- Messages

- 23,804

- Reaction score

- 4,364

- Points

- 288

Roku has $487 million of cash and cash equivalents in uninsured deposits at failed Silicon Valley Bank, the streaming media company said in an filing on Friday with the Securities and Exchange Commission.

About 26% of Roku’s $1.9 billion in cash was deposited with SVB, which was placed into receivership by the Federal Deposit Insurance Corp. midday Friday.

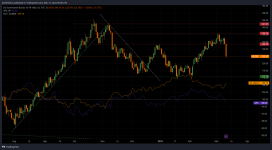

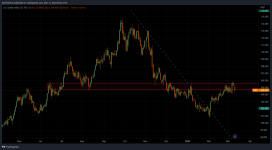

Roku shares fell over 4% in extended trading on the news.

www.cnbc.com

www.cnbc.com

About 26% of Roku’s $1.9 billion in cash was deposited with SVB, which was placed into receivership by the Federal Deposit Insurance Corp. midday Friday.

Roku shares fell over 4% in extended trading on the news.

Roku says 26% of its cash reserves are stuck in Silicon Valley Bank

Around $487 million of Roku's cash reserves are stuck at Silicon Valley Bank, the streaming media company said Friday.