You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Lunatic Fringe - Market and Trade Chat

- Thread starter TheRealZed

- Start date

-

- Tags

- markets

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Status

- Not open for further replies.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

One might ask "Who? Who knows how to handle bankruptcy?"

Jeff Gundlach Stuns Investors With Recent Dollar Prediction

It can't happen in a world of competitive currencies. Maybe against gold, but not on the crosses. The others can and will react.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

- Messages

- 18,774

- Reaction score

- 11,250

- Points

- 288

Oh, the US has gone BK in 1933 if I recall... precedents set, so I think it can be done again.It can't happen in a world of competitive currencies. Maybe against gold, but not on the crosses. The others can and will react.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

- Messages

- 18,774

- Reaction score

- 11,250

- Points

- 288

Prettiest ugly girl at the dance....DXY Daily - Still looking solid. A correction looks due, but apparently not yet!

View attachment 10513

Lancers32

Often Wrong Never In Doubt

- Messages

- 1,842

- Reaction score

- 2,110

- Points

- 298

Just when you thought it was safe to buy. He might actually be right this time.

goldseek.com

goldseek.com

A Few More Days Then Everything Starts to Scream Higher

Gold has been holding up extremely well through this entire corrective process. It has been mostly a sideways churn. Gold is setting up for a breakout above this 2090 area.

Cigarlover

Yellow Jacket

- Messages

- 1,728

- Reaction score

- 2,013

- Points

- 283

For years now every single guru has been wrong about the metals market. They have 99 tons of bullshit to tell you why the metals are going to the moon ad it's your only safety net and all the while the metals continue to go lower.

Manipulation? Sure. The fed gov steps in and sues JPM and collects big money from them and then funnels it into leftist programs instead of returning it to investors. How does the Fed gov even have standing?

At the end of the day the metals gonna do what they gonna do. probably going back to 2020 lows to make a double bottom and then consolidate and then turn around. 1st the fed needs to stop raising rates and driving up bond yields and stengthening the dollar. Once they reverse course and start lowering rates, then the metals can fly and stocks can tank.

Estimates are 1-2 more rate hikes. probably not likely in an erection year. Keeping rates where they are at through 2024 is definitely on the table though. Unless something breaks there is no need to lower rates. Everything is also still in a bubble and those bubbles need to pop. Unemployment needs to go much higher. Probably north of 6 or 7%. Hard to know where we are at in anything with the fed gov releasing numbers to make Bidenomics look good. BLS claims low unemployment, but then revisions happen and unemployment is higher. The fed sees that plus the inflation numbers and has no choice but to keep rates as high as they can for as long as they can. Meanwhile both parties in congress spend like drunken sailers which creates more inflation. Congress gonna spend their way out of inflation with the inflation reduction act which also funnels billions to their cronies and in turn a % comes back to them in the form of election money.

I'm preparing for 2020 lows in everything. Buying miners on the way down and with a little luck my puts on the SPX and QQQ will pay off so I can funnel more money into miners. Thats my plan anyway. All subject to change as market conditions warrant.

Manipulation? Sure. The fed gov steps in and sues JPM and collects big money from them and then funnels it into leftist programs instead of returning it to investors. How does the Fed gov even have standing?

At the end of the day the metals gonna do what they gonna do. probably going back to 2020 lows to make a double bottom and then consolidate and then turn around. 1st the fed needs to stop raising rates and driving up bond yields and stengthening the dollar. Once they reverse course and start lowering rates, then the metals can fly and stocks can tank.

Estimates are 1-2 more rate hikes. probably not likely in an erection year. Keeping rates where they are at through 2024 is definitely on the table though. Unless something breaks there is no need to lower rates. Everything is also still in a bubble and those bubbles need to pop. Unemployment needs to go much higher. Probably north of 6 or 7%. Hard to know where we are at in anything with the fed gov releasing numbers to make Bidenomics look good. BLS claims low unemployment, but then revisions happen and unemployment is higher. The fed sees that plus the inflation numbers and has no choice but to keep rates as high as they can for as long as they can. Meanwhile both parties in congress spend like drunken sailers which creates more inflation. Congress gonna spend their way out of inflation with the inflation reduction act which also funnels billions to their cronies and in turn a % comes back to them in the form of election money.

I'm preparing for 2020 lows in everything. Buying miners on the way down and with a little luck my puts on the SPX and QQQ will pay off so I can funnel more money into miners. Thats my plan anyway. All subject to change as market conditions warrant.

- Messages

- 18,774

- Reaction score

- 11,250

- Points

- 288

but buy my book to learn the secrets of investing in precious metals... $50For years now every single guru has been wrong about the metals market. They have 99 tons of bullshit to tell you why the metals are going to the moon ad it's your only safety net and all the while the metals continue to go lower.

- Messages

- 392

- Reaction score

- 877

- Points

- 268

"I've been predicting this outcome for the last 25 years!"but buy my book to learn the secrets of investing in precious metals... $50

... 1st the fed needs to stop raising rates ...

The markets are waiting for hints that the Fed will consider lowering rates. Holding them steady isn't enough with the probability of more hikes down the road. Did you see Jamie Dimon's comments posted in the Fed Overshoot thread? He posits that the Fed will (eventually) hike to 7%...

