First, you've already lost that battle. 99% of people think of Inflation as price increases and decreases. That is ultimately what they care about, not some obscure number.

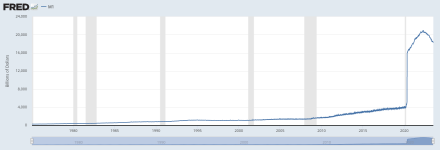

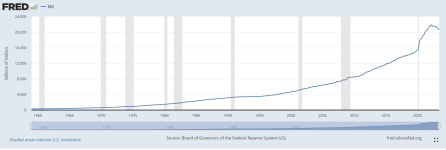

Second, I think they are right and the old Austrians got this one wrong. Inflation (money supply) is a mostly pointless number. We have a debt based system and so it's ALWAYS increasing so who cares? Plus, we also know that prices can go waaay up or even down under Inflation so its also just another mostly useless stat at that point. They pointed out a tree in a forest and missed the bigger picture.

So give me the four terms and then what you call the Sum

This is pretty straightforward

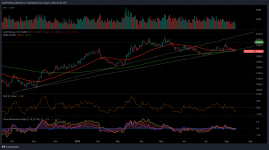

Inflation = Monetary (Supply & Demand) and Physical Goods (Supply & Demand).

As opposed to what ? = Inflation/Monetary Demand and Physical Goods (Supply & Demand)?

Second, I think they are right and the old Austrians got this one wrong. Inflation (money supply) is a mostly pointless number. We have a debt based system and so it's ALWAYS increasing so who cares? Plus, we also know that prices can go waaay up or even down under Inflation so its also just another mostly useless stat at that point. They pointed out a tree in a forest and missed the bigger picture.

So give me the four terms and then what you call the Sum

This is pretty straightforward

Inflation = Monetary (Supply & Demand) and Physical Goods (Supply & Demand).

As opposed to what ? = Inflation/Monetary Demand and Physical Goods (Supply & Demand)?