You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Lunatic Fringe - Market and Trade Chat

- Thread starter TheRealZed

- Start date

-

- Tags

- markets

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Status

- Not open for further replies.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

Self conscious gay <redacted - see forum guidelines on epithets>. Already sprouting man tits at this age.

Moobs...

Maybe that is across some sort of line, I'm sure it will get moderated if so! LOL.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

JPow says the job of taming inflation isn't done yet.

www.cnbc.com

www.cnbc.com

Fed Chair Powell calls inflation 'too high' and warns that 'we are prepared to raise rates further'

Federal Chair Jerome Powell called for more vigilance in the fight against inflation, warning that additional interest rate increases could be yet to come.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

Rates Plateau? The consumer is tapping out, killing them can't be the best idea.JPow says the job of taming inflation isn't done yet.

Fed Chair Powell calls inflation 'too high' and warns that 'we are prepared to raise rates further'

Federal Chair Jerome Powell called for more vigilance in the fight against inflation, warning that additional interest rate increases could be yet to come.www.cnbc.com

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

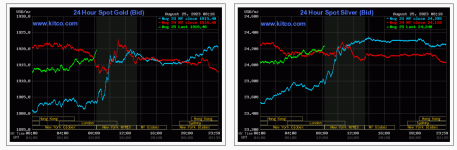

They pulled out the Silver Hammer again last night but both gold and silver seem to be quite resilient. Watching the action it seems to me that the issue lay in silver delivery. It looks to be that much stronger than gold at the moment on a relative basis. I'm half expecting silver to do one of its rapid charges forward before the end of the year. It looks like a reasonable setup to me.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

Zeihan is a BRIC's sceptic, quite dismissive of their potential to achieve anything of meaning.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

Crash volume is hitting 11...

... but the Fed is talking tough.

... but the Fed is talking tough.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

- Messages

- 1,815

- Reaction score

- 2,141

- Points

- 283

Not sure what the actual stats are but every GD analyst out there is calling for a correction. They may be right at some point in the next 12 months. The problem is you could go broke trying to short everything in the meantime.

So far no recession although the revisions to some data is staggering. I think March unemployment was adjusted up 300k. 300k? WTF? More and more it appears the data is just made up by whatever Gov agency is releasing it.

So far no recession although the revisions to some data is staggering. I think March unemployment was adjusted up 300k. 300k? WTF? More and more it appears the data is just made up by whatever Gov agency is releasing it.

- Messages

- 1,815

- Reaction score

- 2,141

- Points

- 283

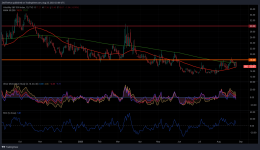

I was looking to buy puts today and then realized I am wrong about 80% of the time so I did nothing. LOLNASDAQ Weekly - That last candle isn't confidence inspiring. Expecting further mean reversion here.

View attachment 10041

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

so I did nothing.

There is your tell.

It takes years of intensive training to fade your own ass! and even then most of us mortals still fail.

I reckon 13200 to 13500 is a reasonable target, not the big short... too much crash noise around. The market rarely lets these people look like heroes.

All the caveats, stops etc, could turn on you for a week or two before going south or just not happen.

Last edited:

- Messages

- 1,815

- Reaction score

- 2,141

- Points

- 283

The big question I have to ask is this. If we are headed for a recession then why aren't the markets reflecting that? The markets are always looking forward 6 -12 months.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

Not sure what the actual stats are but every GD analyst out there is calling for a correction.

Yup... which means the market has or is pricing it in now. They might be right for a bit then we will turn around --> JMO and baring a shock event that isn't expected as of today.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

The big question I have to ask is this. If we are headed for a recession then why aren't the markets reflecting that?

Capital flows, if bonds are selling off, where does the money go? Ditto stocks... like a seesaw, it doesn't have to make absolute sense, it just has to be relatively better. They are paid to beat the market, not be out of the market. At some point, gold will look attractive as this game rocks back and forth. --> JMO.

The markets are always looking forward 6 -12 months.

I think they are still discounting Fed capitulation at some point.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

- Messages

- 1,815

- Reaction score

- 2,141

- Points

- 283

WSS had Adrian Day on today or yesterday. He said recession means lower silver and gold prices short term. Same thing happened in the 70's. Lower metals prices for about 8 months then off to the races.

Everyone looking at the 70's like that's the model to follow but I would say this is a very different world and financial system than that of the 70's.

Everyone looking at the 70's like that's the model to follow but I would say this is a very different world and financial system than that of the 70's.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

Expect the VIX to approach 30 as we mean revert on the SPX etc.. That will likely signal that the correction is ending, and trend reversal is in play. I'm guessing that happens near those averages.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

WSS had Adrian Day on today or yesterday. He said recession means lower silver and gold prices short term. Same thing happened in the 70's. Lower metals prices for about 8 months then off to the races.

Think back a little, was that the period we were in denial about the idea of stagnating inflation? The time that stagflation became a thing?

Everyone looking at the 70's like that's the model to follow but I would say this is a very different world and financial system than that of the 70's.

Absolutely, I don't know that it will be that instructive this time. The 70s were all about the USA, now there are many more moving parts.

With full respect to Adrian, him being reserved is more bullish than not. We never go hard when all the gold bulls are in full voice and feeling confident.

Just sayin...

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

That said... I do believe Zulauf's 2024 call for gold is going to be near the money. I think he made it 2 years ago now... full respect.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

WSS had Adrian Day on today or yesterday.

I've not watch him for a while. Thx for the prod.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

I've not watch him for a while. Thx for the prod.

I agree with him on the rotation thing, you can see it in the charts. It is happening now IMO and I guess it will accelerate.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

FWIW GOAU and GDX are pretty much joined at the hip in terms of performance. Frankly, I don't think that ETF buyers look at the stocks that closely... this is why they buy ETF's after all.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

- Messages

- 1,815

- Reaction score

- 2,141

- Points

- 283

you tube algo's must really be pushing this channel. Never seen it before and now this will be the 3rd on this page.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

you tube algo's must really be pushing this channel. Never seen it before and now this will be the 3rd on this page.

Yeah, seems to have hit a sweet spot.

So far they have been quite good vids IMO.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

I love me some dark Pigeon. If you haven't found him he is worth a listen, I've had him on my radar for a decade or so... youtube kicks him to the curb so you might not have picked up on his stuff up there in the USSA. Always thought-provoking, even if you don't agree! Well off to the right of Dark Horse but not in a redneck fashion.

- Messages

- 1,815

- Reaction score

- 2,141

- Points

- 283

I agree, pretty much spot on. They should get you on an episode. Your every bit as good as they are with your charting abilities.Yeah, seems to have hit a sweet spot.

So far they have been quite good vids IMO.

- Status

- Not open for further replies.