You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Lunatic Fringe - Market and Trade Chat

- Thread starter TheRealZed

- Start date

-

- Tags

- markets

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Status

- Not open for further replies.

...

In a comment almost perfectly opposed to that of Fed Chair Powell, NY Fed's JohnWilliams appeared on CNBC and poured cold water on the idea of imminent and ongoing rate-cuts.

...

More:

Bonds, Stocks, Gold Tumble After Fed's Williams Comments | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

I think it's Palladium that has confirmed we are back into the bull market phase. They lost Paper control of Palladium back in the last rise so It's much less manipulated. Yes, it's also more of an industrial metal but the loss of paper control over it allows us a more clean look on these markets.

Now that's a breakout. Note that physical Platinum and Palladium prices just about got to parody from what I saw around $1,000 / oz.

Now that's a breakout. Note that physical Platinum and Palladium prices just about got to parody from what I saw around $1,000 / oz.

I think it's pretty telling where this economy is at the moment. Most places have the Maple Leafs for a bit more than I paid but they have one thing in common. The Random Year coins are Cheaper than the new minted coins by a significant margin. At Apmex its a $3.5 differential and SD is $1.6 on a small order size.

That tells me that they've seen some weak hands forced to sell some savings in this economy.

That's gone before my coins have even shipped. Deal must be over and that little bit of supply soaked up rapidly. The coins are now $30.48 so I save like $4 a coin.

Cigarlover

Yellow Jacket

- Messages

- 1,684

- Reaction score

- 1,941

- Points

- 283

The week ended pretty well all things considered. No real major selloff after the run up.

SLV calls I bought on Wed I sold on Thursday for 60% gain. I could have bought thumbtack at the same price I pad on Wed but I didn't and will probably regret that early next week but there are lots of trades to be made so I never worry about the ones I missed or about not selling at exactly the top.

CDE seems to be outperforming the rest of my holdings. Would love to see a pullback to the 3.00 level to buy more.

SLV calls I bought on Wed I sold on Thursday for 60% gain. I could have bought thumbtack at the same price I pad on Wed but I didn't and will probably regret that early next week but there are lots of trades to be made so I never worry about the ones I missed or about not selling at exactly the top.

CDE seems to be outperforming the rest of my holdings. Would love to see a pullback to the 3.00 level to buy more.

Cigarlover

Yellow Jacket

- Messages

- 1,684

- Reaction score

- 1,941

- Points

- 283

Heard on a podcast this morning that the reason for that is the big money is getting better yields on bonds now that they have rebounded. I actually haven't been keeping an eye on TLT but it's made a nice move over the last couple months.And I think many videos here and Rafi Faber have been keeping a close eye on the Reverse Repos, the speed it's draining at is gaining speed. Down to $683 million.

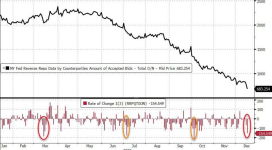

View attachment 11317

Heard on a podcast this morning that the reason for that is the big money is getting better yields on bonds now that they have rebounded. I actually haven't been keeping an eye on TLT but it's made a nice move over the last couple months.

Not quite the same thing. The reverse Repo's were created because there was Too much money/cash in the banks. All the covid money and whatnot. Rafi points to this cash is what is being used to Purchase All of the new treasury debt. Therefore, bonds/banking system have a Real problem when it runs out as not enough money to keep buying the debt. So even though everyone thinks interest rates are gonna plunge now if no one buys the debt they could soar instead.

I'm laughing at the comments to that tweet:

Can't be too important if it can wait a month.

~~~

Huge economic collapse, but I'll get around to it in a month?

~~~

There is imminent danger and it will take me a month to tell you about it

...

- Messages

- 18,189

- Reaction score

- 10,964

- Points

- 288

FED'S MESTER SAYS NEXT PHASE IS TO SEE HOW LONG ITS POLICY NEEDS TO REMAIN 'RESTRICTIVE' - FT

Federal Reserve Bank of Cleveland President Loretta Mester said financial markets had got "a little bit ahead" of the central bank on when to expect interest rate cuts, the Financial Times reported on Monday.

