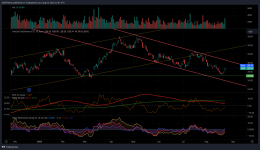

- Despite a remarkable rally in stock markets so far this year, concerns have been growing over the potential ripple effect of a prolonged slowdown in the world's second-largest economy.

- David Roche, president and global strategist at Independent Strategy, told CNBC's "Squawk Box Europe" on Thursday that global stock markets were failing to price in a long-term decline in the role that manufacturing plays in powering emerging market economies.

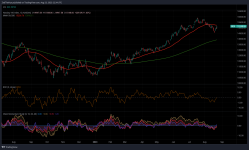

- He suggested the market is due a "very big" downward correction, once many concurrent geopolitical and macroeconomic risks are properly priced in.

...

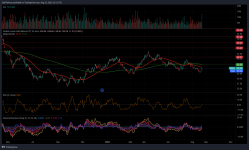

He added that economies that historically exported manufactured goods will struggle to generate any meaningful growth in that sector, which will cause "big disappointments in populations, more geopolitical problems and more riots in the streets."

"The Chinese model is clearly washed up on the beach with a huge number of legacy holes in it, and it's not going to take off again," Roche said.

...

He suggested that the market is due a "very big" downward correction, once these many concurrent risks are eventually taken into account.

As such, Roche recommended investors should look to "slowly accumulate" U.S. Treasurys and safe haven assets that offer yields at their currently cheap levels.

...