Nah, just put him in the insane leftist thread.I'm beginning to think we need a Cramer meme thread.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Lunatic Fringe - Market and Trade Chat

- Thread starter TheRealZed

- Start date

-

- Tags

- markets

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Status

- Not open for further replies.

The thing you have to keep in mind is that, as a network talent, a lot (maybe all) of the stuff he does is what his mgmt tells him to do. Not necessarily reflective of what the guy actually thinks. He's a good clown though.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

This is crap that comes from the efficient market theory's. So bad. Markets trade primarily on emotions and those are predictable and do occur in the same patterns.

Yeah, no it isn't. It has nothing at all to do with efficient market theory. A fully informed market can still incorrectly discount the future however a fully informed market is unlikely to be surprised to the extent that it crashes. This is why I'm expecting a grinding bear market as opposed to a crash.

I have never believed that markets are efficient just the closest thing to efficient that we have. If markets were efficient there would never be the opportunity to make big money and clearly there is opportunity to make big money.

So to reiterate there is less of a chance of a crash because a crash is being so widely anticipated at the moment. These conditions are more lightly to lead to market declines followed by sharp rallies followed by further declines in a bear market pattern. Historically this is more common than a crash. A crash requires a market surprise that a large portion of the market did not see coming.

My 2c

Last edited:

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

No kidding, I bought the options from a market maker...

A.) At that moment in time-sure. But this isn't a 3 sec scalp trade so we're good.

B.) Excellent, because it helps my trade (too bad I'm not running Archecos size book) and there would otherwise be no market

C.) The computer has no idea where we will be in a week or two

D.) Sure, I said this is a low probability trade and I don't buy far OTM options often. But that is the right move for this prediction

Stop just looking at math and do a little research. The math is for quant geeks who can't think. Oh, and I'm already up a few % points and about to be quite a bit more when the market opens.

I don't know why you were getting so emotional about this one. All I did was point out that retail accounts have been buying a very high level of puts. You seem to have a problem with that fact. I don't really understand why.

Overtime playing the probabilities wins. Sure you can make big bets every so often that come off but if you make a habit of it you are going to lose.

I will compare the amount of research that I do with you any day of the week!

Look you are clearly overly emotional about this trade and I hope it works out for you but let's just leave it there eh?

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

Correct me if I am wrong but isn't this basically Make America Great Again?

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

How can you grow up in the USA and completely misunderstand how markets work? This guys is either evil or stupid...

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

LOL!

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

Not that you'd know it!

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

This is probably the thing that makes me most nervous... no one believes it.

Lancers32

Often Wrong Never In Doubt

- Messages

- 1,839

- Reaction score

- 2,106

- Points

- 298

How can you grow up in the USA and completely misunderstand how markets work? This guys is either evil or stupid...

Both

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

What else are we supposed to do? Panic? Doesn't do any good.

I guess my point is that the lack of concern probably means the threat is realer than it has ever been.

Or is it just Joe, what if it where Obama?

- Messages

- 18,356

- Reaction score

- 11,046

- Points

- 288

People don't want to know.

I've attempted to educate folks about the jab.

They got it so they could travel. They're fine (so far?).

They don't want to know anything else.

As if I'm the crazy one for even looking into it.

They won't understand until reality hits.

Government can only push on a string for so long.

I think society, like the stock market need a good cleaning out.

I've attempted to educate folks about the jab.

They got it so they could travel. They're fine (so far?).

They don't want to know anything else.

"Why do you care about that?"

As if I'm the crazy one for even looking into it.

They won't understand until reality hits.

Government can only push on a string for so long.

I think society, like the stock market need a good cleaning out.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

I think a bit of it has to do with information overload in this modern age. I suspect most people have a limited ability to filter the information so they just rely on a narrow base of sources. If their media sources don't hype it they don't buy it.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

Apparently I woke up on the wrong planet a few years back...

I don't know why you were getting so emotional about this one. All I did was point out that retail accounts have been buying a very high level of puts. You seem to have a problem with that fact. I don't really understand why.

Overtime playing the probabilities wins. Sure you can make big bets every so often that come off but if you make a habit of it you are going to lose.

I will compare the amount of research that I do with you any day of the week!

Look you are clearly overly emotional about this trade and I hope it works out for you but let's just leave it there eh?

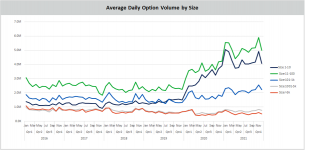

I'm not emotional about this... I don't really get very emotional. The underlying level of options trading in general has surged but this mostly background noise in that chart. So retail is still buying lots of puts and lots of calls. That sharp peak is not retail. It also occurred in 2020 and we saw what happened in 2020.

