You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

US Debt is unsustainable

- Thread starter pmbug

- Start date

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Messages

- 24,182

- Reaction score

- 4,438

- Points

- 288

Gold, Debt, and the Coming Financial Storm

As the global economy edges closer to a potential financial crisis, Weldon’s key takeaway is clear: gold is not just an asset—it is a necessity.

- Messages

- 24,182

- Reaction score

- 4,438

- Points

- 288

Government Spending Is Out of Control! LOL - The Big Picture

Calculation: BEA Table 3.1 Line 20 (Current Expenditures) divided by Table 1.1.5 Line 1 (GDP). Alternatively, Item #2 below divided by GDP. “If you torture data long enough, it will confess to anything.” –Ronald Coase Hey, it’s @TBPInvictus. Let’s delve into a case in point of Coase’s...

- Messages

- 15,790

- Reaction score

- 10,094

- Points

- 288

Martin Armstrong: The Fed Can't Stop Inflation

Tom welcomes back Martin Armstrong from Armstrong Economics for a discussion on the never ending news cycle. Martin begins by reflecting on the current political landscape, comparing it to the challenges faced during the first Trump administration. Armstrong highlights how President Trump has learned from past mistakes, particularly in assembling a cabinet that is not tied to the "deep state." This shift, Armstrong argues, is crucial for enacting meaningful reforms.The conversation then turns to government waste and corruption, with Armstrong referencing specific examples of misallocated funds, such as support for a transgender opera in Columbia. He emphasizes the importance of transparency and accountability, especially given the staggering levels of debt that governments worldwide are accumulating. Armstrong warns that the current system is unsustainable and that a reckoning is inevitable when buyers for new debt no longer exist.

Armstrong also delves into the global reserve currency status of the US dollar, explaining how its dominance emerged post-World War II. He discusses the manipulation of economic indicators, such as CPI adjustments, to hide the true state of fiscal health. Armstrong's firm has successfully forecasted economic trends and events, including Brexit, by focusing on raw data rather than political narratives.

The interview then shifts to geopolitical tensions, particularly the conflict in Ukraine. Armstrong critiques the handling of the crisis, arguing that it is being used as a diversion from deeper economic problems. He suggests that the war serves the interests of certain European leaders who seek to weaken Russia and strengthen their own power. Armstrong also touches on the potential consequences of tariffs and trade policies under Trump, warning against the risks of contagion in global markets.

Finally, Armstrong offers advice to listeners, urging them to pay attention to developments in Europe and the flow of capital during times of conflict. He emphasizes the importance of understanding global economic trends and avoiding the pitfalls of mainstream media narratives.

Time Stamp References:

0:00 - Introduction

0:34 - Trump & News Cycle

3:18 - Government Waste

7:52 - Leadership & Information

12:12 - Trump & Mkt. Optimism?

18:30 - Resource Deals & Peace

23:10 - Europe Preps for War

30:43 - Capital Flight & War

35:08 - European Basket Case

36:34 - U.S. 'Monetization'

42:53 - Creation of the Fed

47:00 - Fed Can't Stop Inflation

49:12 - A Global Perspective

53:05 - Trump & Tariff Impacts

57:50 - Canada - U.S. Takeover?

1:01:43 - Epstein Honey Trap

1:09:37 - Watch Europe & Ukraine

1:13:20 - Wrap Up

74

The Fed can certainly stop inflation.

By stopping the expansion of the money supply.

What the Fed CANNOT do, is make the hard choices that would lead to stopping the expansion of the money supply. Probably the Fed chairman would be removed before he could implement a course of action.

So the Fed chair cannot do it; but that is not the same as the Federal Reserve being unable to do it.

We just have a phalanx of corrupt, weak, craven Elites who hate the nation that has so elevated them, that they'd rather destroy it, pushing the lower classes into the mire first, than cut back on their own growing wealth in returning to responsible monetary and economic policies.

By stopping the expansion of the money supply.

What the Fed CANNOT do, is make the hard choices that would lead to stopping the expansion of the money supply. Probably the Fed chairman would be removed before he could implement a course of action.

So the Fed chair cannot do it; but that is not the same as the Federal Reserve being unable to do it.

We just have a phalanx of corrupt, weak, craven Elites who hate the nation that has so elevated them, that they'd rather destroy it, pushing the lower classes into the mire first, than cut back on their own growing wealth in returning to responsible monetary and economic policies.

They can't stop the expansion now... that's the Rock. The system has to expand or it implodes.

And he isn't lying...

- Messages

- 968

- Reaction score

- 1,373

- Points

- 278

Much of this information was copied from an email subscription from Doug Casey

Red font is my comments

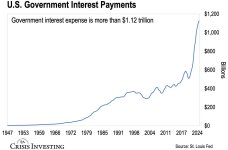

Exploding interest payments have now crossed $1.12 trillion

To put it in perspective: $1.12 trillion is bigger than the entire economy of most countries. It’s larger than Turkey’s economy, and almost double the size of Thailand’s.

It also dwarfs just about everything else in the government’s budget—even the military-industrial complex’s sacred cow. In fact, interest is now the second-biggest budget item, behind only Social Security.

That $1.12 trillion interest bill represents a 36% increase from just two years ago.

According to the latest Monthly Statement of the U.S. Treasury (page 9) gross interest paid in March amounted to $104.4 billion — or about $3.4 billion per day. That's a staggering 56% of the $185 billion the government collected in income tax receipts (page 4).

Put simply, 56 cents of every dollar you paid in income tax in March went to cover interest on the debt.

Red font is my comments

Exploding interest payments have now crossed $1.12 trillion

To put it in perspective: $1.12 trillion is bigger than the entire economy of most countries. It’s larger than Turkey’s economy, and almost double the size of Thailand’s.

It also dwarfs just about everything else in the government’s budget—even the military-industrial complex’s sacred cow. In fact, interest is now the second-biggest budget item, behind only Social Security.

That $1.12 trillion interest bill represents a 36% increase from just two years ago.

According to the latest Monthly Statement of the U.S. Treasury (page 9) gross interest paid in March amounted to $104.4 billion — or about $3.4 billion per day. That's a staggering 56% of the $185 billion the government collected in income tax receipts (page 4).

Put simply, 56 cents of every dollar you paid in income tax in March went to cover interest on the debt.

- Per year: $104.4 billion

- Per month: ≈ $8.7 billion

- Per day: ≈ $286 million

- Per hour: ≈ $11.9 million

- Per minute: $104.4 billion ÷ (365 × 24 × 60) ≈ $198,000

- Per second: $104.4 billion ÷ (365 × 24 × 60 × 60) ≈ $3,300

- $500: Around 63% of workers report being unable to cover this amount.

- $400: Approximately 37% of Americans lack enough savings to cover this expense

- About 18% of Americans say the largest expense they could cover using only their savings is under $100

- 21% having no emergency savings at all

Cigarlover

Yellow Jacket

- Messages

- 1,441

- Reaction score

- 1,663

- Points

- 283

If I had a dollar for every billion the government spends I could retire very comfortably.

- Messages

- 24,182

- Reaction score

- 4,438

- Points

- 288

"You Better Start PREPARING Yourself NOW..." - Peter Schiff

Apr 27, 2025Peter schiff talks about the National Debt, Interest Rates, and the debt payments. he said that we will reach a $1 Trillion Dollar in interest payments of the national debt by next year. because The More Debt We Have, The More Inflation We're Gonna Create, The Higher Interest Rates have to be.

8:24