You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

#silversqueeze

- Thread starter pmbug

- Start date

-

- Tags

- silversqueeze

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

It's interesting that Silver is going to Lease rates while the Contango/EFP (or whatever you wanna call it) is coming in here. About 49 cents as I type.

They just will not let Silver above $32 - $32.50.

- Messages

- 471

- Reaction score

- 305

- Points

- 168

then stop quoting conspiratorial references from social media talking heads about pm manipulation: "FT amongst other media" says there isn't any.@Peter89 - You are the one quoting conspiratorial references from social media talking heads.

Just for those who don't believe to "FT amongst other media", here is another conspiratorial reference from another social media talking head

On Tariffs and Gold Prices

Gold price spreads widen as delivery delays increase. Is the NY/London Gold Pool collapsing? Buy gold, buy silver before prices surge.

If you don't think prices are manipulated by now, then I don't know how to help you. Just more conspiracy facts.

- Messages

- 471

- Reaction score

- 305

- Points

- 168

You keep talking about transportation costs.Come on man. Shipping gold via Air is gonna be the cheapest thing you could possibly ship. It's a simple ratio of the Value/Weight & Size. If you need to get a bunch of gold somewhere you are gonna do it. Unlike trying to move some Oil, or coal or dirt for that matter.

I already told you that when they move tons of gold nobody cares about transportation costs.

The reason why tons of gold don't get flown around the globe "just in case" is not because of low transportation costs.

It's because of the geo-political value of that gold.

You keep looking at that gold in terms of its dollar value.

The entities that manage that gold don't care about its dollar value Voodoo.

They are probably covering for something but feel free to speculate on the actual reasons they are moving things around. It's pretty obvious that big things are afoot.

Perhaps its a Central Bank, or larger bankers, that are getting nervous about a war breaking out. They want their Gold closer to them and less likely to be confiscated. Who knows.

VD, can't you see that you are mentioning alternative reasons? beside tariffs?

I don't need to speculate Voodoo, you do it all by yourself : )

You are nonchalantly softening your previous stance that it's about tariffs. Congratulations. It already happened not long ago when you where convinced that US refineries where clogged up because they were delivering to the Comex. Remember?

How about admitting that you aren't sure anymore that it's the tariffs : )

"The tariff story is a ruse"

Even if the "TF amongst other media" tells you it's the tariffs, don't be afraid to be called a conspiracy lunatic Voodoo

(Apologies for the conspiratorial reference from another social media talking head)

I'm sorry @Peter89 , but I've lost the plot on what the disagreement is. Could you state what your thesis actually is?

For my part, I paid attention to the silver vault situation and:

For my part, I paid attention to the silver vault situation and:

- several years now Silver Institute amongst others says silver is in structural deficit (global production < global demand)

- Vault reporting for COMEX, LBMA and SGE/SFE, at least for all of 2024, did not show a drop in global inventory commensurate with the structural deficit narrative, but there did appear to be a slow drain of inventory from LBMA vaults (presumeably to COMEX and SGE/SFE).

- Trump announced tariff plan on November 25, 2024 and COMEX inventories began spiking shortly after that.

- I don't have any citation/reference, but I think the EFP premium also started blowing out at that time. Maybe @Voodoo or some other charting wizard can show when NY futures - London spot started blowing out.

Trump's tariff announcement was November 2024. That is what sparked the blowout COMEX demand (because shorts needed to cover their naked bets).

- Messages

- 471

- Reaction score

- 305

- Points

- 168

I'm sorry @Peter89 , but I've lost the plot on what the disagreement is. Could you state what your thesis actually is?

After dozens of conspiratorial references from social media talking heads saying that it wasn't the tariff threats, I think my thesis is pretty clear.

Btw you keep talking about silver. The tariff threats story - the narrative of tariff threats as the justification of big movements from London to NY - refers to gold, not silver.

Me and Voodoo, we have been talking the whole time about gold, not silver.

After dozens of conspiratorial references from social media talking heads saying that it wasn't the tariff threats, I think my thesis is pretty clear. ...

Indulge me. What is "it"? What is your thesis?

Well we messed up, should have been in Nickel and/or Tungsten. Who knew. Or perhaps this is just the preview before the real show.

www.zerohedge.com

www.zerohedge.com

Shares Of Tungsten Miner Erupt After China Chokes Supply; CEO Says Customers In "State Of Disbelief" | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

- Messages

- 471

- Reaction score

- 305

- Points

- 168

Now do I believe the narrative that they are just giving it to the COMEX, no not really. They are probably covering for something but feel free to speculate on the actual reasons they are moving things around. It's pretty obvious that big things are afoot.

