You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Lunatic Fringe - Market and Trade Chat

- Thread starter TheRealZed

- Start date

-

- Tags

- markets

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Status

- Not open for further replies.

- Messages

- 947

- Reaction score

- 1,348

- Points

- 278

How Not to Play the Game

Magic beans, Bahamian penthouses, old-fashioned fraud and other important SBF-inspired insights. A postscript to Bloomberg Businessweek’sThe Crypto Story.

On Oct. 25, Bloomberg Businessweek published “The Crypto Story,” a cover-to-cover issue of the magazine that I wrote about what crypto is and what it all might mean. Over the summer prices had crashed and several prominent crypto companies had failed, and it looked like the popular enthusiasm for crypto was finally fading. People called it a “crypto winter.” Still, I wrote, “it’s a good time to be talking about crypto. There’s a pause; there’s some repose.”

That was true for, like, an afternoon? Just two weeks later, in early November, FTX—one of the biggest and most prominent crypto exchanges—imploded. By Nov. 11 it was bankrupt. Its founder Sam Bankman-Fried and other executives were soon charged with fraud.

The crypto winter got colder and darker. FTX and Bankman-Fried—“SBF,” everyone in crypto called him—had been important to the crypto industry. FTX had positioned itself as a well-run exchange that wanted to work with regulators; SBF often spoke to regulators and to Congress about how crypto should be regulated, and they tended to listen to him. When crypto companies failed over the summer, SBF often ended up bailing them out, shoring up confidence in crypto. That confidence is now doubly betrayed.

Possibly another good time to reflect? So, here, I will. Consider this a postscript to “The Crypto Story.”

Remainder of article here:

https://www.bloomberg.com/features/2022-the-crypto-story-FTX-collapse-matt-levine/?utm_source=pocket-newtab&leadSource=uverify wall

- Messages

- 947

- Reaction score

- 1,348

- Points

- 278

Remote Work Is Poised to Devastate America’s Cities

In order to survive, cities must let developers convert office buildings into housing.

The “work from home” revolution has been very good for political columnists who like to write shirtless in pajama pants and share too much personal information with their readers. But the phenomenon hasn’t been so great for America’s cities.

The nation’s office buildings aren’t as empty as they were before COVID vaccines became widely available in spring 2021. But they’re still far less populated than they were in 2019. A recent analysis of Census Bureau data from the financial site Lending Tree found that 29 percent of Americans were working from home in October 2022. In New York City, financial firms reported that only 56 percent of their employees were in the office on a typical day in September.

Full-time remote work has grown less prevalent since the worst days of the pandemic. But flexible work arrangements — in which employees report to the office a couple times a week — are proving stickier. A recent paper from the National Bureau of Economic Research estimated that 30 percent of all full-time workdays would be performed remotely by the end of 2022.

Remainder of article here:

https://nymag.com/intelligencer/202...americas-cities.html?utm_source=pocket-newtab

- Messages

- 383

- Reaction score

- 852

- Points

- 268

This post may contain affiliate links for which PM Bug gold and silver discussion forum may be compensated.

- Messages

- 947

- Reaction score

- 1,348

- Points

- 278

Federal Reserve, top bank regulators flag 'significant' worries over crypto assets

The Federal Reserve, FDIC, and the Office of the Comptroller of the Currency (OCC) issued a joint statement on Tuesday warning about "significant" risks crypto assets may pose to the broader banking system.“It is important that risks related to the crypto-asset sector that cannot be mitigated or controlled do not migrate to the banking system,” the agencies said in a joint statement.

Remainder of article at link:

https://finance.yahoo.com/news/fede...ant-worries-over-crypto-assets-202435516.html

Federal Reserve, top bank regulators flag 'significant' worries over crypto assets

The Federal Reserve, FDIC, and the Office of the Comptroller of the Currency (OCC) issued a joint statement on Tuesday warning about "significant" risks crypto assets may pose to the broader banking system.

“It is important that risks related to the crypto-asset sector that cannot be mitigated or controlled do not migrate to the banking system,” the agencies said in a joint statement.

Remainder of article at link:

https://finance.yahoo.com/news/fede...ant-worries-over-crypto-assets-202435516.html

Meanwhile, people with a brain cell or two have flagged those entities "assets".

...

One gauge of anxiety in the marketplace was seen Tuesday, when gold prices posted solid gains despite a strong rally in the U.S. dollar index. In past months the USDX and gold prices have traded in a strong inverse relationship on a daily basis. The rally in the gold market this week comes amid the shaky global stocks markets and worries about rising Covid infections in China continuing to crimp the world’s second-largest economy.

...

Technically, the gold futures bulls have the solid overall near-term technical advantage. Prices are in a two-month-old uptrend on the daily bar chart. Bulls’ next upside price objective is to produce a close in February futures above solid resistance at $1,900.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $1,775.00. First resistance is seen at today’s high of $1,871.30 and then at $1,900.00. First support is seen at $1,850.00 and then at the overnight low of $1,842.00. ...

