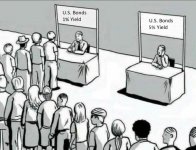

The U.S. economy could be close to a tipping point as bond yields see a bear steepening across the curve, with the long end rising sharply this week.

Although gold continues to see some strong selling pressure, analysts note that the precious metal remains relatively resilient as long-term U.S. bonds continue to rise. Wednesday, 30-year yields rose to a high of 5%, its highest level since August 2007; at the same time, 10-year yields are trading around 4.8%, a fresh 16-year high.

Meanwhile, gold is managing to hold initial support above $1,830 an ounce. December gold futures last traded at $1840.10 an ounce, roughly neutral on the day.

Analysts have noted that the rise in bond yields is creating a market environment similar to that of previous recessionary periods.

"I feel things in 4Q 2023 are shaping up like some combination of 1987, with the bond price collapse before the stock market crash, and 2008, when crude oil peaked," said Mike McGlone, senior strategist at Bloomberg Intelligence. "In 2008, gold went from about $1,000 an ounce down to $700, before embarking on the rally to the 2011 high around $1,900. I see parallels. Gold ETF outflows, I think, are partially due to the overwhelming force of the US government 2yr note above 5% and most inflation measures declining below 5%. The sell-off in treasuries, I think, is a last gasp aligned with the spike in crude oil."

While bond yields do have room to move higher, analysts have said that they are probably getting close to a peak, particularly as the U.S. labor market starts to cool.

Naeem Aslam, chief investment officer at Zaye Capital Markets, said markets will be sensitive to disappointing economic data ahead of Friday's nonfarm payrolls report. The comments come after private payrolls processor ADP said that the private sector added only 89,000 jobs last month, significantly missing expectations.

Aslam added that he sees bond yields reaching a peak, even as the Federal Reserve continues to maintain its restrictive monetary policies for the foreseeable future.

...