Trading in shares of First Republic Bank and Western Alliance Bancorp. was paused after steep initial losses on Monday as bank solvency fears persisted following the failures of Silicon Valley Bank and Silvergate last week.

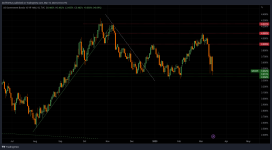

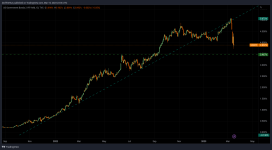

First Republic Bank’s FRC, -75.11% stock initially dropped 74% in morning trades after big losses late last week. The stock was paused for trading as of 10:21 Eastern time.

Western Alliance Bancorp’s WAL, -74.38% stock fell 83% after it resumed trades.

Regions Financial Corp. RF, -8.93% dropped 9.4%, Comerica Inc. CMA, -29.80% moved down by 46% and PacWest Bancorp PACW, -42.43% dove by 57%.

Customers Bancorp Inc. CUBI, -49.56% dropped by 67% and was paused for trading, while Metropolitan Bank Holding Corp. MCB, -48.71% fell 68% and was also paused. KeyCorp. KEY, -27.57% shed 38%.

...