"The next phase is not when to reduce rates, even though that's where the markets are at. It's about how long do we need monetary policy to remain restrictive in order to be assured that inflation is on that sustainable and timely path back to 2%," Mester told the FT in an interview."

The markets are a little bit ahead. They jumped to the end part, which is 'We're going to normalize quickly', and I don't see that."

Federal Reserve Bank of Cleveland President Loretta Mester said financial markets had got "a little bit ahead" of the central bank on when to expect interest rate cuts, the Financial Times reported on Monday.

"The next phase is not when to reduce rates, even though that's where the markets are at. It's about how long do we need monetary policy to remain restrictive in order to be assured that inflation is on that sustainable and timely path back to 2%," Mester told the FT in an interview."

The markets are a little bit ahead. They jumped to the end part, which is 'We're going to normalize quickly', and I don't see that."

The markets are ALWAYS ahead of you idiots.

More Fed efforts at tempering the markets:

www.cnbc.com

www.cnbc.com

Fed's Goolsbee says he was 'confused' by last week's market reaction

The President of the Federal Reserve Bank of Chicago said the market may have read too much into last week's central bank update.

Cigarlover

Yellow Jacket

- Messages

- 1,684

- Reaction score

- 1,941

- Points

- 283

Endeavour Silver Announces At-the-Market Offering of up to US$60 Million

VANCOUVER, British Columbia, Dec. 18, 2023 (GLOBE NEWSWIRE) -- Endeavour Silver Corp. (“Endeavour” or the “Company”) (NYSE: EXK; TSX: EDR) announces it has entered into a sales agreement dated December 18, 2023 (the “ Sales Agreement ”) with BMO Capital Markets Corp. (the lead agent), TD Securities (USA) LLC, CIBC World Markets Inc., Raymond James (USA) Ltd., B. Riley Securities, Inc., H.C. Wainwright & Co., LLC, A.G.P./Alliance Global Partners and Stifel Nicolaus Canada Inc. (collectively, the “ Agents ”) pursuant to which the Company may, at its discretion and from time-to-time during the 25 month term of the Sales Agreement, sell, through the Agents, such number of common shares of the Company (“ Common Shares ”) as would result in aggregate gross proceeds to the Company of up to US$60 million (the “ Offering ”). Sales of Common Shares will be made through “at the market distributions” as defined in the Canadian Securities Administrators’ National Instrument 44-102 - Shelf Distributions, including sales made directly on the New York Stock Exchange (the “ NYSE ”), or any other recognized marketplace upon which the Common Shares are listed or quoted or where the Common Shares are traded in the United States. The Common Shares will be distributed at the market prices prevailing at the time of each sale and, as a result, prices may vary as between purchasers and during the period of distribution. No offers or sales of Common Shares will be made in Canada on the Toronto Stock Exchange (the “ TSX ”) or other trading markets in Canada. All references to dollars ($) in this news release are to United States dollars.

The Offering will be made by way of a prospectus supplement dated December 18, 2023 to the Company’s existing U.S. registration statement on Form F-10 (the “ Registration Statement ”) and Canadian short form base shelf prospectus (the “ Base Shelf Prospectus ”), each dated June 16, 2023. The prospectus supplement relating to the Offering has been filed with the securities commissions in each of the provinces of Canada (other than Québec) and the United States Securities and Exchange Commission (the “ SEC ”). The U.S. prospectus supplement (together with a related Registration Statement) is available on the SEC’s website (www.sec.gov) and the Canadian prospectus supplement (together with the related Base Shelf Prospectus and Sales Agreement) is available on the SEDAR+ website maintained by the Canadian Securities Administrators at www.sedarplus.ca. Alternatively, BMO Capital Markets will provide copies of the U.S. prospectus upon request by contacting BMO Capital Markets Corp. (Attention: Equity Syndicate Department, 151 W 42nd Street, 32nd Floor, New York, NY 10036, by telephone: (800) 4143627, or by email: bmoprospectus@bmo.com) .

