You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Lunatic Fringe - Market and Trade Chat

- Thread starter TheRealZed

- Start date

-

- Tags

- markets

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Status

- Not open for further replies.

- Messages

- 153

- Reaction score

- 266

- Points

- 198

Dollar dropping, reversing this morning's London bludgeoning in the metals. might be a reversal point and a reasonable time to nibble.Looking to add a small piece today. Like a big gap down in the Silver miners this morning. MAG.

jelly

Predaceous Stink Bug

- Messages

- 159

- Reaction score

- 265

- Points

- 188

Spot gold broke below 1940 support. Gold futures, however, are holding the recent low. Which do you believe?

Zed, what do you trade based off of in a situation like this? Ignore the support breakage in spot, and watch gold futures? Or trade it as if spot gold broke below 1940 support. Gold futures however, are holding the recent low. Which do you use?

Sitting on a knife’s edge…

Any other traders opinion?

Zed, what do you trade based off of in a situation like this? Ignore the support breakage in spot, and watch gold futures? Or trade it as if spot gold broke below 1940 support. Gold futures however, are holding the recent low. Which do you use?

Sitting on a knife’s edge…

Any other traders opinion?

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

Zed, what do you trade based off of in a situation like this?

I'm looking at the divergences in the Rate Of Change, Momentum etc and viewing them as having a positive divergence. Also things like today's volume (up) spiked a little on a long tail candle, again skewing me +ve. IMO we are in a similar setup to 23 March. Feeling OK about things, but always nervous as I do have a +ve gold bias... it's a disease but I know I have it.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

- Messages

- 18,467

- Reaction score

- 11,109

- Points

- 288

What caused that erection?

WTF is a Juneteenth?Markets closed Monday.

A joke. I wish.

Lancers32

Often Wrong Never In Doubt

- Messages

- 1,840

- Reaction score

- 2,109

- Points

- 298

Gold: C-Wave Beginning

It is still pretty early in the daily cycle (#13 today) and they generally run 35-50 days for gold, but I think this one will be a little shorter. This is your opportunity to get onboard!

- Messages

- 18,467

- Reaction score

- 11,109

- Points

- 288

Why?MicroVision (MVIS) will be sold at Tuesday's open for a gain of about 22.61%.

What signal in your trading system says 'Sell'?

Lancers32

Often Wrong Never In Doubt

- Messages

- 1,840

- Reaction score

- 2,109

- Points

- 298

Why?

What signal in your trading system says 'Sell'?

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

But for anyone who thinks inflation is over you are a fool.

Or maybe they actually understand what inflation is...

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

I assume that the systems stop have been back tested. They seem to be very wide. I can't help but wonder how a tighter stop would go over the long run.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

jelly

Predaceous Stink Bug

- Messages

- 159

- Reaction score

- 265

- Points

- 188

Bullish or not, Gold seems so tepid right now.

With the Fed meeting last week and options exp. Friday, I suspect that had quite a bit to do with it. Yet it still bugs me.

I would like to see a very strong Tuesday to really put any faith in this being a decent bullish move. ( Since the market is closed Monday)

With the Fed meeting last week and options exp. Friday, I suspect that had quite a bit to do with it. Yet it still bugs me.

I would like to see a very strong Tuesday to really put any faith in this being a decent bullish move. ( Since the market is closed Monday)

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

I think it will be a struggle until we close a week up over 2050 or so, 2025 at the least. --> JMO

- Messages

- 391

- Reaction score

- 874

- Points

- 268

There is a trailing stop loss at about $5 where you can see a little plus sign (+) on that last red bar. It closed the week below the stop loss and so it is a sell.Why?

What signal in your trading system says 'Sell'?

- Messages

- 391

- Reaction score

- 874

- Points

- 268

Condition green is when the IWM Russell 2000 Index ETF weekly chart closes above its 10 week moving average. Then we use 40% trailing stops.

Condition red is when the Index's weekly chart closes below its 10 week moving average. Then we use 10% trailing stops.

