TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

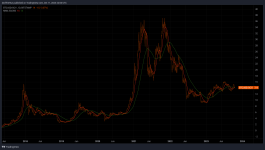

Banks Ranked by Derivatives

https://www.usbanklocations.com/bank-rank/derivatives.html

JPM

92 = 1.6T

23 = 58.9T

21 USD GDP 21.4T

21 Global GDP 84.5T

One US bank is ~double US GDP, I might add the lot up later just for shits and giggles BUT it just doesn't seem quite right. That is a lot of insurance to sell!