Net proceeds of the Offering, if any, together with the Company’s current cash resources, will be used to fund the construction and development of the Company’s Terronera Mine, to advance the evaluation and development of the Pitarrilla and Parral properties, to assess potential development stage mineral properties for acquisition, to fund the potential acquisition of other development stage mineral properties, for continued exploration on the Company’s existing mineral properties and to add to the Company’s working capital.

The Company will pay the Agents compensation, or allow a discount, of 2.00% of the gross sales price per Common Share sold under the Sales Agreement. Sales under the Sales Agreement remain subject to necessary regulatory approvals, including the approval of the TSX and the NYSE.

This press release does not constitute an offer to sell any securities or the solicitation of an offer to buy securities, nor will there be any sale of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction.

The Offering will be made by way of a prospectus supplement dated December 18, 2023 to the Company’s existing U.S. registration statement on Form F-10 (the “ Registration Statement ”) and Canadian short form base shelf prospectus (the “ Base Shelf Prospectus ”), each dated June 16, 2023. The prospectus supplement relating to the Offering has been filed with the securities commissions in each of the provinces of Canada (other than Québec) and the United States Securities and Exchange Commission (the “ SEC ”). The U.S. prospectus supplement (together with a related Registration Statement) is available on the SEC’s website (www.sec.gov) and the Canadian prospectus supplement (together with the related Base Shelf Prospectus and Sales Agreement) is available on the SEDAR+ website maintained by the Canadian Securities Administrators at www.sedarplus.ca. Alternatively, BMO Capital Markets will provide copies of the U.S. prospectus upon request by contacting BMO Capital Markets Corp. (Attention: Equity Syndicate Department, 151 W 42nd Street, 32nd Floor, New York, NY 10036, by telephone: (800) 4143627, or by email: bmoprospectus@bmo.com) .

Net proceeds of the Offering, if any, together with the Company’s current cash resources, will be used to fund the construction and development of the Company’s Terronera Mine, to advance the evaluation and development of the Pitarrilla and Parral properties, to assess potential development stage mineral properties for acquisition, to fund the potential acquisition of other development stage mineral properties, for continued exploration on the Company’s existing mineral properties and to add to the Company’s working capital.

The Company will pay the Agents compensation, or allow a discount, of 2.00% of the gross sales price per Common Share sold under the Sales Agreement. Sales under the Sales Agreement remain subject to necessary regulatory approvals, including the approval of the TSX and the NYSE.

This press release does not constitute an offer to sell any securities or the solicitation of an offer to buy securities, nor will there be any sale of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction.

- Messages

- 18,189

- Reaction score

- 10,964

- Points

- 288

Yes, this is how the they manufactured the 'official unemployment numbers' so the Fake News could crow to all Americans about what a FANTASTIC JOB Barack Obama was doing 'helping' the American economy with the SHIT-TON of strangling gov't regulatory red tape he was binding US businesses with.

If you knew, you knew.

