Lancers32

Often Wrong Never In Doubt

- Messages

- 1,835

- Reaction score

- 2,102

- Points

- 298

Some believe.

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

Wait it gets worse. Metals eventually catch a very large bid I think.Yeah - I have been trying to visualize a plausible scenario for what the next 6-12 months look like and I find I am viewing darker and darker scenarios as time goes by...

For instance - in Europe - how are they gonna function? They simply arent gonna have enough energy to run the factories and keep people from freezing...gonna have to choose one or the other. The obvious choice is to shut down the economy and print money to tide things over a bit. But - how do they make that work? Does the Euro implode? Is Germany willing to shoulder those debts with their industry in shambles? Will the Eurozone break up?

In the US - they are actively working to choke energy production. With the SPR being depleted - gas prices are gonna moonshot after November. That will definitely push the US into a deep, deep recession (depression). Not to mention the 78 million baby boomers retiring at a clip of 10K per day...each day for the next like 25 years. 31 trillion in debt - Social Security and Medicare facing deficits in the near future, a hollowed out industrial base, political division the likes of which I havent seen in my lifetime and a kinetic civil war that seems more and more likely as time goes by.

The food crisis is simply of gargantuan proportions and yet I see very little discussion about it in most circles. I mention it to people and they give me a blank stare. We are literally facing a reality of approx. 1/3 less food next year globally. Globally.

I have all but given up on the precious metals being a durable store of value. The simple truth is that they have not performed over the past several years. The older generation is the ones driving that market - and they arent buyers in sufficient quantity to overcome the machinations of the PTB. The younger generations have no affinity for PMs and prefer memestocks, cryptos, etc...

Everywhere I look I see the growing potential for system failure, with cascading ramifications that cross markets, borders - knocking out the underpinnings of our society.

Wish I had a rosier outlook - but alas - it is what it is...

Global Warming ain't ya heard?I live just south of the 40th parallel. It's been a very cool Fall. Last year it was a very mild Fall and Winter.

The 60th parallel goes through Europe. Based upon how cold it's been around here I think it's going to be really cold along that line this Winter.

I live just south of the 40th parallel. It's been a very cool Fall. Last year it was a very mild Fall and Winter.

The 60th parallel goes through Europe. Based upon how cold it's been around here I think it's going to be really cold along that line this Winter.

I live just south of the 40th parallel. It's been a very cool Fall. Last year it was a very mild Fall and Winter.

The 60th parallel goes through Europe. Based upon how cold it's been around here I think it's going to be really cold along that line this Winter.

Hedgeye seems to be taking regular pot shots @ Raoul Pal over his crypto enthusiasm. I remain wary about what to me had the hall marks of mania... I'm still hearing BTC = $1M calls, makes goldbugs seem sane with 80K calls! and me boring with my 8 to 10K expectation.

Maybe I need to try harder?

inoYou can see the zipper flap

Yeah the incompetence all around. Blow up half a pipeline and half a bridge. Mama said half a loaf is better than none. The Western leaders would rather see the people freeze and starve than buy from Russia. Maybe this will wake up those supporting the war but I doubt it.I missed this... 1/2 of NordStream 2 is a OK and they are ready to pump gas via it.

Did Uncle Sam, a.k.a. Wile E. Coyote, Blow Up the Wrong Pipeline?

And what's behind the unending parade of acts of self-destructive imperial hubris?www.unz.com

Surprised? They ban dead Russian authors. Major dissident at that. World gone bonkers for sure just check the Biden family picture by the copter I posted yesterday. We doomed.For phuck sake!

PayPal is preventing me from paying the kids tennis coach because he has a Russian surname!

Australian Citizen living about as far away from the shit fight as you can imagine and they seem to want to stop the guy making a living.

The world has gone completely f'ing bonkers.

Out.

Retail put buying is now higher than 2020, you really need to go look @ the data. In 2020 retail was already well over institutional use of puts and it has just grown since then. This chart is from the CBOE, you can see the retail level activity by the size of the trades, basically everything below 100 contracts is small retail activity. This chart only runs to 2021 but all reports I hear is that the sub 100 contract activity is higher today than then.

View attachment 735

Sure, more of an issue in individual names than index options but possible.

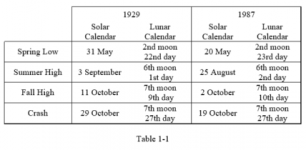

Yeah look, I can pick a part that video on some fundamental lay misunderstandings of the market but lets take it as read that these celestial cycles can exacerbate mood conditions here on terra-firma and feed into a crash. My life experience certainly supports the idea that there is some influence.

Frankly the guy opened up so many theoretical windows for a crash to occur that I got confused, he even contradicted his prior statements at one stage. @ one point it seemed to me that the window for the start closed @ around 3 days from the full moon 10/10 and that the crash low should be the 25/10. After that hes said a number of things that seemed to blur that a lot, at one point he opened up a window from last December to this December... but previously he had said that last June/July was not possible because of cycles?

So for the benefit or the readers here can you layout what you understood to be the windows dates for a crash to start and end given the lunar influence.

What are the dates?

PS> I'm also going to make a distinction here... the SPX has declined to the point that you are no longer looking @ what I call a crash. Crashes come rapidly out of highs so for me that is off the table. What you get from rapid accelations in price decline after long period of decline is capitulation into what typically is a final low. I think that on the SPX we are looking at a potential capitulation. I can see that a bad inflation number this week might trigger all the Fed pivot hold outs into a capitulation. Different dynamic to a crash totally but if you own puts who really cares eh?

spiralcalendar.com

spiralcalendar.com

OK lets make a fools call, just for fun!

Bad CPI, capitulation to around SPX 3250 ish, then an extended rally that confuses most and sucks in folks, then we sink in 23 @ some point as we realize the Eurozone is more screwed over a way longer period that the ADD crowd thought!

Feel free to pillory me as that prediciton falls apart... use Cramer memes for preference!

Well that would let a rather large cat out of the bag...