one.

Viking

Yellow Jacket

Fellow Lunitics, I have a question about investing in PM mining.

In the past I tried individual stocks, and didn’t do too well. Actually did poorly.

But I’m thinking of jumping in again. Maybe funds instead of individual stocks.

Any recommendations? Sprott?

In the past I tried individual stocks, and didn’t do too well. Actually did poorly.

But I’m thinking of jumping in again. Maybe funds instead of individual stocks.

Any recommendations? Sprott?

Jodster

Fly on the Wall

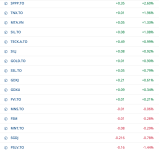

Not giving you any financial advice. This is simply one of my watchlists. DYODD.Fellow Lunitics, I have a question about investing in PM mining.

In the past I tried individual stocks, and didn’t do too well. Actually did poorly.

But I’m thinking of jumping in again. Maybe funds instead of individual stocks.

Any recommendations? Sprott?

Cigarlover

Yellow Jacket

- Messages

- 1,715

- Reaction score

- 1,994

- Points

- 283

So the CEO of Ai goes to Microsoft and 700 of Ai's employees threaten to leave if the entire board doesn't resign. Seems like there could be a good short play here.

Lancers32

Often Wrong Never In Doubt

- Messages

- 1,840

- Reaction score

- 2,109

- Points

- 298

Fellow Lunitics, I have a question about investing in PM mining.

In the past I tried individual stocks, and didn’t do too well. Actually did poorly.

But I’m thinking of jumping in again. Maybe funds instead of individual stocks.

Any recommendations? Sprott?

GDX and SILJ nothing fancy spread the losses around.

Cigarlover

Yellow Jacket

- Messages

- 1,715

- Reaction score

- 1,994

- Points

- 283

It might gap down if NVDA craps the bed. I tried an earnings trade put in an order to short the Friday $515-520 call spread.

Viking

Yellow Jacket

GDX down -0.52% YTD, but it says Category up 88.20% YTD?GDX and SILJ nothing fancy spread the losses around.Decent cross section of stocks.

Federal Reserve officials at their most recent meeting expressed little appetite for cutting interest rates anytime soon, particularly as inflation remains well above their goal, according to minutes released Tuesday.

The summary of the meeting, held Oct. 31-Nov. 1, showed that Federal Open Market Committee members still worry that inflation could be stubborn or move higher, and that more may need to be done.

...

Fed gave no indication of possible rate cuts at last meeting, minutes show

The Federal Reserve on Tuesday released minutes from its Oct. 31-Nov. 1 policy meeting.

Some folks on Wall Street might be starting to realize that talk of cuts in May next year might be hopium.

It's the fancy new fad to justify propping up the markets.

- Status

- Not open for further replies.