Cigarlover

Yellow Jacket

- Messages

- 1,728

- Reaction score

- 2,013

- Points

- 283

Someone mentioned today that the yields were approaching 4.6% which would be a double top. If it turns down from there then the dollar can move lower and we can rally in the metals. I wouldn't expect anything major if that happens. Short term relief rally maybe.Ten year yield daily. Closed higher with an outside bar if that means anything.

[Stocks are not going to be happy with this ongoing.]

View attachment 10518

It's really all about the fed. The selloff right now(In the indexes) could be anticipation for the recession that appears to be headed our way. 10-30% is a healthy correction.

Just my opinion of course.

The markets are waiting for hints that the Fed will consider lowering rates. Holding them steady isn't enough with the probability of more hikes down the road. Did you see Jamie Dimon's comments posted in the Fed Overshoot thread? He posits that the Fed will (eventually) hike to 7%...

The FED does NOT control interest rates. Edit: TL

Cigarlover

Yellow Jacket

- Messages

- 1,728

- Reaction score

- 2,013

- Points

- 283

I did not see that. Interesting though. There's lots of peeps out there that says things start to break when we get over 5% maybe 6.The markets are waiting for hints that the Fed will consider lowering rates. Holding them steady isn't enough with the probability of more hikes down the road. Did you see Jamie Dimon's comments posted in the Fed Overshoot thread? He posits that the Fed will (eventually) hike to 7%...

I honestly don't know if he needs to go the high. I guess if inflation were persistent then maybe. That will depend on how much the fed Gov continues to overspend.

The housing market is already slowing considerably and that's really the backbone of our economy nowadays. Consumer debt is at record highs and growing and bankruptcies are on the rise. Theoretically this should slow inflation down. It will take time though. Thats why I say, I'm not so sure rate cuts are in the cards for next year. It's an election year and as long as something isn't broke I would think Jerome just wants to maintain things as is. Especially if inflation is creeping down. I think the 1st rate cuts were about a year ago and from what I have read it takes 12-18 months for those to worm their way into the economy. So the effects of the 1st rate cuts are just starting to be felt although the rate for mortgages is based upon the current fed rate so that does not take 12-18 months.

At 7% what's our interest payment on the debt of 33 trillion and growing?

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

Broad based melt up... hmmmm... mebe.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

Bonds are traded on supply and demand, and the US Govt (not the Fed) are supplying the hell out of them.

Monetising the debt isn't the stigma it once was, and the bond vigilantes seem to have Stockholm Syndrome.

I dunno, I suspect that computer trading, with the national interest being the motivating factor, is at an all-time high. Manipulation may well be too strong a term, but influence seems to be happening. This is not your father's market.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

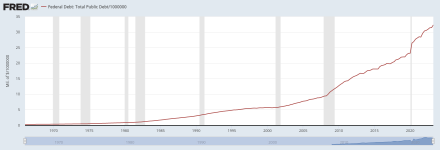

Help me out here, I have to have stuffed this chart up somehow. This cannot be correct.

Its

"Federal government current expenditures: Interest payments, Billions of Dollars, Seasonally Adjusted Annual" X 1000 to make it millions.

over

"National Totals of State and Local Tax Revenue: Total Taxes for the United States, Millions of U.S. Dollars, Seasonally Adjusted"

Its

"Federal government current expenditures: Interest payments, Billions of Dollars, Seasonally Adjusted Annual" X 1000 to make it millions.

over

"National Totals of State and Local Tax Revenue: Total Taxes for the United States, Millions of U.S. Dollars, Seasonally Adjusted"

That looks correct. Yellen has been selling bonds like there is no tomorrow. Cause I think they know the jig is up. Why not sell as many as possible till it ends?

I think you might have been trying to /1000 but it doesn't matter. The trend is correct.

I think you might have been trying to /1000 but it doesn't matter. The trend is correct.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

Expenditure doubles tax take?

Expenditure doubles tax take?

For the last month or two its probably 4x or more. Yellen go BRRRRRRR. And the economy really slowed down with tax receipts falling now.

- Messages

- 986

- Reaction score

- 1,405

- Points

- 278

Consider this....At 7% what's our interest payment on the debt of 33 trillion and growing?

How much is only one trillion dollars? If you spent one million dollars a day, every day since the birth of Julius Caesar of the Roman Empire, you would not have spent a trillion dollars yet!

America's debt stands at what now? Something like $31.4T.

How much does $31.4 trillion cover? It’s enough to give $94,700 to every citizen in the United States right now. It’s $247,700 for every taxpayer in the country

How can that ever possibly be repaid?

We can’t even balance its budget much less pay back debts — bad news for those who own bonds?

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

And the economy really slowed down with tax receipts falling now.

According to my chart since 22.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

America's debt stands at what now? Something like $31.4T.

32.33T

If you want to impress and scare your friends all at the same time.

We'll hit $100 Trillion in no time. Kinda how power/exponential functions work.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

How can that ever possibly be repaid?

It can't be.

The question is at what point is it in the market's interest to recognise that fact. By that I mean all the Wall St boys and girls that are paid to make bank each quarter. It's the king and his clothes until...?!

The Wall St boys were too dumb to understand and see that time coming. 60/40 for the win. Lol. They are probably realizing just about now that they are in a world of hurt. I imagine looking at those loses right now are downright scary. Though the red in my account is probably as bad, for now.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,607

- Points

- 298

- Status

- Not open for further replies.