Buying tons of puts can also cause a gamma squeeze just like Call options. So a bunch of puts could also exacerbate a crash as market makers hedge the options that start running in the money. It is not solely a contrary indicator.

I gave the reason and 1.5 hour video of the research and reason here. I have a very specific date for a Crash bottom. I also went and dug out the book and reviewed a couple of the most relevant chapters.

Wazzup Zed - you Roo chaser...

Long time no hear...

Hope life is smiling on you and that you and your family are doing well...

Long time no hear...

Hope life is smiling on you and that you and your family are doing well...

- Messages

- 44

- Reaction score

- 72

- Points

- 68

I think a bit of it has to do with information overload in this modern age. I suspect most people have a limited ability to filter the information so they just rely on a narrow base of sources. If their media sources don't hype it they don't buy it.

People don't want to know.

I think both of you are on the scent. I suspect that many people have had a gut full, but feel at loss for what to do about it all, so they check out, at least to some degree, to stay sane. This is where I’m at with all. There isn’t much that Biden could or could not do, say or not say, support or not support, that would surprise me at this point. While Montana is Red across the board, as far as elected officials are concerned, there are plenty of liberal justices holding court and the swell of post-Covid Blue State refugees could very well change the political fabric of the State, so I don’t feel “safe” here, anymore, and I no longer have any faith in politics, even at the local level, to effectively carry the torch of Conservative values.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

I'm not emotional about this... I don't really get very emotional. The underlying level of options trading in general has surged but this mostly background noise in that chart. So retail is still buying lots of puts and lots of calls. That sharp peak is not retail. It also occurred in 2020 and we saw what happened in 2020.

Retail put buying is now higher than 2020, you really need to go look @ the data. In 2020 retail was already well over institutional use of puts and it has just grown since then. This chart is from the CBOE, you can see the retail level activity by the size of the trades, basically everything below 100 contracts is small retail activity. This chart only runs to 2021 but all reports I hear is that the sub 100 contract activity is higher today than then.

Buying tons of puts can also cause a gamma squeeze just like Call options. So a bunch of puts could also exacerbate a crash as market makers hedge the options that start running in the money. It is not solely a contrary indicator.

Sure, more of an issue in individual names than index options but possible.

I gave the reason and 1.5 hour video of the research and reason here. I have a very specific date for a Crash bottom. I also went and dug out the book and reviewed a couple of the most relevant chapters.

Yeah look, I can pick a part that video on some fundamental lay misunderstandings of the market but lets take it as read that these celestial cycles can exacerbate mood conditions here on terra-firma and feed into a crash. My life experience certainly supports the idea that there is some influence.

Frankly the guy opened up so many theoretical windows for a crash to occur that I got confused, he even contradicted his prior statements at one stage. @ one point it seemed to me that the window for the start closed @ around 3 days from the full moon 10/10 and that the crash low should be the 25/10. After that hes said a number of things that seemed to blur that a lot, at one point he opened up a window from last December to this December... but previously he had said that last June/July was not possible because of cycles?

So for the benefit or the readers here can you layout what you understood to be the windows dates for a crash to start and end given the lunar influence.

What are the dates?

PS> I'm also going to make a distinction here... the SPX has declined to the point that you are no longer looking @ what I call a crash. Crashes come rapidly out of highs so for me that is off the table. What you get from rapid accelations in price decline after long period of decline is capitulation into what typically is a final low. I think that on the SPX we are looking at a potential capitulation. I can see that a bad inflation number this week might trigger all the Fed pivot hold outs into a capitulation. Different dynamic to a crash totally but if you own puts who really cares eh?

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

Capitulation fodder for sure.... SPX 3241 in a rush would setup a low with divergent momentum. Maybe leading to the first sustained rally of what I think will be a longer bear. <-- totally JMO. See @Lancers32 old tag. Always confident but often wrong... or some such sentiment.

Last edited:

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

RE hitting the canvas...

Zed - any guesstimates of how markets are gonna deal with Europe freezing, Germany not able to manufacture, presumably a ramping up of sabotage in unpredictable fashion, food shortages run amok, etc...

Whats the 30K ft. view from down under?

Whats the 30K ft. view from down under?

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

Hearing 3200-3300 a lot on the chat boards.

There is an obvious line there that is @ a 61.8% retracement level. Looks like a monty... we will see.

Lancers32

Often Wrong Never In Doubt

- Messages

- 1,839

- Reaction score

- 2,106

- Points

- 298

RE hitting the canvas...