Perhaps its a Central Bank, or larger bankers, that are getting nervous about a war breaking out. They want their Gold closer to them and less likely to be confiscated. Who knows.

So, after my multiple "conspirational references to some social media talking heads" you have changed your mind and now you are questioning the mainstream narrative of LBMA gold being shipped to Comex because of the tariffs. That's good Voodoo. Only those following mainstream media are still holding on to the tariffs narrative. Let's see if I can help any further

Let's say 30 years ago you bought and - out of convenience, safety, liquidity, whatever - kept stored your holdings in a vault in Singapore or Dubai.

Would you ship it back home today because of tariff threats?

No you wouldn't.

Why not.

Because there are no tariff threats Voodoo, neither vs Singapore nor vs UAE.

When the narrative of the gold being shipped from London to NY because of tariffs got spread out, there weren't - actually still there aren't - any tariff threats vs England.

Sometimes it's just a matter of common sense.

If Comex wants to deliver gold there is no need to deliver it in NY. For years Comex have delivered it in London through the EFP mechanism. They can keep doing it.

Moreover, Comex has warehouses all around the world, in the major gold trading hubs. They can deliver from there.

When they tell you that gold is being shipped from London to NY so that Comex can deliver, don't be afraid of people like pmbug reminding you of what "FT amongst other media" says and dismissing your quotes as "conspirational references to some social media talking heads". Just use your common sense.

Ask yourself: Who is moving those tons of gold?

You know Andrew Maguire, he reports that if they try to put larger orders they get flagged up and blacklisted within the LMBA circle.

So, who is doing the moving Voodoo? It's not commercial entities. Hedge funds. Traders etc. That's the narrative mainstream media is feeding you with.

Only be bullion banks and their overlords can move those inventories out of London.

But who are they you ask.

They are entities who don't give a f**k about tariffs Voodoo.

Those entities don't care about percentages. They don't care about money. They produce it. They belong to the club managing the world money supply.

Those entities don't see gold as a way to make money. They are not that narrow-minded. They know what gold is.

If you start looking at things from this POV you'll get why the narrative spread around by financial mainstream media of those entities shipping around the globe tons of gold "because of tariff threats" is what it is.

...

Only be bullion banks and their overlords can move those inventories out of London.

...

They are entities who don't give a f**k about tariffs Voodoo.

Those entities don't care about percentages. They don't care about money. ...

So this is the foundation of your premise. I don't know that I agree with it. The bullion banks that are short on the COMEX are facing huge losses as they cannot cover their positions with physical metal (in both gold and silver markets). I posit that they do very much care about the losses.

Borrow fees on SLV (as if they hadn't already been raiding that thing) did explode yesterday. Now, I've sort of noticed in regular stocks that the price moves after the borrow fee as they start covering. This can take a long time if the supply is decent.

www.iborrowdesk.com

www.iborrowdesk.com

To this

Good video from Rafi.

IBorrowDesk

| 0.8 % | 100,000 | 2025-02-05 09:15:03 |

| 0.6 % | 100,000 | 2025-02-05 09:00:03 |

| 0.5 % | 2,200,000 | 2025-02-04 16:45:03 |

| 11.5 % | 10,000 | 2025-02-06 16:45:03 |

Good video from Rafi.

Banks don't care about money? I'd argue that is All they care about.

Regarding post #157:

Silver ETFs - the real story

As USA citizens we have a policy to tariff Chinese silver bars and guidelines for not importing Russian bars that are post Ukraine invasion.

However, these silver bars are ending up in ETFs that US investors are piling money into. Why is this practice allowed to happen and more importantly are US officials and the public aware of this practice.

Know what you are invested in. Silver ETFs involve risk and this is another example.

I want to give a big shout out to @mypreciousilver for putting this information together. I have been trying to find a way to consolidate this data.

- Messages

- 471

- Reaction score

- 305

- Points

- 168

If you don't think prices are manipulated by now, then I don't know how to help you. Just more conspiracy facts.

Exactly

when someone mentions "FT amongst other media" as a way to strengthen his point we don't care because we know that "FT amongst other media" purports e.g. that pm are not manipulated.

Likewise, when the same guy dismiss "conspirational references to some social media talking heads" we don't care because we know that that's the typical argument used by mainstream media tools.

The 4-8 weeks delivery delay didn't concern gold moving to the USA, and it didn't concerned LBMA.

It concerned 400oz bars (Comex trades 100oz bars) and Bank of England.

It was gold moving to Asia, not to the USA.

It had nothing to do with tariffs.