[In this way, the Weekend Trend Trader swings for the fences, because its success lies with extreme winning outliers.]

- Messages

- 391

- Reaction score

- 874

- Points

- 268

^^^^^^^^^

The stop loss levels for Nick Radge's Weekend Trend trader work as I just posted above. Yes, I have backtested the system and it works great over time. Nick has stated that making the stop loss levels tighter makes the system work worse.

Also, no one trade matters that much. What we care about is the sum of all trades. Over time we shall do well.

The stop loss levels for Nick Radge's Weekend Trend trader work as I just posted above. Yes, I have backtested the system and it works great over time. Nick has stated that making the stop loss levels tighter makes the system work worse.

Also, no one trade matters that much. What we care about is the sum of all trades. Over time we shall do well.

Or maybe they actually understand what inflation is...

Don't tell me you an inflation is ONLY a monetary thing. Inflation as most people see it is the prices of things they buy increasing.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

Don't tell me you an inflation is ONLY a monetary thing. Inflation as most people see it is the prices of things they buy increasing.

So what? Confusing a potential symptom with the disease doesn't help you identify the disease. Calling people that can identify the disease fools because a symptom is present but caused by a different issue is somehow wise/warranted?

The evidence is that we have a deflationary impulse underway, that isn't always going to be reflected in CPI or any specific price level in a timely fashion.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

BTW - July August have mostly been gold +ve over the last decade.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

So what? Confusing a potential symptom with the disease doesn't help you identify the disease. Calling people that can identify the disease fools because a symptom is present but caused by a different issue is somehow wise/warranted?

The evidence is that we have a deflationary impulse underway, that isn't always going to be reflected in CPI or any specific price level in a timely fashion.

Supply and Demand can still cause inflation. Unless you have a better term for differentiating different types of inflation. But that is useless because you could never breakout how much was caused by each underlying effect.

If we were to vaporize all the wheat on the planet wheat prices would go parabolic. The money supply did not instantly change, the supply of the goods changed. Too much money chasing Too few goods has TWO very distinct variables.

There is also a third type that Martin Armstrong discusses but it's a bit more nuanced as well. It mostly reflects the demand for the money itself, ie Confidence. If Nothing changes in Either money supply or product supply but people simply STOP wanting dollars prices will still Increase.

Last edited:

The gold market has been steady so far in June, trading between $1,940 and just under $2,000 an ounce. But analysts warn that after weeks of sideways price action, gold is ready for a more significant move.

The caveat is it could be in either direction, Gainesville Coins precious metals expert Everett Millman told Kitco News. "Gold has traded sideways long enough that we are due for a bigger move one direction or the other — retesting the $1,880 level or getting back up to around $2,000," Millman said.

...

There is still a risk of a significant selloff in the gold market because that would be symmetrical to what happened over the past two years when gold reached $2,000 an ounce, Millman pointed out. "The next most likely move for gold is lower," he said.

Markets are eyeing Powell's two-day testimony before the House and Senate next week, a lineup for Fed speakers, and more macro releases.

"Gold is going to be facing a lot of mixed signals next week," said Moya. "Fed speakers, flash PMIs, and more easing from China (commercial banks are cutting rates). In theory, we could still see risk appetite holding in there, which will keep gold choppy."

With the Fed largely data-driven into the July meeting, macro releases could become big market movers.

"Gold pricing is still searching for confirmation that the Fed is really done and/or a US$-negative catalyst," said MKS PAMP head of metals strategy Nicky Shiels. "Data will become more sensitive and important into a July meeting where a hike is pretty much guaranteed."

Gold's technical trading is also essential to monitor. The longer the precious metal remains steady in the face of this hawkish pressure, the more likely prices will rally, noted Shiels.

"On the surface, it's a bearish precious outcome, but the longer gold can't go down, [it] must go up. The thinking is that gold prices will read through their hawkish rhetoric/talk, and at the core is, the Fed has paused (and can pause again) = therefore, they're done," she said.

...