The silver bulls have the solid overall near-term technical advantage. A choppy, four-month-old uptrend is in place on the daily bar chart. Silver bulls' next upside price objective is closing March futures prices above solid technical resistance at $25.00. The next downside price objective for the bears is closing prices below solid support at $23.00. First resistance is seen at this week’s high of $24.775 and then at $25.00. Next support is seen at this week’s low of $24.095 and then at $24.00. ...

Gold price rallies to 6-mo. high on safe-haven buying

Senior Technical Analyst Jim Wyckoff prepares investors with an overview of how the markets opened and closed. What moved metal prices? How do the technicals look? By looking at important developments

www.kitco.com

- Messages

- 15,718

- Reaction score

- 10,058

- Points

- 288

They meant to say "We don't want any competition and we'll fight it tooth n nail to keep control..."The Federal Reserve, FDIC, and the Office of the Comptroller of the Currency (OCC) issued a joint statement on Tuesday warning about "significant" risks crypto assets may pose to the broader banking system.

Cigarlover

Yellow Jacket

- Messages

- 1,412

- Reaction score

- 1,624

- Points

- 283

BABA been having a nice run last couple days. Bought yesterday, sold today for a 10% gain. Good start to the year.

Oldmansmith

Fly on the Wall

- Messages

- 50

- Reaction score

- 170

- Points

- 103

Just did a job for a computer guy, we were chatting and he said “don’t invest in Bitcoin.” He said that the supposed advantage of it was anonymity, and that it was no longer anonymous and could be easily tracked. Not that most here are big crypto investors but I thought that was interesting.

Cigarlover

Yellow Jacket

- Messages

- 1,412

- Reaction score

- 1,624

- Points

- 283

Gapped up twice so just figured I would take the profit and wait and see if those gaps get filled. I expect some profit taking at some point soon and that should be a good point for a re entry. Or, the gaps never fill and this just runs. LOL.

Miners looked good today. Even some action in the Jr's.

- Messages

- 383

- Reaction score

- 852

- Points

- 268

It has been a couple of not very good years for the Weekend Trend Trader system.

I did not start running it at the beginning of 2020 but sometime in 2020. Also, I had a coding error for most of 2020 where I was not running the exact algorithm correctly. I still did OK, about 24% in 2020. However, if coded correctly and running from 1/1/2020 the WTT system would have racked up about 75%.

It's hard to trade through the bad times, but so far I keep taking the trades. Here's why:

Below is my backtesting equity curve had I started 1/1/2020 with 100K portfolio and traded straight through until today.

In this backtest we started with $100,000 and currently would be sitting at $209,753. Even with 2 bad years, the Annualized return would have been 27.95%.

[2020 was an extreme outlier and we should not expect it to be repeated in my lifetime. That was as good as it gets.]

I did not start running it at the beginning of 2020 but sometime in 2020. Also, I had a coding error for most of 2020 where I was not running the exact algorithm correctly. I still did OK, about 24% in 2020. However, if coded correctly and running from 1/1/2020 the WTT system would have racked up about 75%.

It's hard to trade through the bad times, but so far I keep taking the trades. Here's why:

Below is my backtesting equity curve had I started 1/1/2020 with 100K portfolio and traded straight through until today.

In this backtest we started with $100,000 and currently would be sitting at $209,753. Even with 2 bad years, the Annualized return would have been 27.95%.

[2020 was an extreme outlier and we should not expect it to be repeated in my lifetime. That was as good as it gets.]

Last edited:

- Messages

- 383

- Reaction score

- 852

- Points

- 268

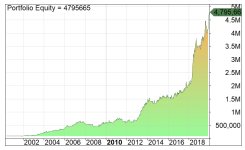

Here's a longer-term backtest of this system starting 1/1/2000 and ending 12/31/2019 which is a total of 20 years.

Again we start the backtest with a portfolio value of $100,000. Notice that we've excluded the Unicorn year of 2020. Also, notice that we have traded right through the DotCom bubble collapse and the Global Financial Crisis.

Ending balance is $4.79 million.

I admit this scenario is a little far fetched and we'd actually start having some lack of liquidity issues buying great quantities of small cap stocks.

So it is for speculative educational purposes only. [But this is what WTT system does.]

Again we start the backtest with a portfolio value of $100,000. Notice that we've excluded the Unicorn year of 2020. Also, notice that we have traded right through the DotCom bubble collapse and the Global Financial Crisis.

Ending balance is $4.79 million.

I admit this scenario is a little far fetched and we'd actually start having some lack of liquidity issues buying great quantities of small cap stocks.

So it is for speculative educational purposes only. [But this is what WTT system does.]

