TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

If we could get 10-30 million to march on DC we might be able to put a stop to this shit.

That'd be impressive.

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

If we could get 10-30 million to march on DC we might be able to put a stop to this shit.

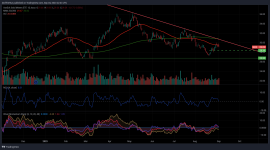

That was my view as well so took a position in zsl to protect against a downturn in Silver shares.Silver Weekly - Further along than gold in pushing the line. Sold back, which probably indicates the breakout isn't next week. My guess is that we pull back to the 23's then come back shortly after.

View attachment 10194

I bet they're good eatin too!What is it with you lot and black swans? Down here, they are ALL freaking BLACK!

I bet they're good eatin too!

UPDATE: BIGGEST CREDIT BUBBLE IN HISTORY IS POPPING!!

Silver.

When did they do this? I thought Congress was off for summer break?

goldswitzerland.com

goldswitzerland.com

What is it with you lot and black swans? Down here, they are ALL freaking BLACK!

Kirby says Ukraine has reached the second line of Russian defense.Now I don't know the deal with Lira at this point but I found this ironic. These guys have no self awareness.

So this guy from the Deep South in the US popped up on my YouTube algo a few days back. Pretty well sums things up.

I just finished my fourth round of baby back ribs. For some reason, everyone else at the abortion center is staring at meSold!

Send me some ribs.