Endeavour Silver Announces At-the-Market Offering of up to US$60 Million

VANCOUVER, British Columbia, Dec. 18, 2023 (GLOBE NEWSWIRE) -- Endeavour Silver Corp. (“Endeavour” or the “Company”) (NYSE: EXK; TSX: EDR) announces it has entered into a sales agreement dated December 18, 2023 (the “ Sales Agreement ”) with BMO Capital Markets Corp. (the lead agent), TD Securities (USA) LLC, CIBC World Markets Inc., Raymond James (USA) Ltd., B. Riley Securities, Inc., H.C. Wainwright & Co., LLC, A.G.P./Alliance Global Partners and Stifel Nicolaus Canada Inc. (collectively, the “ Agents ”) pursuant to which the Company may, at its discretion and from time-to-time during the 25 month term of the Sales Agreement, sell, through the Agents, such number of common shares of the Company (“ Common Shares ”) as would result in aggregate gross proceeds to the Company of up to US$60 million (the “ Offering ”). Sales of Common Shares will be made through “at the market distributions” as defined in the Canadian Securities Administrators’ National Instrument 44-102 - Shelf Distributions, including sales made directly on the New York Stock Exchange (the “ NYSE ”), or any other recognized marketplace upon which the Common Shares are listed or quoted or where the Common Shares are traded in the United States. The Common Shares will be distributed at the market prices prevailing at the time of each sale and, as a result, prices may vary as between purchasers and during the period of distribution. No offers or sales of Common Shares will be made in Canada on the Toronto Stock Exchange (the “ TSX ”) or other trading markets in Canada. All references to dollars ($) in this news release are to United States dollars.

The Offering will be made by way of a prospectus supplement dated December 18, 2023 to the Company’s existing U.S. registration statement on Form F-10 (the “ Registration Statement ”) and Canadian short form base shelf prospectus (the “ Base Shelf Prospectus ”), each dated June 16, 2023. The prospectus supplement relating to the Offering has been filed with the securities commissions in each of the provinces of Canada (other than Québec) and the United States Securities and Exchange Commission (the “ SEC ”). The U.S. prospectus supplement (together with a related Registration Statement) is available on the SEC’s website (www.sec.gov) and the Canadian prospectus supplement (together with the related Base Shelf Prospectus and Sales Agreement) is available on the SEDAR+ website maintained by the Canadian Securities Administrators at www.sedarplus.ca. Alternatively, BMO Capital Markets will provide copies of the U.S. prospectus upon request by contacting BMO Capital Markets Corp. (Attention: Equity Syndicate Department, 151 W 42nd Street, 32nd Floor, New York, NY 10036, by telephone: (800) 4143627, or by email: bmoprospectus@bmo.com) .

Net proceeds of the Offering, if any, together with the Company’s current cash resources, will be used to fund the construction and development of the Company’s Terronera Mine, to advance the evaluation and development of the Pitarrilla and Parral properties, to assess potential development stage mineral properties for acquisition, to fund the potential acquisition of other development stage mineral properties, for continued exploration on the Company’s existing mineral properties and to add to the Company’s working capital.

The Company will pay the Agents compensation, or allow a discount, of 2.00% of the gross sales price per Common Share sold under the Sales Agreement. Sales under the Sales Agreement remain subject to necessary regulatory approvals, including the approval of the TSX and the NYSE.

This press release does not constitute an offer to sell any securities or the solicitation of an offer to buy securities, nor will there be any sale of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction.

That explains it's recent underperformance... They all knew what was coming.

Also, how the hell does it take EIGHT companies to simply hit the sell button a few times?

Simon White @ Bloomberg posits that the Fed dovish pivot was forced by the rising Treasury yields:

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

The FED will act on ONE thing and ONE thing alone in the end. To preserve their system and money. If the debt market dies the whole thing is dead.

Jane Foley - Senior FX strategist at Rabobank said:...

The market is also continuing to shrug off efforts by Fed policymakers to push back on market rate cut expectations. Yesterday, Atlanta Fed president Bostic said that there was no urgency to lower rates. Despite the warnings from Fed officials on policy, US stocks continued to push higher yesterday on rate cut hopes.

[ZH: Rate-cut expectations briefly declined after the initial Powell pivot plunge, but are now heading back to cycle lows, pricing in over 6 rate-cuts for next year]

...

Market Continues To Shrug Off Efforts By Fed Policymakers To Push Back On Rate Cut Expectations | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Markets to the Fed damage control efforts:

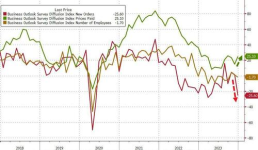

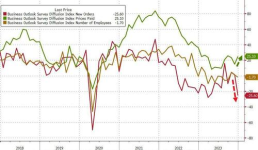

Suddenly and with no news the stocks tanked today. Should have since the morning on horrid Fedex and General Mills data.