This is what pmbug is referring to when he mentions "FT amongst other media"

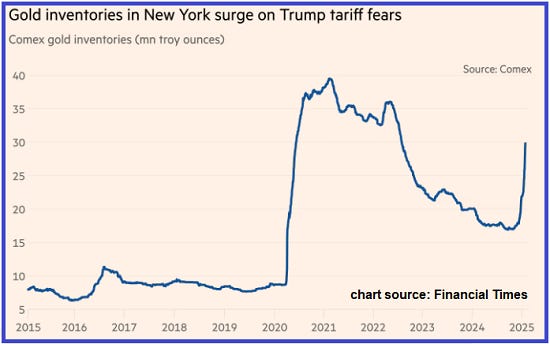

The chart was part of a report by the FT that the amount of gold being shipped to the U.S. and into Comex vaults was a function of fears that the Trump import tariffs slapped on gold and silver would restrict the supply into the U.S. and thus gold was being hoarded on the Comex ahead of this. This supposed tariff-driven hoarding was being used as the reason for a gold bar shortage on the LBMA that has developed.

There's a lot of moving parts, plus "footprints in the snow" that lead to the truth, that are involved in explaining why this "tariff" narrative is nothing more than the cover story being disseminated by the big bullion banks using the ignorant mainstream financial media as the echo chamber.

Apologies for the "conspirational reference to some social media talking head" pmbug

@Peter89 - I seem to have struck a nerve with my earlier comment. I really didn't intend any offense.

You posted the FT chart but didn't explain how you perceive that chart as either supporting or contraindicating the COMEX vault inflow reporting. As I have mentioned previously, Trump announced the tariffs on November 25, 2024. The inventory build began almost immediately afterwards.

I'm still not clear on what exactly your thesis is because you have not taken the effort to articulate it. For my part, I think the tariff announcement lit a fire on a situation that was already on a slow burn with silver. I documented the silver metal flow from LBMA to COMEX with monthly reports all throughout 2024 in the demand drivers thread:

I didn't watch the gold vaulting situation as closely, but the chart you posted is pretty compelling evidence that metal was not flowing into the COMEX until after Trump's tariff announcement. The bullion banks have to be able to cover their naked short COMEX positions. The COMEX short, LBMA long trade is now deleveraging.

You posted the FT chart but didn't explain how you perceive that chart as either supporting or contraindicating the COMEX vault inflow reporting. As I have mentioned previously, Trump announced the tariffs on November 25, 2024. The inventory build began almost immediately afterwards.

I'm still not clear on what exactly your thesis is because you have not taken the effort to articulate it. For my part, I think the tariff announcement lit a fire on a situation that was already on a slow burn with silver. I documented the silver metal flow from LBMA to COMEX with monthly reports all throughout 2024 in the demand drivers thread:

The Silver Institute - Press Release said:Posted on 11 08, 2023

(Washington, D.C. – November 8, 2023) Three key sectors of global silver demand – industrial, jewelry and silverware – are significant drivers for annual silver consumption and accounted for nearly three-quarters of the world’s demand for silver in 2022. This stands in contrast to investment demand for silver, which was a sturdy 27 percent of overall silver demand last year. New research indicates that silver industrial demand is forecast to increase 46 percent through 2033, while jewelry and silverware demand is projected to rise 34 and 30 percent...

- pmbug

- physical demand

- Replies: 348

- Forum: Silver Bug

I didn't watch the gold vaulting situation as closely, but the chart you posted is pretty compelling evidence that metal was not flowing into the COMEX until after Trump's tariff announcement. The bullion banks have to be able to cover their naked short COMEX positions. The COMEX short, LBMA long trade is now deleveraging.

- Messages

- 471

- Reaction score

- 305

- Points

- 168

Perhaps its a Central Bank, or larger bankers, that are getting nervous about a war breaking out. They want their Gold closer to them and less likely to be confiscated. Who knows.

Exactly, who knows. How low is it to treat as conspiracy nuts those who question the mainstream narrative.

Let's see.

The new Trump admin is tidying up.

They know gold. The new Treasury Secretary knows gold.

Is it possible that the new Administration instructed the US Treasury to bring home the US gold?

It's not possible, it's obvious.

One week after Trump inauguration, news of gold moving from London to USA .

What could the reason be?

The tariffs of course. How conspirational would be to think otherwise. After all it's the "FT amongst other media", right?

... How low is it to treat as conspiracy nuts those who question the mainstream narrative. ...

You are mischaracterizing my earlier comment.

... You are the one quoting conspiratorial references ...