More:

I think I'm going to go long Nat Gas now too. It took a long slow process to build a base but it looks bullish now to me. This is a chart of NatGas / Oil price (which reached a near record low). Looks like an inverse H&S pattern nearly confirmed and points to at least 0.06. Which with a $70 WTIC price would be $4.20 Nat gas. $3.91 looks like the first technical resistance.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

Supply and Demand can still cause inflation. Unless you have a better term for differentiating different types of inflation. But that is useless because you could never breakout how much was caused by each underlying effect.

If we were to vaporize all the wheat on the planet wheat prices would go parabolic. The money supply did not instantly change, the supply of the goods changed. Too much money chasing Too few goods has TWO very distinct variables.

There is also a third type that Martin Armstrong discusses but it's a bit more nuanced as well. It mostly reflects the demand for the money itself, ie Confidence. If Nothing changes in Either money supply or product supply but people simply STOP wanting dollars prices will still Increase.

The problem is that the word inflation has become synonymous with rising prices due to the way it is used in the media etc. Supply and demand for any given good may drive the price higher but it's not inflation.

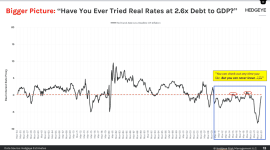

Inflation/deflation is a money supply issue that may impact price. It does it with a delay and it doesn't always hit the prices that cause us pain. We've just lived through 25+ years of inflation driving asset prices disproportionately higher. Of course that isn't 'inflation' in the popular press, that is simply a wide spread out break of investment genius.

Anyway... right now we have plenty of evidence that we have a deflationary impulse underway. The discussion should be around what part of the money supply is contracting and in what order that impacts the economy. Right now the PPI is in inarguable decline which is also reflected in the trend in oil prices etc. Credit is the most volatile part of the money supply, as it deflates with the application of eye wateringly fast interest rate rises it will impact all things that are in credit dependent markets first. Say for an example we are increasing the base money supply at the same time you could generate cost pressure in the cash economy while the total money supply is shrinking. These things are not hardwired together.

So yeah, costs might be rising but calling it all inflation all the time doesn't help anyone save for maybe the central wankers.

Really we need to understand what part of the money supply is doing changing and what that means in the real world. To add to the confusion we are also talking about a relative level. An expanding money supply is only really inflation if it out strips the productive capacity of the economy. Of course measuring that is next to impossible, doubly so with our 'goobermint' metrics... so that debate will never end.

For now it looks like we are headed into a credit crunch aka a slower deflation in the credit portion of the money supply accelerates to a point of crisis... 2008 style. My immediate worry is that we are looking at another period where all assets go out the window, gold included. Opportunity will arise for sure but first we have to avoid being caught up in the accident. Considering it looks like this brush fire is in the banking system and quietly growing it may not be that easy to avoid.

I dunno...

How much is left in the FDIC's fighting fund? 1 or 2% of what might be needed? Print some more to solve that issue? That might really hit street level pricing.

... but who knows. I don't.

Shutup Zed...

OK.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

Even Steve mixes and mashes the term inflation, the argument becomes much clearer when you separate the terms. CPI is one possible measure of inflation, it isn't inflation. In the same way a cough isn't a virus, just one possible symptom of a virus.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

In the eleventh edition of Merriam-Websters Collegiate Dictionary, inflation was no longer defined as an expansion in money and credit.

This shift has happened over the last 100 years, it basically serves to obfuscate the activities of Central Bankers and their impact on the economy. The current widely used definition of inflation muddies the water surrounding the phenomenon to such an extent it is impossible to have a clear debate about the actual mechanics of the situation. This is just another example of language being used against us, you can see it all the time in the modern political landscape. Terms like "climate change" have been weaponized and basically redefined to mean something that they never did. This serves to make any clear debate surrounding the topic harder and harder... all the terms end up loaded to weigh in the favor of those that want to confuse the issues. Inflation was one of the first terms I can recall that underwent this process.

- Status

- Not open for further replies.