Lancers32

Often Wrong Never In Doubt

- Messages

- 1,846

- Reaction score

- 2,116

- Points

- 298

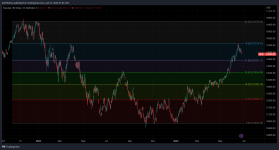

I don't know how much stock any of you put into the musings of Martin Armstrong's computer but he says that Gold is bottoming here/next week. Gold support $1902 which we came close to early this morning. If you want to buy Gold do so before mid July. Don't know if he means fizzie or paper but this time he says Gold will break out.

It is hard psychologically to go ballz in at $1900 if you didn't buy the whack to $1600 yeah? At any rate I think this will be the big one but am willing to give up some leverage and just go more into Sprott's Gold and Silver vehicles with some miners on the side.

It is hard psychologically to go ballz in at $1900 if you didn't buy the whack to $1600 yeah? At any rate I think this will be the big one but am willing to give up some leverage and just go more into Sprott's Gold and Silver vehicles with some miners on the side.