I was being literal with comment. It wasn't an epithet. The sources you were citing were claiming that the MSM were conspiring to push a false narrative (for reasons which you have not articulated AFAICT). It's the literal definition of an assertion of a conspiracy. I never disparaged you or the sources you were citing. I do not treat you or anyone here as a "nut" even when I disagree on the issues or have a different point of view (except maybe for that serial Hari Krishna spammer that shows up once a year or so to post the same ' Practical Explanation about Next Life' screed over and over).

Last edited:

- Messages

- 471

- Reaction score

- 305

- Points

- 168

It's being reported by the FT amongst other media. It's not just a few publicity seekers talking about it on social media.

Yeah if the tariffs narrative is being reported by the FT amongst other media must be the tariffs

@Peter89 - You are the one quoting conspiratorial references from social media talking heads. It's on you to provide an alternative thesis if you think the tariff narrative is wrong.

"tariffs have nothing to do with this"

Apologies for the umpteenth conspiratorial reference from social media talking heads.

That's still as "conspiratorial" as the tariffs for a "reason" why metal is moving. Both are really just hypothesis.

But that theory makes since, although I still question if its just "banks". It looks like an attack on the COMEX.

www.zerohedge.com

www.zerohedge.com

And that would explain why London ran out. They couldn't even do EFP because of the huge standing for delivery.

Is Someone Attacking the Comex? January Sees $5.2B in Gold Deliveries | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

And that would explain why London ran out. They couldn't even do EFP because of the huge standing for delivery.

- Messages

- 471

- Reaction score

- 305

- Points

- 168

It's being reported by the FT amongst other media. It's not just a few publicity seekers talking about it on social media.

- Messages

- 471

- Reaction score

- 305

- Points

- 168

I think this and the Trump tariffs are certainly connected.

I think not. Here, just for fun, another one of what pmbug calls "conspirational references from some social media talking heads".

The Media’s Narrative

The FT and others frame this new drainage event as a tariff-driven shift which provides a convenient scapegoat:“Trump’s tariffs are why gold is leaving London.”

In reality, the volume of gold leaving the LBMA far exceeds what tariffs alone would explain. The U.S. is pulling gold back, just as China has been.

The Secret Reason USA Wants Its Gold Back! It's Not Tariffs.

Uncover why $30B in gold/silver fled LBMA for NY & China vaults—tariffs don’t explain 2025’s bullion migration mystery.

www.scottsdalemint.com

www.scottsdalemint.com

Something's up today in Silver. Up to $33.33 high overnight (yes I see you special numbers) and gold is flat. But the spreads are blowing up to. Up 80 cents to like $1.2.

The other interesting connection (perhaps quite likely in my head only) but Gamestop popped this morning. They made up a bogus news story about them wanting to get into crypto and bitcoin for cover. I don't think this is just a coincidence.

The other interesting connection (perhaps quite likely in my head only) but Gamestop popped this morning. They made up a bogus news story about them wanting to get into crypto and bitcoin for cover. I don't think this is just a coincidence.

Last edited:

- Messages

- 4,988

- Reaction score

- 5,012

- Points

- 308

Something's up today in Silver. Up to $33.33 high overnight (yes I see you special numbers) and gold is flat. But the spreads are blowing up to. Up 80 cents to like $1.2.

The other interesting connection (perhaps quite likely in my head only) but Gamestop popped this morning. They made up a bogus news story about them wanting to get into crypto and bitcoin for cover. I don't think this is just a coincidence.

Silver always seems to lag behind gold. I don't know why that is, but it does. Gold is flirting with $3,000. $36 silver should be near the breakout zone. Any bets on where it will be close of the year?

Nope. That has a variance of Thousands of dollars.

Of course the mining stocks will break their correlation with silver today and instead follow gold.

...

Due to the surge in gold and silver prices and the resulting spike in demand, which has outpaced supply, the Korea Minting and Security Printing Corp. halted its supply of gold bars to banks on Wednesday.

The Korea Gold Exchange, for its part, had already suspended bank sales of 10-gram and 100-gram gold bars since October while continuing to sell 1-kilogram bars.

However, with silver bar prices also soaring, the exchange notified banks of the suspension of silver bar supply on Thursday. It also noted that the remaining stock of 1-kilogram gold bars would no longer be available.

...

The Korea Times

Get the latest on what's happening in Korea from the nation's top English-language media outlet.

www.koreatimes.co.kr

Seems interesting. I wonder how much of the actual market in Korea is that? Do they not have coin shops, etc?

$3 an oz? Holy snikes. Need to add to my stacks here like today. That looks like a paper default.

Interesting to note the others. Platinum is basically just a call us but Palladium, well they've got that.

Interesting to note the others. Platinum is basically just a call us but Palladium, well they've got that.