TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

Full moon on Friday.

Yeah, it's always a problem.

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

Full moon on Friday.

The dollar is screaming higher.

The question is what will shake loose first from the stress and what the ramifications will be. I'm really glad I still have a job...It is a sign of stress.

I'm really glad I still have a job..

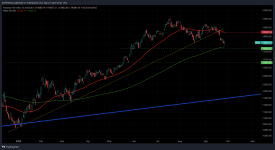

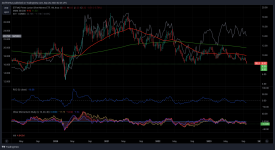

I concur. Metals and indexes may turn around anytime and run for end of year. I am waiting and watching carefully. When it turns jump on them magnificent 7 and hang on until end of year.GDX Daily - Looks like this is the start of a capitulation phase. If so, momentum should roll down further while ROC starts to hold up at some point. IMO, the buy is coming up for the run into years end. DYODD and be careful, it could be here or down further @ low 25's

View attachment 10552.

We just had a crash 3 years ago.What are we seeing out there? I'm still seeing too much crash calling for me to think it is going to happen. What about you?

We just had a crash 3 years ago.

Bought some SILJ today. Might be early might regret it but with all the small buys over the last little while I still haven't acquired enough to watch prices in the overnight. Got a long way to go before the position is meaningful at least for me.

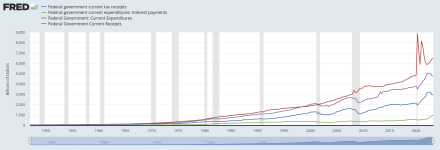

Qt should be leading to a pullback in the markets. Higher interest rates should slow down the economy and drive unemployment higher which should lead to a recession. There's no question we have bubbles everywhere that need to pop. I think Powell is doing all he can to try and pop them.What are we seeing out there? I'm still seeing too much crash calling for me to think it is going to happen. What about you?

I think 1850 was a crazy call I made a couple months ago on here. Doesn't seem so crazy now.