Curtman

Fly on the Wall

- Messages

- 27

- Reaction score

- 26

- Points

- 58

Oh this is where I belong. Should be interesting to see how all the big Corporation layoffs are going to affect the matter. That many more people on unemployment and possibly losing their second or third home putting pressure on an already stressed out housing market. Not to mention all the small debt they have.

Viking

Yellow Jacket

*or data from 2020, 2019…

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

The miners both GDX and GDXJ are breaking above their recent highs as well. Looking good to me. Nice solid move above $30. Need to finish strong today.

View attachment 5463

$33.30 then a pause... mebe 32.70.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

I admit this scenario is a little far fetched and we'd actually start having some lack of liquidity issues buying great quantities of small cap stocks.

Yes... scale brings its own issues. Small traders often over look that concept. IMO it is a part of the challenge that gold and silver have relative to the trillions floating around the system.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

I did not start running it at the beginning of 2020 but sometime in 2020. Also, I had a coding error for most of 2020 where I was not running the exact algorithm correctly. I still did OK, about 24% in 2020. However, if coded correctly and running from 1/1/2020 the WTT system would have racked up about 75%.

What platform are you using?

- Messages

- 383

- Reaction score

- 852

- Points

- 268

If I were to find myself in the position where volume was an issue, I would consider running the same system but against different universes of stocks, like S&P 500 Large Caps, Mid Caps, Small Caps, etc. Run the same system separately for different universes. Like I should have such a problem.Yes... scale brings its own issues. Small traders often over look that concept. IMO it is a part of the challenge that gold and silver have relative to the trillions floating around the system.

- Messages

- 383

- Reaction score

- 852

- Points

- 268

Amibroker out of Australia. This is the same system that Nick Radge uses. He likes it because one can perform whole portfolio backtesting. I read his WTT booklet and interpreted it and coded it. As stated I had a flaw at first, but did discover it and fix it.What platform are you using?

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

Like I should have such a problem.

Down here we have miners that trade for 0.10's of a cent... you can play god with all the issues that god has. It goes to some noobs heads... but when the volume dries up, as it is want to do, SPLAT! Bug into a windscreen. However in theory some of the profits are huge! In theory...

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

Amibroker out of Australia. This is the same system that Nick Radge uses. He likes it because one can perform whole portfolio backtesting. I read his WTT booklet and interpreted it and coded it. As stated I had a flaw at first, but did discover it and fix it.

OK yup, I have that somewhere here... they've been going a long while now!

Now I member you mentioning that in the past... auldtimers etc...

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

Run the same system separately for different universes

Yes... you should be able to get to quite some size that way. Enough for most mortals anyway!

% returns should decline as you move up, but the $ return should be satisfying enough. LOL.

Curtman

Fly on the Wall

- Messages

- 27

- Reaction score

- 26

- Points

- 58

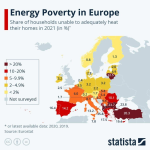

This is a crime against humanity

How so? Who is responsible? What remedy do you propose?This is a crime against humanity

Lancers32

Often Wrong Never In Doubt

- Messages

- 1,835

- Reaction score

- 2,102

- Points

- 298

The US and the War Machine is responsible. Nothing wrong with blowing up a pipeline or two then selling your supposed allies nat gas at thrice the price. Leaders of Europe need to burn in Hell along with those responsible here and there.How so? Who is responsible? What remedy do you propose?

The US and the War Machine is responsible. Nothing wrong with blowing up a pipeline or two then selling your supposed allies nat gas at thrice the price. Leaders of Europe need to burn in Hell along with those responsible here and there.

When did any of that happen in 2020 or 2021? Nordstream explosion was September 2022. Russia invaded Ukraine in February 2022. The graphic posted was for 2021.

There are always going to be poor folks living below the poverty line and unable to afford things. Are you folks thinking governments are responsible to ensure no one going without electricity? That's a very socialistic/communistic sentiment for a community that loves to use "communists" as an epithet.

China, the world’s second-largest economy behind the U.S., is set to reopen in just a few days and one major Wall Street firm has boiled down the likely impact on financial markets.

...

“.... China/EM [emerging-market] equities, copper, and commodity-linked FX still broadly appear to be the biggest beneficiaries,” they wrote. “The shifting correlation patterns from a response to China reopening—potentially higher DM [developed-market] yields alongside a weaker USD [U.S. dollar], potential for a stronger JPY [yen] alongside stronger Japanese equities—offer ways of exploring additional leverage.”

...

What China's reopening means for markets, according to Goldman Sachs

China's economy is set to reopen in a few days and one major Wall Street firm has boiled down the likely impact on financial markets.

...

Gold began to show signs of a bullish pattern in the fourth quarter of 2022 on expectations of a pivot by the Federal Reserve.

