jelly

Predaceous Stink Bug

- Messages

- 159

- Reaction score

- 265

- Points

- 188

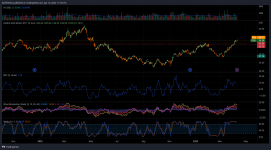

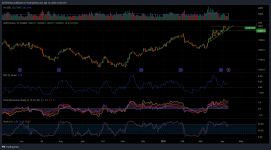

Small down days and sideways days keep the uptrend healthy and ongoing. Tough spot to be in as overbought as the mining shares are, but I think we still get some good short term upside before a correction. But I've been wrong before.