Bob Coleman said:#Gold and #Silver Exchange for Physical (#EFP) discussion

The following may be technical in detail, however I hope it helps educate others how the precious metals markets function.

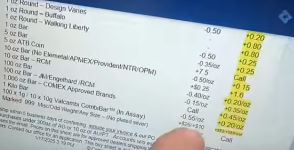

On December 11, 2024 we had a blow out to the upside on the EFP premium. This meant that the futures price went to an extreme premium relative to the spot price.

Gold February contract to Gold spot went to a $45 premium (normal was about $24 premium)

Silver March contract to Silver Spot went to a $1.05 premium (normal was about 45 cent premium)

Normally, when this occurs, arbitrage trading would have players deliver physical to the Comex and short the lead month contract. This would alleviate the abnormal pricing environment.

speed up to today's EFP :

Gold February contract to Gold spot went to a $12 premium (normal is about $13 premium)

Silver March contract to Silver Spot went to a $.53 premium (normal is about 35 cent premium)

As one can see, Gold has normalized while Silver is still elevated. The chart below shows the increase in the Gold Comex registered category which helped alleviate the EFP premium while the Silver Comex registered category saw a decline in ounces. This seems to explain why the Silver EFP is still unusually elevated. Players have yet to deliver silver 1000 oz bars. This could be due to the elevated premiums they would have to pay to obtain the bars. Normally when bar premiums are elevated, that is a sign of tightness.

...

Context: