You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Lunatic Fringe - Market and Trade Chat

- Thread starter TheRealZed

- Start date

-

- Tags

- markets

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Status

- Not open for further replies.

Cigarlover

Yellow Jacket

- Messages

- 1,431

- Reaction score

- 1,653

- Points

- 283

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

Yes seasonally speaking the last 5 years have been an exception. However they have been the last 5 years, so you have to wonder if the trend is to continue.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

We are hitting 12 on the volume scale...

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

Yes, well...

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

That implies that there is falling margin in use with SLV.

Could be bad, lenders are worried about it as collateral, speculators are not wanting to be long on leverage?

Could be good, low sentiment normally means we are done with down.

Cigarlover

Yellow Jacket

- Messages

- 1,431

- Reaction score

- 1,653

- Points

- 283

I don't have a fancy meme or anything but think about it. All these lawyers spend millions to get elected so thy can make about 175k a year. And then people wonder why we are 32 trillion in debt and climbing fast.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

Your average Silver investor...

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

An upcoming lead balloon!

www.zerohedge.com

www.zerohedge.com

The Western World Is About To Deliver Some Very Bad News To Its Young Adults | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

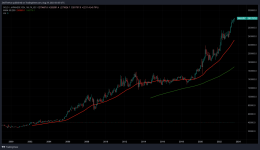

Nvidia in a chart...

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

Oh brother, I'm having some fun here, got the tin foil hat on and a beer in hand.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

Broken Money: Why Our Financial System is Failing Us and How We Can Make it Better : Alden, Lyn: Amazon.com.au: Books

Broken Money: Why Our Financial System is Failing Us and How We Can Make it Better : Alden, Lyn: Amazon.com.au: Books

www.amazon.com.au

This post may contain affiliate links for which PM Bug gold and silver discussion forum may be compensated.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

- Messages

- 383

- Reaction score

- 852

- Points

- 268

Jones Plantation. A film by Larkin Rose.

jonesplantationfilm.com

jonesplantationfilm.com

Jones Plantation Film

You can control a man with brute violence but you can never truly OWN a man until he's convinced that your word is law, and obedience is a virtue. A film destined to be a cult classic, and at the forefront of American Dissident Cinema.

Hedge funds continue to liquidate their bullish gold bets and increase their short positioning as the Federal Reserve is expected to maintain its hawkish bias and keep interest rates elevated at aggressive levels for the foreseeable future.

The CFTC's disaggregated Commitments of Traders report for the week ending Aug. 22 showed money managers increased their speculative gross long positions in Comex gold futures by 8,061 contracts to 105,085. At the same time, short positions rose by 12,366 contracts to 95,976.

"Sharply higher petroleum complex prices over the last several weeks and spiking rates along the yield curve prompted specs to take on short exposure and liquidate longs. Concerns that gold may go through support to significantly lower levels near $1,840 was also a significant driver," said analysts at TD Securities.

...

While speculative interest in gold has fallen to neutral territory, the price has managed to hold critical support levels, and according to some analysts, this resilience in the marketplace could create conditions for a short squeeze.

In a recent interview with Kitco News, Christopher Vecchio, head of futures and forex at Tastylive.com, said he thinks the worst days for gold and silver could be over.

"You can't ignore the strength in gold and silver right now. It appears that the floor in the market has been raised. The market is not ready to run higher, but I expect we could trend around $1,900 for a while," he said.

...

More:

Hedge funds remain bearish on gold, but a potential short squeeze is building

Kitco News' general-interest stories takes a look at what is making headlines in the marketplace and how that is impacting precious metals prices

www.kitco.com

The gold market is seeing some buying momentum as the U.S. labor market shows signs of cooling.

Job openings, a measure of labor demand, dropped to 8.8 million on the last day of July, the Labor Department said in its monthly Job Openings and Labor Turnover Survey, or JOLTS report, on Tuesday.

According to consensus estimates, economists were looking for job openings to drop to 9.49. At the same time, June’s data was revised substantially lower to 9.16 million job openings.

The gold market has jumped above critical resistance at $1,950 an ounce in initial rection to the weaker-than-expected labor market data. ...

Gold prices jump to session highs as JOLTS shows job openings fall to 8.8 million

(Kitco News) - The gold market is seeing some buying momentum as the U.S. labor market shows signs of cooling.

www.kitco.com

Gold prices continued their steep rise this morning as U.S. consumer optimism finally hit a wall in August.

The Conference Board announced on Tuesday that its consumer confidence index declined sharply to 106.1 in August, down from July's downwardly revised reading of 114. The data came in well below expectations, as economists were looking for only a slight decline to 116.

“Consumer confidence fell in August 2023, erasing back-to-back increases in June and July,” said Dana Peterson, Chief Economist at The Conference Board. “August’s disappointing headline number reflected dips in both the current conditions and expectations indexes. Write-in responses showed that consumers were once again preoccupied with rising prices in general, and for groceries and gasoline in particular.”

...

Gold prices surge higher as U.S. Consumer Confidence falls to 106.1

(Kitco News) - Gold prices continued their steep rise on Tuesday morning as U.S. consumer optimism finally hit a wall in August.

www.kitco.com

Markets are showing strong movements at the moment.

- Messages

- 15,750

- Reaction score

- 10,073

- Points

- 288

BOOM!More:

Hedge funds remain bearish on gold, but a potential short squeeze is building

Kitco News' general-interest stories takes a look at what is making headlines in the marketplace and how that is impacting precious metals priceswww.kitco.com

Speaking of that Rafi shows a very Large potential squeeze, not in gold but in Palladium...

Just heard something that I find amazing and makes total sense. From my odd point of view anyway.

Can anyone find any larger FRN's that were printed AFTER 2017? I just checked my small emergency fund and nope.

Can anyone find any larger FRN's that were printed AFTER 2017? I just checked my small emergency fund and nope.

Cigarlover

Yellow Jacket

- Messages

- 1,431

- Reaction score

- 1,653

- Points

- 283

2017's here as well.Just heard something that I find amazing and makes total sense. From my odd point of view anyway.

Can anyone find any larger FRN's that were printed AFTER 2017? I just checked my small emergency fund and nope.

- Messages

- 955

- Reaction score

- 1,359

- Points

- 278

The dates that show on a bill, any bill, reference a print series and not the actual date the bill was printed

Only the five dollar bill has a series run later than 2017

Carranza-Mnuchin: 2017 $1, $10, $20 Federal Reserve Notes, 2017A $1, $2, $5, $10, $20, $50 and $100 Federal Reserve Notes.

Malerba-Yellen: 2021 $1, $5 Federal Reserve Notes.

Only the five dollar bill has a series run later than 2017

Carranza-Mnuchin: 2017 $1, $10, $20 Federal Reserve Notes, 2017A $1, $2, $5, $10, $20, $50 and $100 Federal Reserve Notes.

Malerba-Yellen: 2021 $1, $5 Federal Reserve Notes.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

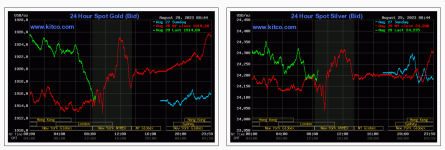

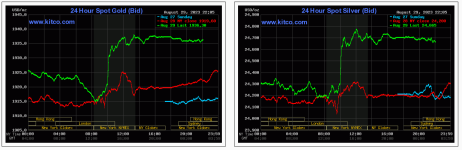

Hmmmm, really silver should be shitting itself here but no, which tells us this is a bash gold to get silver operation.

View attachment 10132

The next morning, we look like this...

I think Silver gave someone a bad day @ the office.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

Luke is the anti dollar milkshake guy, he is Brent Johnson's nemesis. Making some good points!

In the spirit of equal time...

In the spirit of equal time...

Last edited:

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

August Silver delivery is done, non-delivery month, but we still cleared 954 contracts. This Friday, the delivery window opens for September. 6,351 contracts left open as the paper jockeys bailout. Delivery could easily be 5K +

August Gold delivery is still open with 236 contracts still open, hanging in there to the bitter end with 12,272 delivered so far this month and days left to settle. September is a non-delivery month, really the active contract is now December.

August Gold delivery is still open with 236 contracts still open, hanging in there to the bitter end with 12,272 delivered so far this month and days left to settle. September is a non-delivery month, really the active contract is now December.

- Status

- Not open for further replies.