Saw that we must read some of the same folks over at Twitter. You would not believe the amount of building that is going on in my neck of the woods in North Carolina. Tech jobs and the like. Someone gonna be holding a pretty big bag though I think.

Lancers32

Often Wrong Never In Doubt

- Messages

- 1,839

- Reaction score

- 2,106

- Points

- 298

Close to the pre Covid highs too which they should undercut to get everyone really bearish.There is an obvious line there that is @ a 61.8% retracement level. Looks like a monty... we will see.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

You usually don't get 2 stock market crashes so close. Maybe never.

No, it would be a first.

I would also argue that we are past any possibility of a crash, whatever happens now is capitulation and is likely a mid term low. I'm guessing that this market will disappoint all comers in the end. That is a bears job after all.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

Zed - any guesstimates of how markets are gonna deal with Europe freezing, Germany not able to manufacture, presumably a ramping up of sabotage in unpredictable fashion, food shortages run amok, etc...

Whats the 30K ft. view from down under?

I think you are seeing that now... none of this is a surprise. So unless we get a shock it will be counterintuitive as markets look further forward. My guess is that they have not worked out that 23 will be worse so there may soon be relief rally's that last quite a bit until that reality sinks in.

Pure guesswork though!

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

OK lets make a fools call, just for fun!

Bad CPI, capitulation to around SPX 3250 ish, then an extended rally that confuses most and sucks in folks, then we sink in 23 @ some point as we realize the Eurozone is more screwed over a way longer period that the ADD crowd thought!

Feel free to pillory me as that prediciton falls apart... use Cramer memes for preference!

Bad CPI, capitulation to around SPX 3250 ish, then an extended rally that confuses most and sucks in folks, then we sink in 23 @ some point as we realize the Eurozone is more screwed over a way longer period that the ADD crowd thought!

Feel free to pillory me as that prediciton falls apart... use Cramer memes for preference!

Yeah - I have been trying to visualize a plausible scenario for what the next 6-12 months look like and I find I am viewing darker and darker scenarios as time goes by...I think you are seeing that now... none of this is a surprise. So unless we get a shock it will be counterintuitive as markets look further forward. My guess is that they have not worked out that 23 will be worse so there may soon be relief rally's that last quite a bit until that reality sinks in.

Pure guesswork though!

For instance - in Europe - how are they gonna function? They simply arent gonna have enough energy to run the factories and keep people from freezing...gonna have to choose one or the other. The obvious choice is to shut down the economy and print money to tide things over a bit. But - how do they make that work? Does the Euro implode? Is Germany willing to shoulder those debts with their industry in shambles? Will the Eurozone break up?

In the US - they are actively working to choke energy production. With the SPR being depleted - gas prices are gonna moonshot after November. That will definitely push the US into a deep, deep recession (depression). Not to mention the 78 million baby boomers retiring at a clip of 10K per day...each day for the next like 25 years. 31 trillion in debt - Social Security and Medicare facing deficits in the near future, a hollowed out industrial base, political division the likes of which I havent seen in my lifetime and a kinetic civil war that seems more and more likely as time goes by.

The food crisis is simply of gargantuan proportions and yet I see very little discussion about it in most circles. I mention it to people and they give me a blank stare. We are literally facing a reality of approx. 1/3 less food next year globally. Globally.

I have all but given up on the precious metals being a durable store of value. The simple truth is that they have not performed over the past several years. The older generation is the ones driving that market - and they arent buyers in sufficient quantity to overcome the machinations of the PTB. The younger generations have no affinity for PMs and prefer memestocks, cryptos, etc...

Everywhere I look I see the growing potential for system failure, with cascading ramifications that cross markets, borders - knocking out the underpinnings of our society.

Wish I had a rosier outlook - but alas - it is what it is...

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

I wouldn't venture a guess. Metals low a buyable one anyway for at least a BMR this week or maybe wait on that a little while longer?

Silver is a 1000hp drift car that is driven by an eight year old who is crunching 1st gear. If he hooks it up get the fug outta the way!

Last edited:

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

Watch this space...

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

Commodities rising...

- Messages

- 18,356

- Reaction score

- 11,046

- Points

- 288

I live just south of the 40th parallel. It's been a very cool Fall. Last year it was a very mild Fall and Winter.

The 60th parallel goes through Europe. Based upon how cold it's been around here I think it's going to be really cold along that line this Winter.

The 60th parallel goes through Europe. Based upon how cold it's been around here I think it's going to be really cold along that line this Winter.

- Status

- Not open for further replies.