The next target that gold needs to breach is around $1,896.50, which is the 61.8% retracement of the losses since last March's peak near $2,070, Bannockburn Global Forex managing director Marc Chandler told Kitco News.

"I am not convinced it makes it up there as momentum indicators are getting stretched, and I think the risk is greater than the around 1-in-3 chance that the Fed funds futures are pricing in of a 50 bp hike at the FOMC meeting that concludes on Feb 1," Chandler stated. "That said, as long as the yellow metal holds above the $1,825-$1,830 area, the upside looks favored."

After Friday's data, markets started to price in a 74.2% chance of a 25-basis-point rate hike in February, according to the CME's FedWatch Tool.

Gold has been anticipating and pricing in a slowdown in rate hikes by the Fed, but the ETF investors still need some convincing before the rally can really kick off, said Commerzbank analyst Barbara Lambrecht.

"Its upswing is presumably due primarily to more optimism among speculative financial investors, who are generally more fickle," Lambrecht wrote Friday. "However, any lasting recovery of prices on the gold market will require, above all, a shift in sentiment among ETF investors, who are still exercising caution. They appear to be waiting for the U.S. rate hike cycle to come to an end. In the short term, we envisage, if anything, a risk of setbacks on the gold market."

...

Lancers32

Often Wrong Never In Doubt

- Messages

- 1,835

- Reaction score

- 2,102

- Points

- 298

Ok but instead of funding a war machine when a country is not at any risk of being invaded how about we help out people instead. You need money to fend off cyber attacks fine but when you start wasting money on equipment that for the most part doesn't even work I would say it is more important someone's pockets get lined than doing the right thing. Now we have socialism in this country for the rich.When did any of that happen in 2020 or 2021? Nordstream explosion was September 2022. Russia invaded Ukraine in February 2022. The graphic posted was for 2021.

There are always going to be poor folks living below the poverty line and unable to afford things. Are you folks thinking governments are responsible to ensure no one going without electricity? That's a very socialistic/communistic sentiment for a community that loves to use "communists" as an epithet.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

Wow... Interesting... it COULD also line up with Marty A's idea that peak authoritarianism comes in 2028.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

How so? Who is responsible? What remedy do you propose?

1. Bad, sort sighted policy.

2. In general, government.

3. Free the market up.

Are you folks thinking governments are responsible to ensure no one going without electricity?

No... but when they create a problem that would not otherwise exist, then they are totally responsible. You do remember them laughing @ Trump when he laid out their obvious energy vulnerability? You do recall the Germans pursuing a policy to shut down bought and paid for Nuclear capacity? Historically governments globally have been responsible for the death of a far greater number of their own citizens than any external aggressor ever has.

I know that graphic is old but the current energy situation in Europe's was a totally predictable cluster F driven by borderline insane policy. The government will have blood on its hands for this one. Typically they used to consume 1/2 the energy per capita as the USA and pay between 2 and 3 times what you guys pay for it. Now that is in the 6 times region, budget breaking for normal folk let alone marginal folk and totally unacceptable. It would not occur without government miss management.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

ChatGPT's response to the question..

There are several criticisms that have been leveled at European energy policy:

There are several criticisms that have been leveled at European energy policy:

- Lack of coordination: Many critics argue that European energy policy is disjointed and lacks coordination between different countries. This can lead to inefficiencies and a failure to optimize the use of resources.

- Dependence on imports: Europe is heavily dependent on imported energy, particularly natural gas and oil. This makes the continent vulnerable to price fluctuations and supply disruptions.

- Limited domestic production: Europe has relatively limited domestic production of fossil fuels, which means that it is more reliant on imports.

- High costs: Some critics argue that European energy policy has led to higher energy prices for consumers.

- Inflexibility: Some argue that European energy policy is too inflexible and does not allow for sufficient market competition.

- Slow progress on renewables: While Europe has made significant progress in increasing the use of renewable energy, some critics argue that progress has been slow and that more needs to be done to promote the use of clean energy sources.

- Lack of focus on energy efficiency: Some argue that European energy policy has not paid enough attention to improving energy efficiency, which could help to reduce energy demand and lower costs.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

Quote..

Assuming that doubling the cost will not have an exponential impact on the numbers (it probably will) you are looking @ a minimum of 16% of the population this year given the, at minimum, doubling of cost recently.

...and that has to be a very optimistic guess.

Even in the relatively prosperous EU, “energy poverty” is widespread. Around 35 million people, or 8% of the EU population, were unable to keep their homes adequately warm in 2020, according to Eurostat. 20 Dec 2022

Assuming that doubling the cost will not have an exponential impact on the numbers (it probably will) you are looking @ a minimum of 16% of the population this year given the, at minimum, doubling of cost recently.

...and that has to be a very optimistic guess.

Last edited:

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

- Status

- Not open for further replies.