I thought it was obvious that we were heading into serious Stagflation long ago but the data is now finally clearly pointing to that effect.

www.zerohedge.com

www.zerohedge.com

New orders plunged and prices went UP.

Philly Fed Flops - New Orders Plunge As Prices Paid Jump | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

New orders plunged and prices went UP.

Cigarlover

Yellow Jacket

- Messages

- 1,684

- Reaction score

- 1,941

- Points

- 283

Cigarlover

Yellow Jacket

- Messages

- 1,684

- Reaction score

- 1,941

- Points

- 283

Cigarlover

Yellow Jacket

- Messages

- 1,684

- Reaction score

- 1,941

- Points

- 283

I like the chart on gold. If it continues up from here I can see it running to at least 2300 early next year. Then when the fed cuts rates up to 3k.

I'd like to see silver get to 26.50. From there it can break out and run to 30 and then on to 50. For now it's just kind of stuck in a range.

Fortuna and CDE looking pretty good and ready to run if they can get above current levels. EXK I expect to continue in the downward channel for at least another quarter and maybe 3. Teranova starts up 4th quarter of next year barring any problems. After that they become a major player. Just under AG IIRC based on projected output.

I'd like to see silver get to 26.50. From there it can break out and run to 30 and then on to 50. For now it's just kind of stuck in a range.

Fortuna and CDE looking pretty good and ready to run if they can get above current levels. EXK I expect to continue in the downward channel for at least another quarter and maybe 3. Teranova starts up 4th quarter of next year barring any problems. After that they become a major player. Just under AG IIRC based on projected output.

... Poor Silver bugs gotta wait till next year.

So you are saying that 2024 is the year?

Lancers32

Often Wrong Never In Doubt

- Messages

- 1,837

- Reaction score

- 2,104

- Points

- 298

Dunno. You got some outsize gains in crap like CDE and HL. Others too like Fortuna. What is disappointing is the performance of something like GDX.Looks like Christmas came a little early for the gold bugs. Poor Silver bugs gotta wait till next year.

Lancers32

Often Wrong Never In Doubt

- Messages

- 1,837

- Reaction score

- 2,104

- Points

- 298

If the queen had...Miners are doing well and right at another previous high. The smaller H&S has held and we should be going to $34 soon. I could see a little resistance here and form another even larger Inverse Head & Shoulders. Which would point to $39 if we break this level.

View attachment 11442

Viking

Yellow Jacket

...

This Mysterious Document Reveals Why The Fed Just Shocked Everyone...

As I've said before, I don't normally watch videos - I much prefer to read. That said, I do enjoy watching Mr. Gammon's videos as they get posted in the forum.

At the end of this video, he talks about the BTFP, but there are a couple of important issues with it that he missed:

- Banks are not selling underwater collateral (MBS, Treasuries, etc.) to the Fed - they are loaning them at Par value. The banks purportedly have to pay the loans back.

- There appears to be an arbitrage trade available to banks that have accounts at the Fed to loan collateral at the BTFP and park the loan funds in a Fed account earning more interest than the loan rate. Supposedly they can unwind these positions at any time, so it's not clear how much of the $140B in the BTFP right now is reflective of true bank stress.

- The terms of the loan collateral likely extends way beyond the current end date for the BTFP. Either the Fed is going to extend the program, banks are going to face stress paying back the loans in a margin call type situation, or the Fed is going to simply forget/forgive the loans (poof, and they're gone) and hold the collateral to maturity (and consider the loss on the loans as a bailout to the banks).

Viking

Yellow Jacket

A rambling look at gold's prospects in 2024:

stockhead.com.au

stockhead.com.au

Gold Digger: 'Assured growth' – central bank buying spree set to drive gold higher in 2024 - Stockhead

Central banks will drive the price of gold higher in 2024, believe various analysts. Spot gold prices seem stable/strong as year end nears.

- Status

- Not open for further replies.